At Issue MD - The Housing Supply/Demand Imbalance is About to Get Much Worse

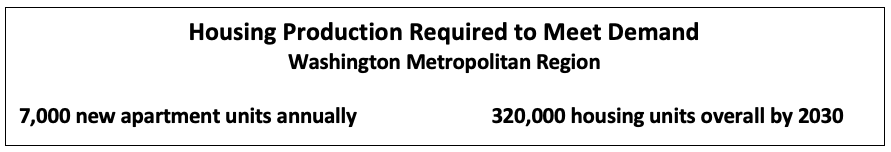

The Washington metropolitan region’s housing supply deficiency is well-documented. According to the National Apartment Association (NAA) and the National Multifamily Housing Council (NMHC), we need to build 7,000 apartments per year just to keep pace with demand and not fall further behind the supply/demand curve. The Council of Governments (COG) affirms these projections with their own regional housing targets. COG calls for at least 320,000 housing units to be added in the region between 2020 and 2030. With only 245,000 units projected for this period, that leaves an additional 75,000 units (both rental and owner-occupied) that are needed.

There’s good news and there’s bad news on this front. The good news is that the region has seen a surge in building over the last four to five years. Fueled by low interest rates and abundant financing, the region has kept pace with, and even exceeded its goals. We have seen the addition of approximately 15,000-16,000 units to the market each year since 2020, with another 41,485 units in the pipeline. The delivery of this much-needed influx of supply has already begun to bring some measure of reprieve for a strained market in the form of tempered year over year rent growth, as depicted below.

There’s good news and there’s bad news on this front. The good news is that the region has seen a surge in building over the last four to five years. Fueled by low interest rates and abundant financing, the region has kept pace with, and even exceeded its goals. We have seen the addition of approximately 15,000-16,000 units to the market each year since 2020, with another 41,485 units in the pipeline. The delivery of this much-needed influx of supply has already begun to bring some measure of reprieve for a strained market in the form of tempered year over year rent growth, as depicted below.

But all signs point to a sharp drop-off in new housing construction as the same factors which drove the building boom have dried up and now threaten to exacerbate the supply/demand imbalance that drives our housing affordability challenges.

Nationally, starts for multifamily projects of five or more units dropped 11.6% for the month and declined 11.2% for the year. According to Costar data, the multifamily asset class has seen only 220,000 units start construction after a record-breaking 727,000 units broke ground in 2022. The U.S. Census Bureau recently released further data showing the slowing pipeline of new multifamily development, citing a 32.2% year-over-year drop in multifamily permitting for the month of July.

These figures are even more pronounced locally. In the second quarter of 2023, construction starts in the Washington metropolitan region dropped by 57% from the previous quarter and 55% year-to-year.

While there are still a number of projects in the pipeline, experts predict that the faucet will run dry in the middle of 2025. And even worse still, the problem is particularly acute among affordable housing development projects, which the region so desperately needs.

What is to blame for this housing supply cliff?

As reported by CoStar News, it’s a combination of factors: “rising interest rates, economic uncertainty and lending hesitancy are among many factors real estate professionals say are stifling new development, sales and more.”

Interest rates

Interest rates have gone from nearly zero to roughly 7% in the last year. This significantly inhibits the ability of a developer to build profitably and thus serves as a major deterrent to new investment. Over the life of a financing term, this can add millions to the cost of building and managing a property.

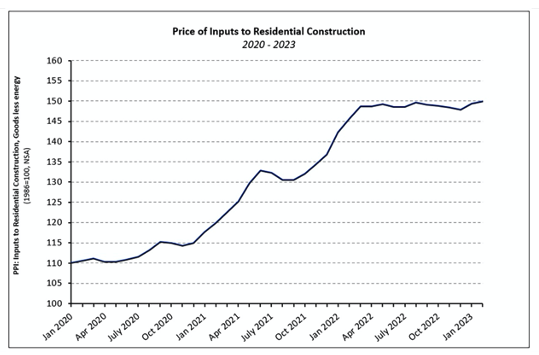

Inflation and materials costs

While we have seen inflation levels taper off in the most recent quarter, materials costs remain far more expensive than they were prior to the pandemic. The National Association of Home Builders (NAHB) tracks the price of inputs to residential construction. While growth in costs has leveled off, they remain significantly higher than they were three years ago, with no signs of relief on the horizon.

Even if a developer is able to make the math work to construct the property, the numbers have to continue to work post-construction in order for the investment to be worthwhile.

A dearth of financing/re-financing options

In addition to the higher costs of borrowing, investors have seen workable financing options dry up in recent months. Institutional lenders that have historically dominated this space have been burned by underperforming commercial loans. As tenant leases come up for renewal over the next several years, it is expected that many commercial tenants will be either giving back the keys entirely or significantly reducing their footprints. Office vacancy rates, already high prior to the pandemic, threaten to climb to historically unseen levels. This added risk forces lenders to demand more upfront capital and less favorable loan terms.

In spite of persistent demand for rental housing, the same financing troubles that plague the commercial real estate have spread to the multifamily sector, creating an additional obstacle for new housing construction and actually endangering the ability of existing properties to secure necessary refinancing.

Implications Locally

The housing supply/demand imbalance continues to drive up the costs of housing. Left unaddressed, it will only perpetuate our ongoing housing affordability crisis, deepen equity concerns, and hinder economic and workforce development efforts.

If housing affordability is truly a priority, the state and local governments that comprise the Washington metropolitan region must work to remove regulatory barriers to construction and allocate funding for additional subsidies to combat the scarcity of private equity financing.

At Issue is compiled by the Apartment and Office Building Association (AOBA) of Metropolitan Washington, and is intended to help inform our elected decisionmakers regarding the issues and policies impacting the commercial and multifamily real estate industry.

AOBA is a non-profit trade organization representing the owners and managers of approximately 185 million square feet of office space and over 400,000 apartment units in the Washington metropolitan area. Of that portfolio, approximately 61 million square feet of commercial office space and 151,000 multifamily residential units are located in Montgomery and Prince George’s County, Maryland. Also represented by AOBA are over 200 companies who provide products and services to the real estate industry. AOBA is the local federated chapter of the Building Owners and Managers Association (BOMA) International and the National Apartment Association.

Along with input provided by AOBA member companies, the following data sources and references were used in compiling the attached report:

- WeAreApartments.org. Data for the District of Columbia, drawn from the U.S. Census Bureau’s 2021 American Community Survey. The National Apartment Association and the National Multifamily Housing Council.

- Metropolitan Washington Council of Governments. “COG Board Looks to Accelerate Action on Housing, TOCs.” February 16, 2023.

- CoStar Commercial Real Estate Data, Information and Analytics Service.

- Jack Witthaus. “Brookfield Properties Lays Off Dozens of Workers as US Construction Slows.” CoStar News. July 19, 2023.

- National Association of Home Builders. “Concrete Products Lead Building Materials Prices Higher.” March 28, 2023.

- Barbara Ballinger. “Multifamily Permits Down 32.2% From a Year Ago.” Globe Street. August 29, 2023.

AOBA strives to be an informational resource to our public sector partners. We welcome your inquiries and feedback. For more information, please contact our Senior Vice President of Government Affairs Brian Gordon at bgordon@aoba-metro.org.