How Investors Assess Real Estate Opportunities

Part V in a six-part series analyzing the state of rental housing in Suburban Maryland

The need for additional housing supply in Suburban Maryland is well-documented and widely accepted. According to the Metropolitan Washington Council of Governments, we need to add 320,000 new apartment units by 2030 to keep pace with demand, with 75% of those additional units needing to be affordable to low- and middle-income households.

Getting there will require a partnership among public and private sector partners. To understand how we can create a hospitable environment to attract new housing production to our community, it is essential to understand what motivates investors and developers. [See how multifamily housing is financed]

To Get it, We Need to Attract Investment/Investors

Be they independent rental owners, large real estate investment trusts, or even institutional investors like insurance companies, college endowments, and state and local employee pension funds, our region competes nationally and even globally to attract investors to build new housing stock. Regardless of investor profile, all investors consider multiple factors when determining how to invest their capital and if they should invest it in real estate vs. other forms of investment, like stocks and bonds.

Factors that Affect Real Estate Investment Decisions

Investors consider multiple factors when deciding whether to invest in multifamily real estate and where. These include:

- Housing demand;

- The costs to build in a particular location;

- The costs to operate in that location;

- The regulatory environment;

- Availability of capital, financing, and incentives;

- Stability, consistency, and predictability of the political and regulatory landscape (trust that the policy environment won’t change);

- Intangible qualities such as quality of life, community assets, aesthetics, and perceptions of an individual neighborhood

The Value Proposition of Investing in Multifamily Housing

Let’s look at the value proposition of investing in multifamily housing in Suburban Maryland.

The vast majority of rental income goes to cover the operating costs of a community. Maryland housing providers generally see a return on investment of approximately 5%. It is worth noting here that investors gain primarily from value growth of their assets. To this end, multifamily investors use a loan management strategy wherein the borrower relies on refinancing to take advantage of built-up equity in the property. This prospect of investment growth is much of what attracts investors to invest in rental housing. Since the best way to find value growth is to continue to reinvest in communities, investors seek to improve the quality of the housing provided during each financing cycle. Thus, housing providers are incentivized to reinvest excess revenue into the property or into new housing development.

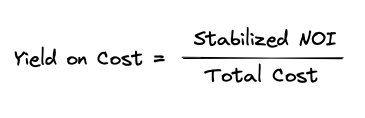

Assessing Real Estate Value: Yield on Cost

In determining whether to invest in a particular project and community, investors undergo a complex analysis incorporating all the previously listed factors along with an in-depth financial analysis to determine whether a project will “pencil out.” The most basic form of this analysis is known as “yield on cost.” This simple measure compares the potential revenue associated with a product with the overall cost of the investment (purchase price + development/renovation expenses). A higher percentage yield on cost will make for a more attractive investment. A lower percentage yield on cost reflects a less attractive investment.

Looking at the top part of the equation, Suburban Maryland is an incredibly attractive market with strong demand, high income levels, and solid rents. However, ever-increasing operating costs mitigate the potential yield on cost.

Before the pandemic, investors sought a yield on cost of around 5-6%. As interest rates have climbed, the threshold has been raised to around 7% to make a deal “pencil out” with sufficient return on investment.

As we explored in part I of this series, myriad other operating costs have increased exponentially in the last five years, including utilities, insurance, building materials, etc. These particular cost increases are not unique to Suburban Maryland. However, numerous governmental mandates enacted since have further driven up the cost side of the investment equation, rendering Montgomery and Prince George’s Counties a less attractive market. These include Building Energy Performance Standards (BEPS), mandated frequent radon testing of entire buildings, security camera requirements, and mandatory fire and life safety system upgrades. Add rent control to the mix, effectively restricting the potential NOI to offset these costs, and it becomes very difficult, if not impossible, to hit the 7% yield on cost standard.

And remember, we are competing with other communities like our neighbors in Northern Virginia, where these additional costs aren’t a factor. The intangible perceptions of the regulatory environment and business climate further tip the scale, leaving Suburban Maryland at a relative disadvantage.

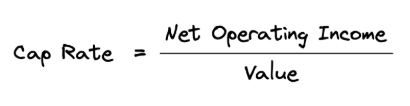

Assessing Real Estate Value: Capitalization Rates

Capitalization rates, or “CAP rates,” are another common measure of potential return on investment in a multifamily property. This is derived by dividing the NOI for an investment by the property’s market value. In this equation, a lower CAP rate represents a more desirable investment opportunity, whereas a higher CAP rate suggests less opportunity for increasing value and therefore return on investment.

A reflection of potential return on investment, CAP rates can vary significantly among similar buildings in different submarkets. Take Flats 8300 for example.

Built in 2016, the 10-story, 359-unit mid-rise is located right off Wisconsin Avenue in the upscale downtown core of Bethesda. It boasts a plethora of amenities, including a Harris Teeter on the ground floor, a Starbucks, a fitness center, rooftop pools, a business center, a pet spa, and coworking space. The property is highly walkable, with great access to transit with two Metrorail stations within a 12-minute walk. The building has a healthy vacancy rate of 5% and average monthly rents of $3,243, with some units renting for as much as $6,357 per month.

According to CoStar, the CAP rate for Flats 8300 is 6.2%. For contrast, let’s compare this to a similarly situated building in another competing submarket.

950 South George Mason Drive in the Barcroft neighborhood of Arlington County is strikingly similar to Flats 8300. The mid-rise property, constructed in 2019, has 366 units, also with a Harris Teeter on the ground floor, a fitness center, pool, rooftop terrace, and a sundeck. Like Flats 8300, the property is located within a 12-minute walk of two different Metrorail stations. The vacancy rate is lower than its Maryland counterpart at 3.3% and average rents are also lower at only $2,569 per month. The CAP rate for this property, according to CoStar is 5.2%, a full percentage point below that of Flats 8300.

The two properties, though nearly identical, are viewed much differently by investors based on the submarkets in which they are located. The CAP rates show that the Virginia-based property is seen as a more potentially lucrative investment because of fewer constraints on net operating income and lower operating costs.

CAP rates in Suburban Maryland have increased substantially over the past few years in the wake of the pandemic. The ultimate confirmation of this decline in the desirability of the Maryland markets is reflected in the recent sale of Flats 8300. The building sold last Spring for $129.8 million – a 37% discount over the property’s previous sales price of $207 million just 8 years prior in 2016.

Investors Vote with Their Feet

Investors seeking to build their portfolios will flock toward markets and investments where they can achieve a higher return on investment. Suburban Maryland has seen a decline in sales volume, while Northern Virginia transactions have been relatively level.

Likewise, investors may consider alternate forms of investment. Despite the high demand for rental housing, investors may opt to focus on other types of real estate, such as industrial or retail, which do not bring the same regulatory burdens, or invest their capital in other, more liquid financial instruments that carry less risk.