Addressing Housing Affordability Requires Working with Housing Providers, Not Against Them

Like many other states, Virginia faces a challenge of housing affordability.

According to the U.S. Census Bureau, nearly half of Virginia renters (46.3%) are housing cost-burdened, with more than 30% of their gross income spent on housing costs. Almost one in four (24.1%) are severely housing cost-burdened, devoting more than half of their income to housing expenses.1

While some allege “greedy” housing providers are the root cause of this challenge, such an assertion is neither productive nor accurate.

Contrary to popular sentiment, the rental housing industry operates on narrow margins, with an average rate of return that is around half the historical average for the stock market.

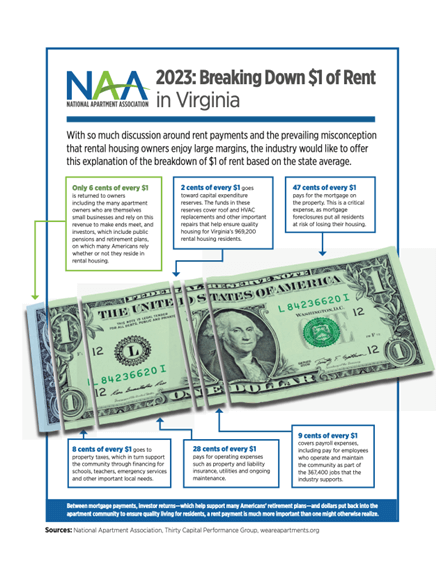

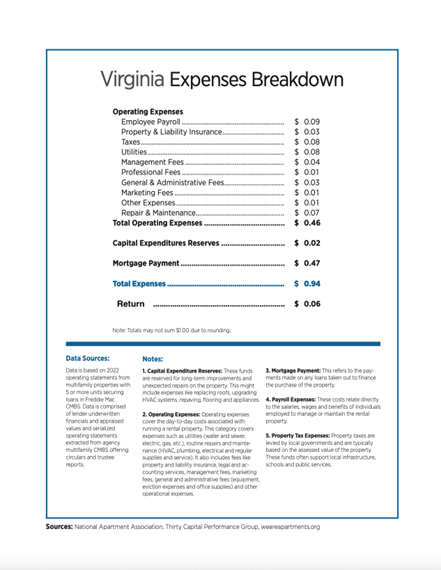

Approximately 94% of the rent collected is allocated directly to the costs of maintaining, managing, and operating the property, as well as funding the local jurisdiction through real estate taxes. Virginia rental housing providers typically see a return of approximately 6 cents for each dollar of rent collected, with the bulk of the funds reinvested into the property. 2

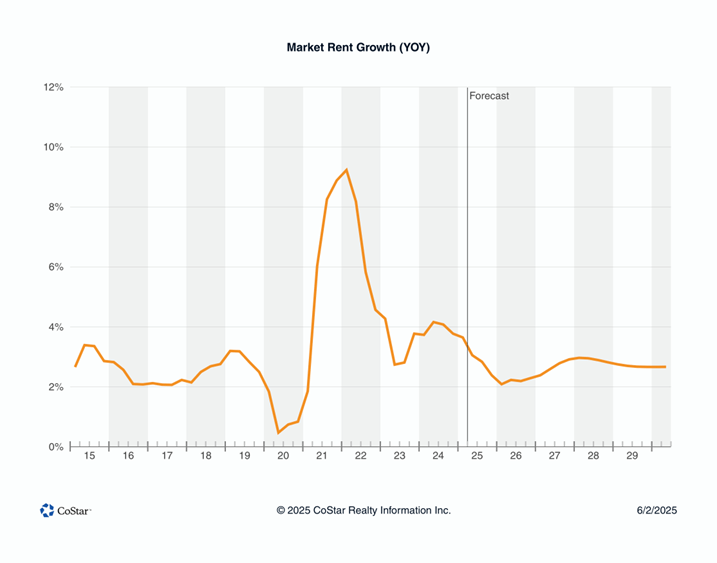

With the exception of an isolated blip during the COVID-19 pandemic market shock (which has since moderated back to long-term norms), Virginia has experienced very modest year-over-year rent growth of around 3%.3 This hardly aligns with the narrative that housing providers are gouging renters.

Rather, rents are determined by a myriad of factors, not the least of which is the cost of providing housing, which has skyrocketed in recent years.

Many of the rental housing industry’s primary operating costs have grown at a rate far in excess of inflation:

- Dominion Virginia Power customers’ fuel rates soared by 73% in July of 2023, and then again by another 22% in 2024, resulting in a 111% increase over a two-year period.4

- According to HUB International, multifamily property insurance rates have increased by roughly 30% since 2020.5

- Gas utility costs increased substantially at the end of 2023. Group metered apartments are now paying approximately 35% more for distribution costs than before the pandemic. These costs are regulated by the Public Service Commission.6

- The Fed has aggressively raised the cost to borrow money since the pandemic, resulting in millions in additional expenses over the life of a multifamily loan.7

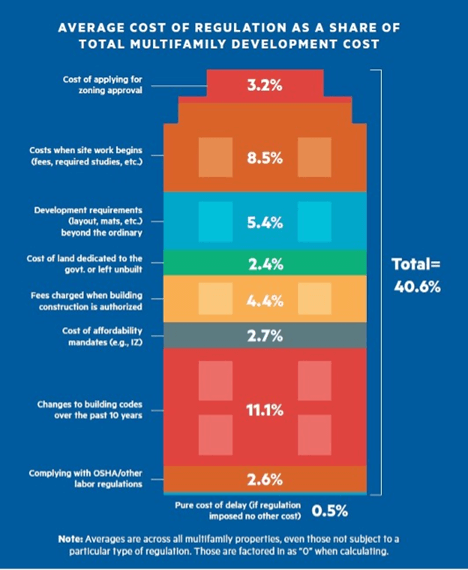

Moreover, the costs associated with developing new rental housing levied at the federal, state, and local levels remain substantial, collectively accounting for about 40% of the costs of constructing a new apartment building.8

Simply put, the government lacks the necessary resources to build the housing supply required to meet demand on its own. Therefore, to meet housing production goals, we need to see housing providers and their investors as vital partners in solving our housing affordability challenges. The first step in this process is to lower the costs of providing housing and ensure Virginia’s regulatory environment remains conducive to attracting new investment.

- ^ An Overview of Cost-Burdened Households in the U.S. and Virginia. Abel Opoku-Adjei. Virginia Association of Realtors. August 21, 2024.

- ^ Virginia: Where Does $1 of Rent Go? Thirty Capital Performance Group and the National Apartment Association. 2023.

- ^ CoStar Commercial Real Estate Data, Information and Analytics Service.

- ^ Dominion Virginia Power. State Corporation Commission Case No. PUR-2023-00067 fuel rate request.

- ^ Patricia Kirk. “Insurance Burdens Stymie Investment.” Multi-housing News. December 11, 2024.

- ^ Washington Gas & Light Company. Apportionment of Distribution Revenue Increase. Case No. PUR-2022-00054.

- ^ Federal funds effective rate. (n.d.). Federal RESERVE Bank of St. Louis, FRED, Federal Reserve Economic Data. Retrieved September 25, 2025, from https://fred.stlouisfed.org/series/FEDFUNDS

- ^ Regulation: 40.6 Percent of the Cost of Multifamily Development. Paul Emrath, National Association of Home Builders (NAHB) and Caitlin Sugrue, National Multifamily Housing Council (NMHC). June 9, 2022.