Utilities At Issue - September 2019

New Building Energy Performance Standards (BEPS) – What Building Owners Must Do Now

On January 18, 2019, Washington Mayor Muriel Bowser signed the “CleanEnergy DC Omnibus Amendment Act of 2018” into law. The goal of this legislation is to:

- Reduce GHG emissions in the District by 50% by 2032, and 100% by 2050

- Achieve 100% renewable electricity in the District by 2032

- Develop Building Energy Performance Standards (BEPS) for buildings in the District

- Adopt Net Zero Energy (NZE) for new construction, starting in 2026

The legislation established a Building Energy Performance Standard (BEPS) program to set benchmarks for energy performance for buildings in the District. The standards will be established by the DC Department of Energy and Environment (DOEE) and will initially apply to all private buildings with 50,000 square feet or greater and all District-owned buildings 10,000 square feet or greater. These initial standards will go into effect on January 1, 2021.

In addition, private buildings 25,000 square feet or greater will have to comply with the BEPS standards by January 1, 2023. Private buildings greater than 10,000 square feet must comply by January 1, 2026.

The legislation also decreed that buildings that fail to meet a median or higher Energy Star rating will need to adopt and implement measures that either: (i) increase their rating to meet or exceed the median rating or (ii) achieve a 20% improvement in the building’s energy efficiency. DOEE is still developing the standards and AOBA is actively participating in this process, as are AOBA members.

What you need to do now:

- Identify all buildings in your portfolio that are 50,000 square feet and above and ensure you are currently in compliance with DC Benchmarking Rules.

- Check the Energy Star rating for your buildings. EPA released an updated ENERGY STAR scoring model for commercial buildings, which went into effect on July 15.

- Identify where the buildings in your portfolio rank in relation to the median score

- DOEE has provided guidance for the median Energy Star score for buildings in DC:

- 64 for commercial buildings

- 66 for multifamily buildings

- DOEE has provided guidance for the median Energy Star score for buildings in DC:

- Develop a plan for your path to compliance with the new standards.

EPA Updates New ENERGY STAR Scoring – Model to Address Real Estate Concerns

Reprinted from BOMA July 31, 2019 Newsletter

The U.S. Environmental Protection Agency (EPA) released an updated ENERGY STAR scoring model for commercial buildings, which went into effect on July 15. The update comes after numerous real estate owners and managers discovered that the methodology was unfairly skewed against buildings in colder climates, which received lower scores, on average, than similar buildings in warmer climates.

During EPA’s review phase, staff shared their modeling methodology with BOMA International and other real estate partners, requesting comments. At their request, BOMA surveyed its membership and shared energy data from hundreds of buildings. That data, along with numerous meetings and negotiations, led to a significant change that is reflected in the updated model.

Buildings in certain markets including New York, Chicago and Washington, DC, will now see an increase in their ENERGY STAR scores by about five points above EPA’s original model. Craig Haglund, program manager for ENERGY STAR, presented EPA’s findings and changes at BOMA International’s recent annual conference in Salt Lake City. Haglund thanked BOMA’s members for their collaboration with ENERGY STAR, stating that EPA’s changes are a direct result of BOMA and other industry partners coming together to make the program stronger and fairer for all buildings across the U.S.

BOMA Presentation on Energy Star Scoring

*Used with permission from BOMA

Pepco Requested a Multi-year Rate Increase of $162 Million in D.C. *NEW

On May 30, 2019, Pepco requested a multi-year rate plan in the District of Columbia, which would increase rates in the District by $162 million over the three-year period beginning in May 2020 (Formal Case No.1156). As part of the request, Pepco seeks to change its ratemaking from the traditional rate case filings, where Pepco files a request with the DCPSC based on an historical test year when it wants to increase its rates, to a multi-year rate plan in which rates based on Pepco’s forecasts would increase automatically each year over the three-year period, 2020 through 2022.

Pepco proposes to raise rates in three steps, scheduled for May 1, 2020, January 1, 2021, and January 1, 2022. Pepco proposes to increase rates by $84.9 million in 2020, $40.4 million in 2021, and an additional $36.4 million in 2022. If the DCPSC does not approve the multi-year rate plan, Pepco asks, in the alternative, to increase its rates by $88.6 million in May 2020.

With the multi-year rate plan, Pepco is also asking the Commission to approve several incentive mechanisms that would allow the Company to earn more money if it hits certain annual performance metrics which could raise rates even further in 2021 and 2022 than what is estimated.

AOBA has intervened in this case and will file testimony challenging Pepco’s proposed multi-year rate plan, the Company’s proposed rate increase and Return on Equity (ROE), as well as many other Pepco adjustments and proposals contained in the company’s new application.

On August 9, 2019, the DC PSC issued an order adopting a procedural schedule in this proceeding which may, under certain circumstances allow for hearings beginning on June 29, 2020. Based on the schedule adopted by the Commission, AOBA anticipates that any Pepco rate change would not occur until November/December 2020.

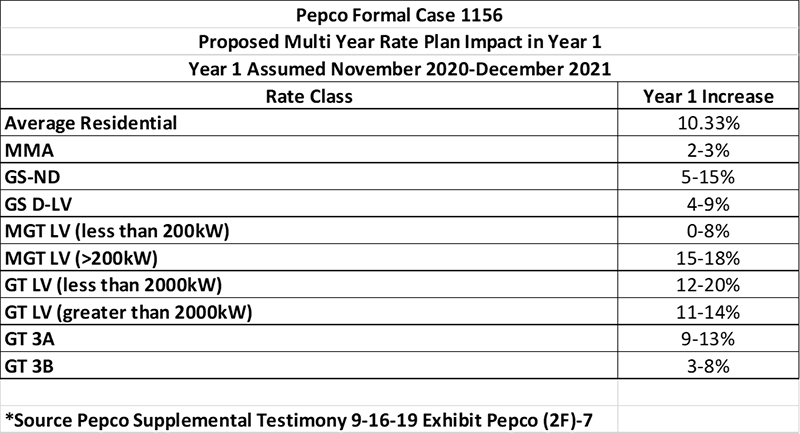

The table on the next page shows Pepco’s calculated bill impact. The link to the DC PSC’s Public Notice of the rate increase is inserted below.

DC PSC FC 1156 Public Notice

Pepco Rate Increase Estimates

Washington Gas Requested a $35.9 Million Increase in Maryland – Settlement Filed *UPDATE

On August 30, 2019, Washington Gas, AOBA, the Maryland Office of People’s Counsel and the Maryland Public Service Commission Staff filed a Stipulation and Settlement of all issues in Washington Gas’ pending rate case in Maryland Case No. 9605.

The Settlement agreement provides for an increase in the Company’s annual base rate revenue of $27.0 million, an increase of approximately 8.0%. This increase includes approximately $3.0 million of costs that are currently collected under the STRIDE plan that will now be included in base rates. New rates will be effective after the PSC issues a final order in this proceeding, i.e. October/November 2019.

On April 22, 2019, Washington Gas had filed its Application requesting a $35.9 million increase in rates, in the Company's Maryland annual base rate revenues (Maryland Case No. 9605). AOBA, the Office of People’s Counsel and PSC Staff all submitted additional testimony, including changes in the revenue allocation by customer class. The proposed rate increase includes $5.1 million of costs that are currently collected under the STRIDE plan that will now be included in the base rates, resulting in an incremental increase of $30.8 million, or 5.75%. All monthly customer charges are proposed to increase by 5%.

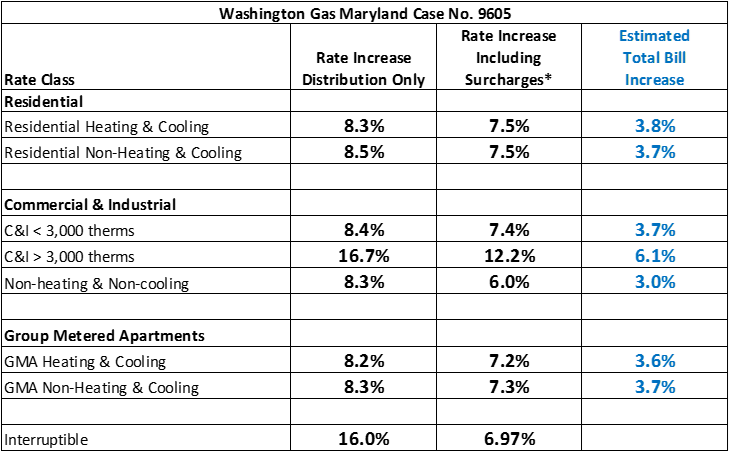

The chart on the next page shows the estimated rate increase impact on each customer class for 1) distribution charges only, 2) a distribution increase including surcharges and 3) an estimated total bill impact including all surcharges.

Washington Gas distribution charges represent roughly 50% of the total customer bill and therefore the third column shows an estimated increase in the total bill.

* Items included are Non-Tariff Delivery Customers, RES amount, GRT Surcharge, Firm Credit Adjustment, Franchise Tax and Montgomery Fuel Energy Tax

* Items included are Non-Tariff Delivery Customers, RES amount, GRT Surcharge, Firm Credit Adjustment, Franchise Tax and Montgomery Fuel Energy Tax

* These additions serve to dampen the impacts of the requested increase in distribution for all classes.

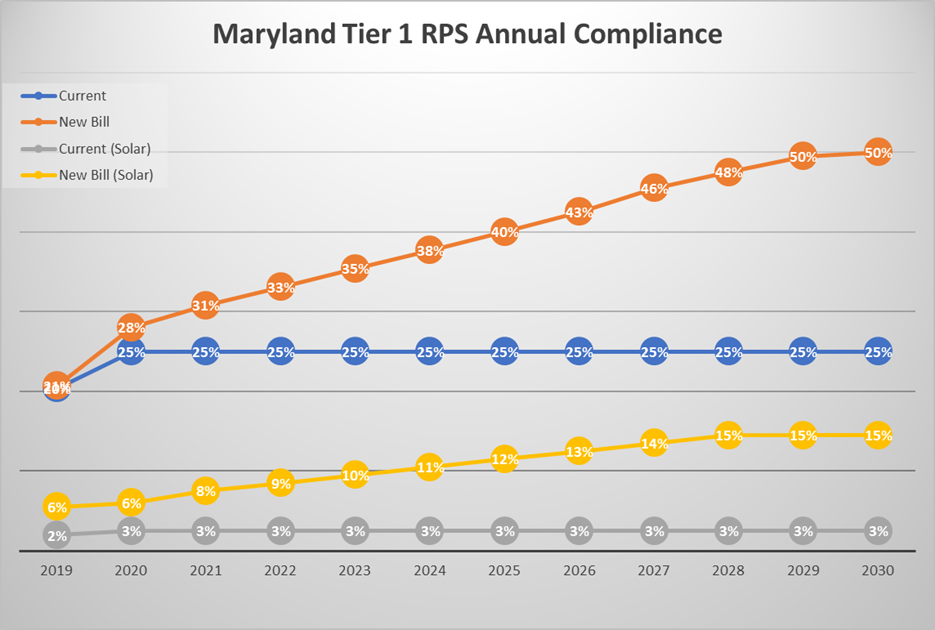

Maryland Renewable Portfolio Standards to Increase October 1st

On April 8, 2019, the Maryland General Assembly passed the Maryland Clean Energy Jobs Bill [SB516], which will impact retail electric supply rates in Maryland through an increase in the Renewable Energy Portfolio Standard (RPS). Governor Hogan chose to neither sign nor veto the bill and therefore, the bill will be effective on Oct. 1, 2019. This legislation phases in annual increases to the RPS requirements from 25 percent to 50 percent in 2030, and the increases will begin to phase-in on Oct. 1, 2019.

Maryland customers can expect to see electric supply prices include higher costs after the effective date of the enactment of this legislation. Additionally, in response to the passing of this bill, the market for Maryland SRECs has become volatile. We have seen prices range from $20 per MWh on April 3 (before the RPS legislation was passed) to $60 per MWh on April 10 (after the RPS legislation was passed).

All electric supply contracts executed before the effective date are considered “grandfathered” and are not subject to the higher RPS requirements. Supply contracts entered after Sept. 30, 2019 will be subject to the higher RPS requirements.

The potential impact of the new higher percentage of SRECs needed to meet compliance in the near term (2020 - 2022) is estimated to be between $1.00-$3.00 per MWh ($0.001/ kWh- $0.003 /kWh) at this time, assuming the SRECs remain priced at current levels. Additionally, this legislation includes an Offshore Wind Renewable Energy Credit (OREC) obligation going forward that will also push electric supply prices higher. The OREC obligation was included in the 2013 Maryland Offshore Wind Energy Act which requires suppliers to purchase ORECs for the energy they supply. The obligation is 2.5% of the supplier’s load. The impact of the additional OREC obligation is estimated to be between $1.00-$2.00 per MWh ($0.001/kWh - $0.002/kWh).

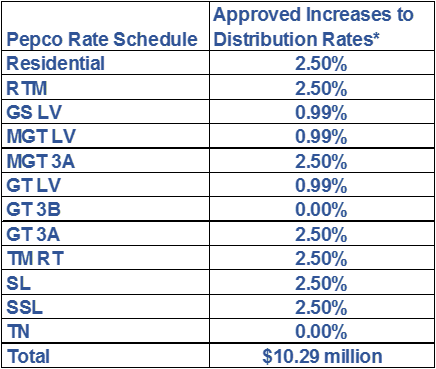

Pepco’s Request for a $29.9 Million Rate Increase in Maryland Reduced to $10.3 Million

UPDATE: On July 9, 2019, a Proposed Order of the Public Utility Law Judge (PULJ) authorized an increase in rates of $10.3 million for Pepco based on a return on equity (“ROE”) of 9.6%.

This PULJ Order was appealed by the Maryland PSC Staff. On Aug. 12, 2019, the MDPSC affirmed the PULJ’s Proposed Order and new rates became effective Aug. 13, 2019.

On Jan. 15, 2019, Pepco filed a request for an increase in base distribution revenues of $29.9 million (approximately a 7% increase in distribution revenues), which was reduced to approximately $27 million during the course of the proceedings. AOBA intervened in this case and filed testimony stating that Pepco was entitled to no more than a $398,000 increase in rates. Hearings concluded May 24, 2019 and the Commission decision was issued Aug. 12, 2019. New rates became effective Aug. 13, 2019. (Maryland Case No. 9602).

* The above percentage increases are based on class averages on distribution rates. The amount of increase per customer will vary by the size of the account. Also, the increase will be affected by changes in the monthly Bill Stabilization Adjustment (“BSA”).

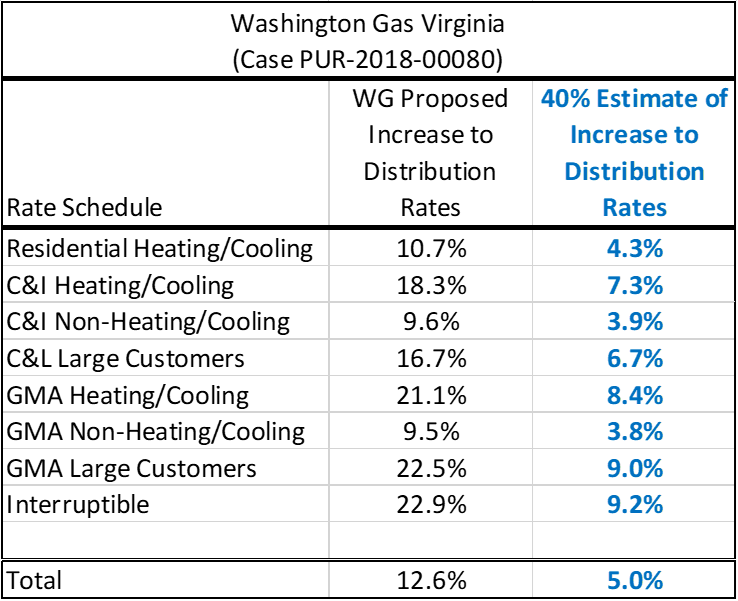

Washington Gas Request for a $37.6 Million Increase in Virginia Reduced *UPDATE

UPDATE: The Hearing Examiner issued his decision on Sept. 16, 2019 and found that no increase or decrease to WG’s current level of revenue is warranted, i.e., there will be a refund of a portion of the rates that went into effect in January 2019.

- The Hearing Examiner agreed with AOBA that WG’s TCJA regulatory liability of $35.4 million should be refunded to customers in a one-time bill credit.

- Washington Gas must return to customers approximately 60% of its distribution rate increase that went into effect Jan. 1, 2019

- New rates going forward will be approximately 40% of the increase that went into effect on Jan. 1, 2019

- Washington Gas has until Oct. 21, 2019 to file for reconsideration of the Hearing Examiner’s decision.

Washington Gas filed an application on July 31, 2018, requesting authorization to increase its rates and charges and to revise the terms and conditions applicable to gas service effective for usage beginning with the January 2019 billing cycle, subject to refund (Case PUR-2018-00080).

AOBA requested a refund in the form of a bill credit for over collected income tax charges from the Tax Cuts and Jobs Act of 2017.

Impact to WG Bill

- A tax refund of $35.4 million will be returned to customers as a bill credit

- Rate case refund for rates implemented from Jan. 1 until SCC approval of the Hearing Examiner’s decision

- Roughly 60% of the rate increase approved will be returned to customers

- New rates going forward will be approximately 40% of the initial Jan. 1, 2019 approved rates

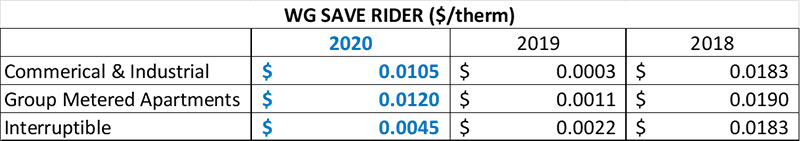

Washington Gas Virginia Files for $14.2 million SAVE Rider Approval (Case No. PUR-2019-00142)

On Aug. 30, 2019 Washington Gas Virginia filed its annual approval for SAVE Rider for Calendar Year 2020. The SAVE rider provides natural gas utilities in Virginia to recover the costs of specific infrastructure replacement programs that have the potential to reduce greenhouse gas emissions and to enhance safety and reliability.

The Company is seeking approval for $14.2 million in revenue requirements for 2020.

If approved by the Virginia SCC, the updated SAVE rider charge would be effective Jan. 1, 2020.

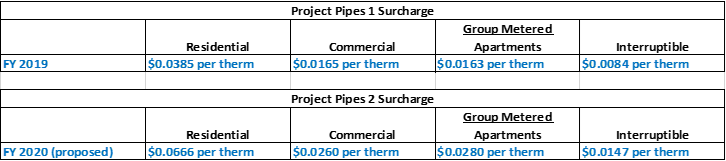

Washington Gas Filed Revised Pipe Replacement Plan in the District of Columbia “PROJECTpipes 2” *UPDATE

UPDATE: The DC PSC approved the recommendation of AOBA and OPC to extend the initial PROJECTpipes plan through March 31, 2020 while PROJECTpipes 2 was under consideration.

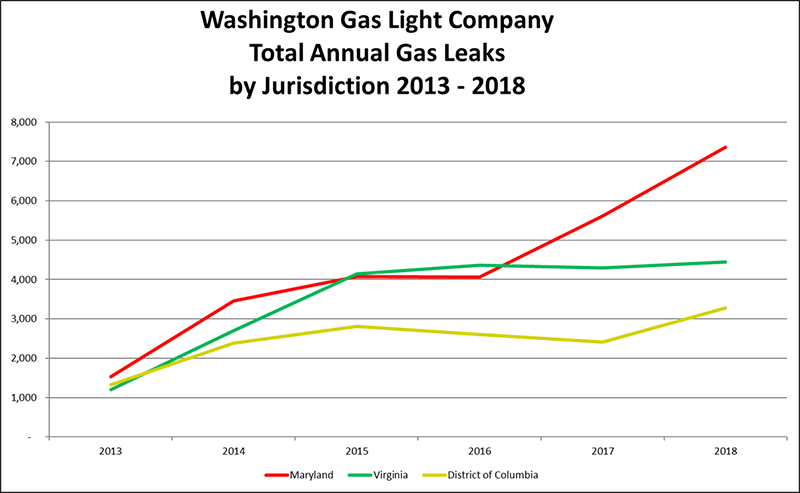

On March 22, 2019 AOBA filed comments with the D.C. Public Service Commission that called into question the effectiveness of the original pipe replacement plan and the new proposed PIPES 2 plan going forward. AOBA urged the PSC to issue an RFP for an independent third-party consultant to design and implement the replacement of WGL’s most leak prone pipes, i.e., the PROJECTpipes 1 Plan.

AOBA further urged the PSC to require WGL to immediately remediate hazardous gas leaks (Grade 1 and 2), under the purview of the third party administrator, and seek cost recovery in a separate rate case and delay ruling on the PIPES 2 plan until the Commission is able to verify that Washington Gas is able to make progress towards elimination of the most hazardous leaks on time and at reasonable cost.

AOBA noted that there has been a 169% increase in reported Grade 1 leaks from 2013 to 2018 which coincides with the original accelerated pipe replacement plan (Formal Case Nos. 1115 and 1154).

AOBA’s comments also note that Washington Gas is focusing on the wrong type of pipe replacements. WG’s focus should be on the riskiest mains which are the cast iron pipes; instead Washington Gas is focusing its PIPES 2 plan more on bare steel and vintage mechanically coupled mains. The cast iron mains represent the vast majority of risky mains in the District and should be the primary focus and priority replacement in the District.

On December 7, 2018, Washington Gas Light Company filed a revised plan for Accelerated Pipe Replacement in the District of Columbia with the District of Columbia Public Service Commission, PROJECTpipes 2 Plan. AOBA, which participated in the initial phase of this proceeding and has also reviewed similar plans filed by Washington Gas in Maryland and Virginia, has performed a preliminary review of the Company’s recent filing and filed comments with the District of Columbia PSC regarding Washington Gas’s proposed PROJECTpipes 2 Plan.

The proposed PROJECTpipes 2 charges are on the next page along with a graph showing the total number of gas leaks in Washington Gas’ territories over the past six years.

AOBA Utility Update – Rate Case Expectations *UPDATE

Pepco-District of Columbia

| Rate case and Multi-year rate plan filed May 30, 2019 PSC decision expected December 2020 New rates expected to be effective January 1, 2021 |

Pepco-Maryland

| Rate case filed January 15, 2019 New rates effective August 13, 2019 Multiyear rate plan expected after February 1, 2020 |

Washington Gas-District of Columbia

| Rate case expected on or after January 2, 2020 Multi-year rate plan expected |

Washington Gas-Maryland

| Rate case filed April 22, 2019 New rates effective November 18, 2019 |

Washington Gas-Virginia

| Hearing Examiner decision issued, rates effective January 1, 2019, subject to refund |

Dominion-Virginia

| Next review of rates will be Triennial Review in 2021 |