The Costs of Providing Rental Housing

One of the biggest misconceptions surrounding the rental housing industry is that managing rental housing is a high-margin business. This is primarily due to a misunderstanding among policymakers and the general public about how the rental housing business operates.

Approximately 94 percent of rent collected by housing providers in Virginia is allocated to maintaining, managing, and operating the property. Eight percent is used to pay real estate taxes, which are then utilized by local jurisdictions throughout the Commonwealth to fund programs and services. Virginia rental housing providers see a return of approximately 6 cents for each dollar of rent collected.1 A portion of the remaining six percent is returned to investors, typically including pension funds and 401(k)s, which many Americans have a stake in. The remainder is then reinvested in the property.2 This average rate of return of six percent is approximately less than the historical returns of the S&P 500 3 and only slightly above the returns for government bonds, both of which are substantially less risky investments. 4 5

Since the best way to find value growth and repay investors is to continue to reinvest in communities, multifamily investors make use of a loan management strategy wherein the borrower relies on refinancing to take advantage of built-up equity in the property to constantly reinvest, improve the quality of the housing, and grow the value of the asset during each financing cycle.6 Multifamily loans are typically amortized over 20-30 years but must be repaid in full after a much shorter term – typically three, five, seven, or 10 years. While some owners of apartment properties hold these assets for decades, others plan to sell buildings after a set period of time.7

So where does the rent go?

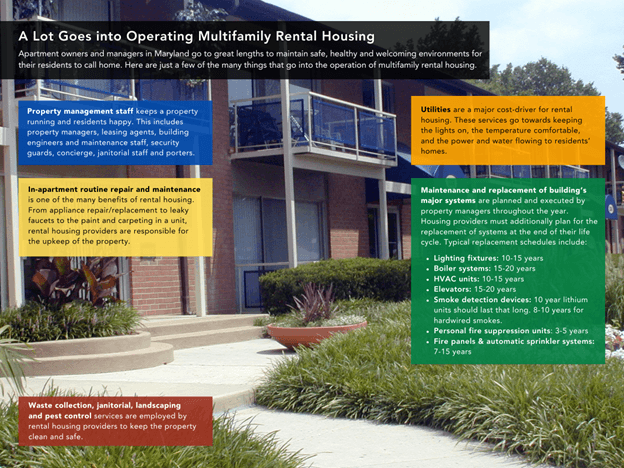

The operation and upkeep of multifamily housing requires tracking and covering an extensive list of expenses that includes mortgage payments and interest, payroll, utility transmission costs, business licenses and other taxes, hazard and liability insurance, in-apartment routine repair and maintenance, contract services like waste collection, janitorial services, maintenance of mechanical systems, boilers, air conditioning systems, and elevators, and fire suppression systems. Maintaining replacement reserves for major repairs to windows, masonry, roofs, elevators, plumbing, electrical systems, and HVAC systems is also critical, as these systems and components have useful lives of 10 to 50 years.8 Rent is almost exclusively relied upon to cover these operational costs.

In part II, we outlined the need for lawmakers to enact statewide policy to incentivize greater new housing development to meet demand. It is equally important that lawmakers foster a consistent, predictable regulatory environment for the management and operation of existing housing.

Unlike other businesses, housing providers cannot offset losses with other revenue streams. Unexpected cost increases may be managed only by increasing rent, reducing services to residents, or deferring planned capital investments. Layering unfunded legislative and regulatory mandates on housing providers only exacerbates the frequency with which they must make these types of decisions.

- ^ Virginia: Where Does $1 of Rent Go? Thirty Capital Performance Group and the National Apartment Association. 2023.

- ^ Virginia: Where Does $1 of Rent Go? Thirty Capital Performance Group and the National Apartment Association. 2023

- ^ Investopedia. What is the average annual return for the S&P 500? Retrieved September 26, 2025, from https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

- ^ Trading Economics. United States government bond yield. Retrieved September 26, 2025, from https://tradingeconomics.com/united-states/government-bond-yield

- ^ U.S. Department of the Treasury. Treasury bonds. Retrieved September 26, 2025, from https://treasurydirect.gov/marketable-securities/treasury-bonds/

- ^ How Multifamily Rental Properties are Financed. The Apartment and Office Building Association (AOBA) of Metropolitan Washington.

- ^ How Multifamily Rental Properties are Financed. The Apartment and Office Building Association (AOBA) of Metropolitan Washington.

- ^ Fannie Mae. (n.d.). Multifamily economic and market commentary: High interest rates and construction costs continue to impact multifamily housing supply. Retrieved September 26, 2025, from