The Dire Consequences of Rent Control

Despite ample evidence of its consequences, rent control has seen a resurgence in popularity, even garnering some attention right here in Virginia. Hindsight and academic research shows that implementing this policy would be do little to address an affordability issue driven by an undersupply of housing.

Academic Research

A vast catalog of empirical studies documents the various socioeconomic and demographic impacts of rent regulation – 206 to be exact. Overall, these studies have found that at the micro level, rent controls can be effective in slowing rent growth for individual tenants. However, the benefits of such policies can be offset by the wide range of adverse unintended effects, both housing-related and otherwise, that impact renters and the broader community.

Commonly cited outcomes include:

-

Significantly reduced community investment and new housing construction

-

Increased rents for unregulated units

-

Declines in the quality of existing housing

-

Reductions in residential mobility

Case Studies

Beyond academic research, recent case studies offer examples of rent control in action and its extremely harmful, immediate consequences.

St. Paul Minnesota

In November of 2021, St. Paul, Minnesota voters approved a rent stabilization ordinance restricting annual residential rent increases to no more than 3%. The market’s response was abrupt, severe, and swift.

New housing construction plummeted, as investors and developers withdrew from the city at an alarming rate. A series of real estate developers signaled that they had pulled the plug on planned housing construction, sold off existing units, or killed plans in the pipeline. The city experienced a decline of more than 30% in new housing starts, as measured by building permits, compared to the previous four-year average.

The Wall Street Journal summed up the policy's effects as disastrous, foreseeable, and avoidable.

“What happened next should be no mystery. One developer has ‘already pulled applications for three buildings,’ a representative told the St. Paul Pioneer Press. Another ‘lost a major investor’ in ‘an apartment building he’s trying to get off the ground.’ Who could have foreseen it, other than basically every economist with a pulse?”

“If a city’s housing supply can’t grow to meet demand, the natural result is that prices go up. Artificial caps then produce shortages and other distortions, such as dilapidated properties that landlords don’t have an incentive to renovate.”

– The Wall Street Journal

Since the 2021 ballot initiative, policymakers in St. Paul have scrambled to unravel its disastrous effects. They continue to fight an uphill battle to restore community investment and investor confidence. Despite several rounds of amendments to roll back certain provisions of the city’s rent control scheme, the precipitous decline in new housing construction continues amid the city’s housing shortage. Overall, the city has seen 81% fewer housing units built compared to the average over the previous three years.

Suburban Maryland

The recent passage of restrictive rent control in Suburban Maryland is the most significant reason why developers and housing providers are avoiding making new investments.

Both Montgomery County and Prince George’s Counties adopted rent control legislation in 2023. Once again, investor withdrawal from the previously strong markets came swiftly. Multifamily transaction volume in both counties fell 13% in the first three quarters of 2024 compared with the same period in 2023, according to data from MSCI Real Assets. One major brokerage reported that multifamily transactions in Montgomery and Prince George’s Counties declined by 80% compared to 2023.

Take a look at the trendline for new multifamily construction starts in the two jurisdictions immediately after they adopted rent control. New projects have cratered by approximately 90% in the two years since rent regulation policies were approved.[1] And much of what remains was already in the pipeline prior to the Council’s ill-conceived action.

Adam Pagnucco, a former Montgomery County Council staffer and journalist covering county politics, asked his real estate sources about the combined effect of rent control and the wider regulatory environment on housing development. The consensus among the six sources that responded was that the County has become radioactive for investment, while multiple sources stated Northern Virginia is the go-to market.

Some significant industry practitioners have gone public expressing similar views. Equity Residential’s CEO Mark Parrel stated on an earnings call in May 2025 that the company is unlikely to invest further in the County, citing the “poor” political climate. He also highlighted Virginia as a state that is “encouraging housing production.” Ryan Smyth, Senior Director of Acquisitions for Stoneweg, an apartment investment firm, and Scott Choppin, the CEO and Founder of Urban Pacific Group, an urban infill developer, have been similarly critical.

These sentiments are reflected in data collected by the Montgomery County Department of Permitting Services. At a County Planning Board Meeting on July 31, 2025, planning staff presented data on economic indicators in the County. Staff presented two slides on building permits. Staff summarized the data as follows: “The big takeaway is that there is essentially no- there’s no for-rent multifamily, it's been over nine months, we haven’t seen a permit for for-rental multifamily units.”

Montgomery County Planning Department staff also conducted a survey of developers and conducted 14 follow-up interviews back in September. 11 of the 14 interviewed cited rent control as the most significant barrier to completing residential projects.

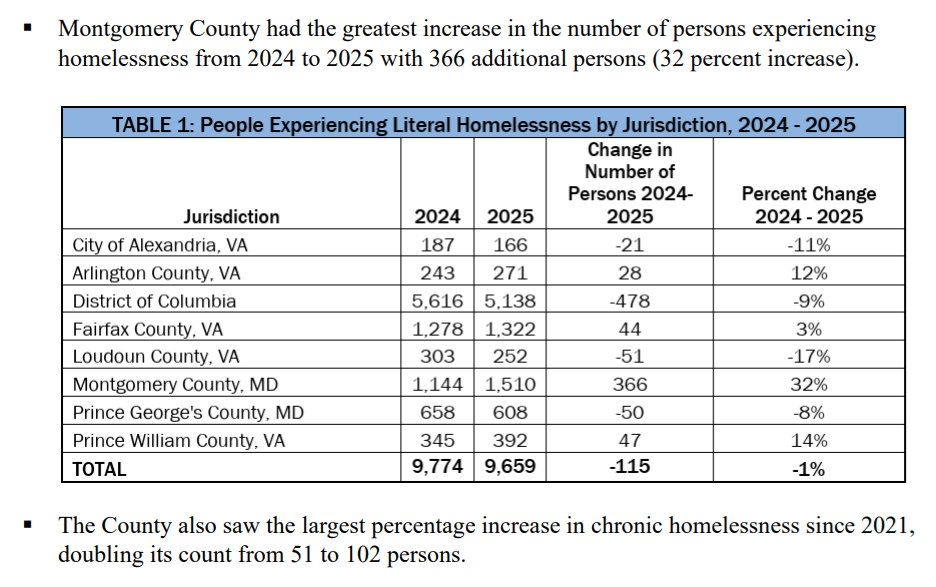

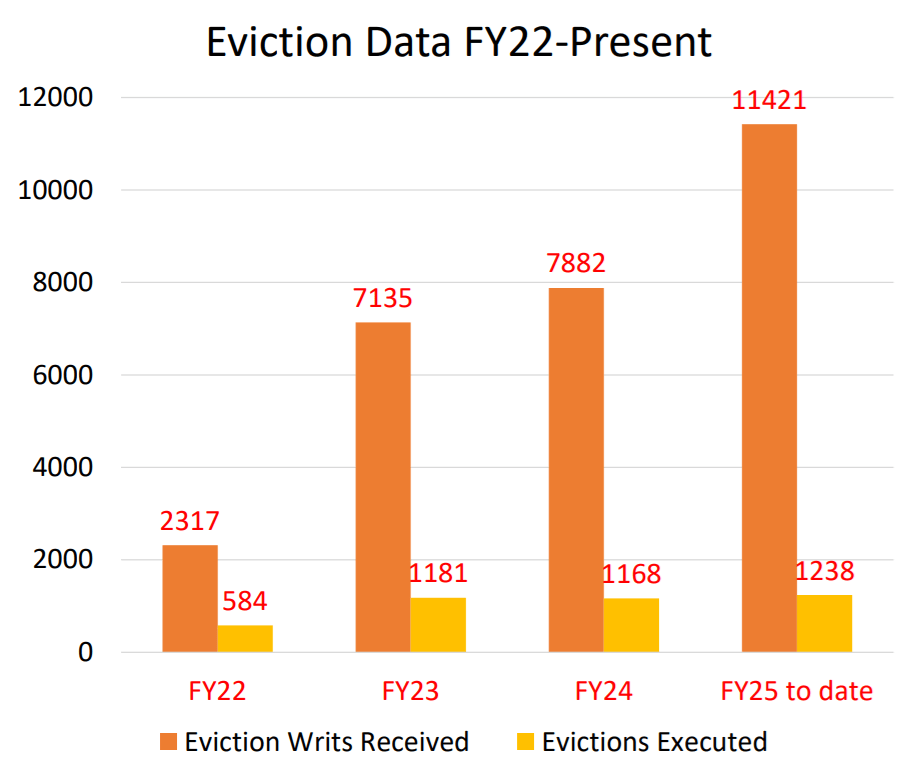

Some advocates and policymakers argue that a decrease in housing construction is a tradeoff worth taking if rent control reduces homelessness and evictions. That hasn’t happened in Montgomery County; homelessness and evictions have actually increased.

Recent attempts to implement rent control have failed to achieve intended outcomes. Policymakers in Virginia should avoid being the next state to try it, expecting different results.