Utilties At Issue - October 2018

Pepco Maryland – new rate case expected after December 15, 2018

Washington Gas Maryland - currently in progress and a new rate case is expected within two years

Washington Gas Virginia - rate case currently in progress

Washington Gas Files Request for a $56.3 Million Increase in Maryland

New Rates Expected by December 10, 2018

On May 15, 2018, WGL filed a request for a $56.3 million increase to the Company’s Maryland annual base rate revenues. The proposed base rate increase includes $15 million of cost currently being collected through surcharges associated with WG’s STRIDE plan. AOBA, Washington Gas and other parties filed several rounds of testimony and hearings were held from October 1, 2018 through October 9, 2018. A PSC decision is expected by December 10, 2018 and new rates will be effective shortly thereafter. This is the first base rate case that Washington Gas has filed in Maryland in approximately 5 years.

The Washington Gas proposed increases to distribution rates by customer class are shown in the chart below. The increases requested for Interruptible customers are substantial. The proposed distribution charges for Interruptible customers for the first 75,000 therms are proposed to increase by approximately 29% and the proposed distribution charges for therms used over 75,000 are proposed to increase by approximately 40%.

| Customer Class | Proposed Increases to Distribution Rates Distribution Only |

Proposed Increases to Distribution Rates Total Bill Impact |

| Residential Heating /Cooling | 19.77% | 10.67% |

| Residential Non-Heating/Non-Cooling | 15.17% | 8.86% |

| C&I Heating/Cooling < 3,000 | 9.73% | 5.95% |

| C&I Heating/Cooling > 3,000 | 19.95% | 13.08% |

| C&I Non-Heating/Non-Cooling | 9.53% | 6.02% |

| GMA Heating/Cooling | 15.36% | 11.46% |

| GMA Non-Heating/Non-Cooling | 9.50% | 7.17% |

| Interruptible | 16.96% | 16.96% |

| Total | 18.43% | 10.96% |

However, after AOBA filed supplemental direct testimony, WG substantially revised its testimony and cost of service study in accordance with the recommendations of AOBA’s expert consultant Bruce R. Oliver.

| Surrebuttal Table 1 Comparison of Class Relative Rates of Return |

||||

| Case No. 9481 | ||||

| WG Errata Filing Exhibits ABG - |

WG Rebuttal Exhibits ABG - |

|||

Class |

SUP5 CP |

SUP6 NCP |

R8 CP |

R9 NCP |

| Res Heat/Cool | 1.27 | 1.27 | 0.97 | 0.98 |

| Res Non-Heat | 1.63 | 1.59 | 1.20 | 1.16 |

| C&I Heat < 3000 | 1.53 | 1.44 | 1.59 | 1.52 |

| C&I Heat > 3000 | 0.64 | 0.65 | 1.00 | 1.01 |

| C&I Non-Heat | 1.67 | 1.67 | 1.85 | 1.84 |

| GMA Heat | 0.90 | 0.88 | 1.24 | 1.23 |

| GMA Non-Heat | 1.89 | 1.72 | 1.88 | 1.75 |

| Non-Firm | -0.54 | -0.53 | 0.41 | 0.41 |

The Company’s further corrected class cost of service study results shown above yield important and substantial changes in the relative rates of return for several classes impacting AOBA members, which should ameliorate the impact of any rate increase on AOBA members. Further complicating this proceeding, WG stated that it did not have time to file a rate design. At this time, settlement discussions are ongoing and final briefs are due November 9, 2018, with a decision expected no later than December 10, 2018, with new rates effective shortly thereafter.

Washington Gas Files Application for New STRIDE Plan in Maryland

On June 15, 2018, WG filed its Application for approval of a new gas system Strategic Infrastructure Development and Enhancement Plan (“STRIDE 2”) and an accompanying cost recovery mechanism to become effective January 1, 2019. The estimated cost of the initial five-year period of Washington Gas’ gas system infrastructure replacement plan (2019 to 2023) is approximately $393.6 million. WG proposes to fund the costs of the accelerated infrastructure replacement through a surcharge cost recovery mechanism, the STRIDE surcharge. A PSC decision is expected by mid-December, 2018 with new surcharges effective shortly thereafter.

The proposed monthly STRIDE surcharges by customer class are shown in the chart below.

| Billing Class | Estimated Monthly Surcharge |

| Residential Heating/Cooling | $0.37 |

| Residential Non-Heating/Non-cooling | $0.19 |

| C&I Heating/Cooling <3,000 therms | $0.59 |

| C&I Heating/Cooling >3,000 therms | $3.99 |

| C&I Non-Heating/Non-Cooling | $1.50 |

| GMA Heating/Cooling | $4.87 |

| GMA Non-Heating/Non-Cooling | $1.06 |

| Interruptible | $48.15 |

Washington Gas Files Request for a $37.6 Million Increase in Virginia

Washington Gas filed an Application on July 31, 2018 requesting authority to increase its rates and charges and to revise the terms and conditions applicable to gas service effective for usage beginning with the January 2019 billing cycle, subject to refund. WG has proposed to increase the annual operating revenues of Washington Gas by $37.6 million with approximately $14.7 million of the request relating to costs associated with the SAVE Plan. WG states that the revenue requirement reflects a $16.3 million reduction for lower tax expense due to the implementation of the Tax Cuts and Jobs Act of 2017 (“TCJA”) and does not include any costs related to the acquisition of WG by AltaGas. The SCC will consider the effects of the accrued liability resulting from the Tax Cuts and Jobs Act (“TCJA”) beginning January 1, 2018, as well the effect on future gas rates going forward in this new proceeding. WG filed its last Application for a general rate increase on June 30, 2016 with rates effective November 28, 2016, subject to refund.

The proposed increases to distribution rates by customer class are shown in the chart below. For 2019 budget considerations, members need to budget for the full increases to be effective with the January, 2019 billing cycle. The full rates will be implemented at that time, subject to refund, pending a SCC decision.

| Customer Class | Proposed Increases to Distribution Rates Distribution Only |

Proposed Increases to Distribution Rates Total Bill Impact |

| Residential Heating /Cooling | 10.65% | 6.09% |

| C&I Heating/Cooling | 18.34% | 9.99% |

| C&I Non-Heating/Non-Cooling | 9.64% | 5.14% |

| C&I Large Customers | 16.74% | 14.40% |

| GMA Heating/Cooling | 21.08% | 12.94% |

| GMA Non-Heating/Non-Cooling | 9.52% | 6.32% |

| GMA Large Customers | 22.51% | 14.22% |

| Interruptible | 22.94% | 7.27% |

| Total | 12.57% | 7.20% |

Dominion Energy Virginia Files Proposal for Updated Underground Rider

On March 19, 2018, Dominion Energy Virginia filed its Application for revision to the Company’s Rider U for the recovery of costs associated with Dominion’s Strategic Underground Program for the rate year February 1, 2019 through January 31, 2020 pursuant to Senate Bill 966. In its Application, Dominion proposes to recover Rider U costs from GS-1 customers and GS-2 customers through a combination of cents-per-kWh charges for bills with load factors equal to or less than 50% and dollars-per-kW (demand) charges for bills with usage that reflect load factors greater than 50%. In AOBA’s testimony filed on June 12, 2018, AOBA witness Bruce Oliver presented an alternative rate design that ensures all GS-2 (and GS-2T) customers are assessed rates that are premised on a more uniform distribution of Rider U revenue requirements in terms of the effective dollars per kW billed. AOBA counsel and witness participated in the public hearing on July 24, 2018 and briefs were filed September 7, 2018. A Hearing Examiner’s decision should be issued before the end of the year.

The proposed Strategic Underground Program rates, Rider U, are shown in the chart below.

| Rate Schedule | DEV Proposed Cents per Electricity Supply kWh Charge |

DEV Proposed Dollars per kW Demand Charge |

AOBA Proposed Cents per Electricity Supply kWh Charge |

AOBA Proposed Dollars per kW Demand Charge |

| Schedule 1 | 0.1920¢/kWh | |||

| GS-1 | 0.1504¢/kWh | Accept DEV | ||

| GS-2 | 0.1083¢/kWh1 | $0.386/kW1 | 0.1330¢/kWh1 | $0.328/kW1 |

| GS-2T | 0.1083¢/kWh2 | $0.386/kW2 | 0.1330¢/kWh2 | $0.328/kW2 |

| GS-3 | $0.000/kW | |||

| GS-4 (Primary) |

$0.000/kW | |||

| GS-4 (Transmission) | $0.000/kW |

1 If the monthly Load Factor is less than or equal to 50%, the Energy Rate (kWh) applies; otherwise the Demand Charge(kW) applies to the kW Demand. Load Factor is calculated as Monthly Total kWh divided by the number of Days in the Billing Month divided by 24 divided by the Maximum Measured kW of Demand.

2 If the monthly Load Factor is less than or equal to 50%, the Energy Rate (kWh) applies; otherwise the Demand Charge(kW) applies to the On-Peak Electricity Supply Demand. Load Factor is calculated as Monthly Total kWh divided by the number of Days in the Billing Month divided by 24 divided by the Maximum Measured kW of Demand.

Settlement Approved in Washington Gas Case Considering TCJA Impacts

Rates Reduced for DC Ratepayers

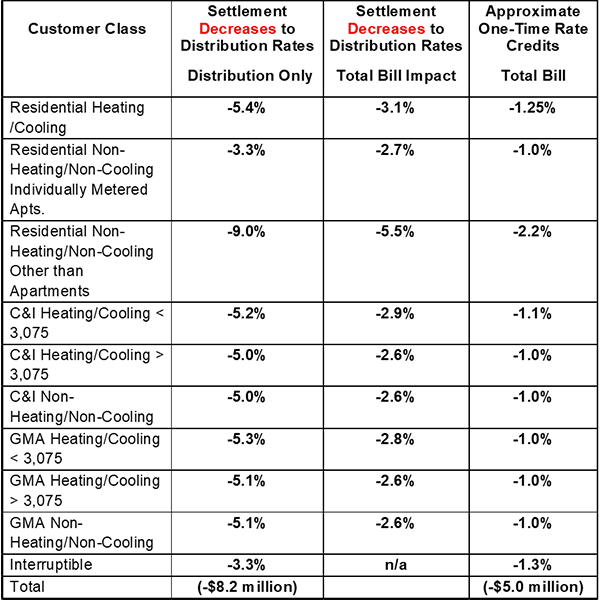

As a result of the Tax Cuts and Jobs Act of 2017 (“TCJA”), the DC PSC ordered Washington Gas to propose reductions to distribution rates and accrue as regulatory liabilities the impacts of the reduced corporate income tax rate beginning January 1, 2018. Washington Gas filed its Application for Approval of Reduction of Distribution Rates to Reflect the Tax Cuts and Jobs Act of 2017 on January 12, 2018 and its proposal to reduce rates by $6.2 million on February 12, 2018 for all classes except the interruptible class.

AOBA, Washington Gas, and the Office of People’s Counsel participated in several settlement discussions regarding WG’s Application. These discussions ultimately resulted in AOBA entering into a Unanimous Settlement Agreement with WG and other parties on April 30, 2018. AOBA submitted testimony in support of the Settlement Agreement on June 18, 2018. As part of the Settlement Agreement, the settling parties agreed to a reduction in WG’s rates of $8,226,090 for all customer classes effective for usage on and after August 1, 2018, including the interruptible class, served in the District of Columbia. These rates reflect the revenue allocation approved in WG’s last base rate case. Further, the allocation of the rate decrease by customer class was based on total distribution revenue including customer charges, peak usage and distribution charges. The settling parties requested that rates become effective on the first day of WG’s next billing cycle following publication of the Notice of Final Tariff in the District of Columbia Register, which was August 1, 2018. The accrued regulatory liability beginning January 1, 2018 through the implementation date of reduction in rates, i.e., July 31, 2018, will be credited to customer’s bills in December, 2018. This one-time rate credit will total approximately $5,101,325.

These reductions are in addition to the $5,422,582 one-time rate credits for WG non-residential customers as a result of the AtlaGas/WG merger which was approved June 28, 2018 by the DC PSC. The rate credit should appear on customer’s bills with the September 2018 billing cycle. As part of the merger, AtlaGas has agreed that WG will not file a new application requesting an increase in base rates in the District of Columbia until after January 3, 2020.

The chart below shows the decreases to distribution rates and approximate one-time credits by customer class for all customer classes in the District of Columbia, including the interruptible class.

Pepco District of Columbia Distribution Rates to be Reduced by $24.1 Million

Settlement Approved in DC Rate and Tax Cases

On December 19, 2017, Pepco filed an application requesting authority to increase electric distribution rates by $66,209,000. The Company also requested an increase in its authorized return on equity (ROE) from the current rate of 9.5% to 10.10%. AOBA retained the consulting firm, Revilo Hill Associates, Inc., to provide expert consulting services in this case.

This base rate case was filed just months after Pepco’s previous request for a base rate increase in DC. In that case, the DC PSC approved a $36,888,000 rate increase and a 9.5% ROE for Pepco on July 24, 2017, with new rates effective August 15, 2017.

The enactment of the Tax Cuts and Jobs Act of 2017 (“TCJA”), which reduced the Federal corporate income tax rate from 35% to 21% effective January 1, 2018, resulted in the DC PSC ordering Pepco to propose reductions to distribution rates and accrue as regulatory liabilities, the impacts of the reduced corporate income tax rate beginning January 1, 2018.

Pepco, AOBA, and other parties agreed to consolidate Pepco’s $66.2 million requested increase to distribution rates with the TCJA proceeding to reflect reductions to distribution rates due to the lower corporate tax rate. The effect of the TCJA on Pepco is in two parts. The first, is a reduction due to the accrued regulatory liability beginning January 1, 2018 until the effective date of its return to customers. The second, is the calculation of reductions in rates going forward due to the lower Federal corporate income tax rate.

Settlement discussions were held in the consolidated proceedings between AOBA, Pepco, and eight other parties to discuss Pepco’s proposed increase to distribution rates in conjunction with the impacts of the TCJA. These discussions ultimately resulted in AOBA entering into a Non-Unanimous Settlement Agreement with Pepco and other parties on April 17, 2018. The Settlement Agreement provides for Pepco to reduce its distribution rates for its DC customers by $24,100,000 going forward. The parties further agreed that customer charges for all classes will remain unchanged and the reduction in rates will be proportional decreases in the volumetric charges and demand charges, where applicable. In addition, the parties agreed to a rate of return on equity of 9.525% and an overall rate of return of 7.45%. Finally, the parties agreed that there will be a moratorium on the filing of new base rate applications by Pepco until May 1, 2019.

The PSC issued an Order on August 9, 2018 approving the Settlement with new rates to be effective for usage on and after August 13, 2018. Further, all Pepco customers will receive an approximately $24.9 million one-time rate credit which reflects the accrued decrease in the Federal corporate income tax rate from 35% to 21% from January 1, 2018 through August 12, 2018. Credits for commercial customers were posted on all commercial accounts on September 26, 2018 and customers will receive their credits on their bills after that date.

Additionally, Pepco agreed to establish a separate MGT-LV Rate Class. The MGT-LV rate class will apply to customers whose maximum 30-minute demand is equal to or in excess of 100 kW during 2 or more billing months within 12 consecutive billing months. Correspondingly, the applicability of the GT-LV class will be redefined to apply only to customers whose maximum 30-minute demand equals or exceeds 1,000 kW in two or more months within 12 consecutive billing months. The establishment of these redefined rate classifications will be accomplished on a revenue neutral basis under the settlement by applying the same customer, distribution and demand charges to both classes. Pepco will compute separate revenue per customer targets for the new MGT-LV rate class and the redefined GT-LV rate class. These recomputed revenues per customer targets will be applied on a going forward basis in all BSA revenue reconciliations with revenues reconciled separately for the MGT-LV and GT-LV rate classes. Pepco agreed to work with AOBA, OPC, and other interested parties to further address in Pepco’s next rate case the Bill Stabilization Adjustment (BSA) structural deficiencies identified by the Commission in previous decisions.

The newly established MGT_LV rate class will be charged the same undergrounding surcharge rates as the GT_LV class which are as follows:

Underground Project Charge: $0.00049 per kWh

Underground Rider: $0.00365 per kWh

The approved decreases to distribution rates by customer class and the one-time rate credit in DC are shown in the chart below.

| Rate Schedule | Proposed Increases to Distribution Rates FC 1150 |

Settlement Decreases to Distribution Rates Including BSA | Settlement Decreases to Distribution Rates Excluding BSA |

Approximate Settlement Regulatory Liability One-Time Rate Credit |

| Residential | 23.61% | -2.77% | -3.02% | -4.83% |

| MMA | 15.78% | -8.07% | -6.05% | -4.83% |

| GS ND | 13.89% | -6.28% | -6.05% | -4.83% |

| GSD- LV | 13.89% | -6.28% | -6.05% | -4.83% |

| GSD-3A | 13.89% | -6.61% | -6.05% | -4.83% |

| GT LV | 13.79% | -6.16% | -6.82% | -4.83% |

| GT 3B | 0.00% | -33.47% | -33.66% | -4.83% |

| GT 3A | 14.00% | -6.76% | -6.82% | -4.83% |

| SL/ SL LED | 23.61% | -2.38% | -3.02% | -4.83% |

| Traffic Signal | 23.61% | -13.06% | -13.11% | -4.83% |

| TN | 0.00% | -43.08 | -44.40% | -4.83% |

| Total | 15.74% | -6.05% (-$24.1 million) |

-4.83% (-$19.25 million)* |

*The regulatory one-time rate credit will be based on $24.9 million. The numbers in the chart above are based on the originally proposed amount of $19.5 million. The one-time rate credit of $24.9 million was posted on all commercial accounts on September 26, 2018. Customers will receive their credits on their bills after that date.

The above decreases will be affected by Pepco’s Bill Stabilization Adjustment (BSA). The effect of the BSA on each class and the individual billing components must be calculated separately.

Pepco Maryland Distribution Rates Reduced by $15 Million

Settlement Approved in Maryland Rate Cases

On January 2, 2018, Pepco filed an application requesting authority to increase electric distribution rates by $41,439,000 and an authorized rate of return on equity of 10.10%, an increase from the current authorized rate of 9.5%. Pepco also requested approval of “a phase in of revenue associated with reliability plant not to exceed $15,000,000.”

This case was filed on the heels of Pepco’s last request for a base rate increase in Maryland. In that case, the MD PSC denied Pepco’s request for a $68,619,000 million increase in rates and reduced Pepco’s request by approximately 50% to $33,967,000 million, with rates effective for service on and after October 20, 2017.

As in DC, the enactment of the TCJA has resulted in the MD PSC ordering Pepco to propose reductions to distribution rates and accrue as a regulatory liability the impact of the reduced corporate income tax rate beginning January 1, 2018.

Pepco, AOBA, and other parties agreed to consolidate Pepco’s requested $41.4 million increase to distribution rates with the Maryland Public Service Commission ordered proceeding to consider reductions to Pepco’s distribution rates as a result of the TCJA. The effect of the TCJA on Pepco is in two parts. The first is a reduction due to the accrued regulatory liability from January 1, 2018 until the effective date of its return to customers. The second is the calculation of a reduction in rates going forward due to the lower Federal corporate income tax rate.

As in DC, extensive settlement discussions were held between AOBA, Pepco, and other parties. AOBA entered into a Settlement Agreement with Pepco and other parties on April 20, 2018 and a hearing was held on May 16, 2018. The MD PSC approved the Settlement on May 31, 2018.

As part of the Settlement Agreement, Pepco agreed to reduce distribution rates for its Maryland customers by $15,000,000 with new rates effective for service on and after June 1, 2018. However, AOBA and other parties did not agree to Pepco’s proposed additional $15,000,000 phase in of revenue associated with reliability plant.

The Settlement Agreement also provides that the TCJA regulatory liability accrued from January 1, 2018 to May 31, 2018 of $9.7 million will be distributed to customers in the form of a one-time bill credit, approximately a 2% decrease, to be issued 60 days from the Commission’s approval of the Settlement Agreement, i.e., July 31, 2018. In addition, Pepco will not file a new Maryland distribution base rate case before December 15, 2018.

The approved decreases to distribution rates and one-time bill credit by customer class in Maryland are shown in the chart below.

| Rate Schedule | Proposed Increases to Distribution Rates Case No. 9472 |

Settlement Decreases to Distribution Rates Including BSA | Settlement Regulatory Liability One-Time Rate Credit *amounts are approximate |

| Residential | 8.71% | -2.12% * | -2.0% |

| RTM | 8.71% | -2.12% | -2.0% |

| GS LV | 6.38% | -3.64% * | -2.0% |

| MGT LV | 6.38% | -3.75% | -2.0% |

| MGT 3A | 8.71% | -2.12% | -2.0% |

| GT LV | 6.38% | -4.64% | -2.0% |

| GT 3B | 0.00% | -14.66% | -2.0% |

| GT 3A | 7.78% | -2.12% | -2.0% |

| TM RT | 7.78% | -4.94% | -2.0% |

| SL | 7.78% | -2.82% | -2.0% |

| SSL | 7.78% | -2.82% | -2.0% |

| TN | 0.00% | -9.26% | -2.0% |

| Total | 7.78% | -2.82% (-$15 million) |

2.0% (-$9.7 million) |

*The BSA may result in small increases to some customer’s bills for the Residential and GS_LV class.

The above decreases will be affected by Pepco’s Bill Stabilization Adjustment (BSA). The effect of the BSA on each class and the individual billing components must be calculated separately.

Credits to be Issued to Dominion Energy Virginia Customers

During the 2018 session of the Virginia Assembly, lawmakers passed a bill to end the freeze to base rates and subjects Dominion Energy Virginia to triennial review of its rates, terms, and conditions for generation, distribution, and transmission services. The bill became effective July 1, 2018 and Dominion’s first review of rates will be in the Triennial Review in 2021. The law also contains provisions that require Dominion to issue its current customers generation and distribution services bill credits.

The credits will be issued in two parts. Dominion will issue the first one-time generation and distribution service bill credit to customers in an aggregate amount of $133.0 million no later than 30 days following July 1, 2018. The one-time distribution credit will be received under Rider BC1D at a rate of 0.0695 cents per kWh for usage consumed on and after January 1, 2017 through and including December 31, 2017. The one-time generation credit will be received under Rider BC1G at a rate of 0.1360 cents per kWh for usage consumed on and after January 1, 2017 through and including December 31, 2017.

The second one-time generation and distribution service bill credit will be issued to customers no later than 30 days after January 1, 2019 in an aggregate amount of $67.0 million.

Dominion Fuel Rider Increase in Effect

On May 21, 2018, the State Corporation Commission (“SCC”) approved an increase to the Fuel Rider on an interim basis effective for usage on and after July 1, 2018. Dominion increased its fuel factor from the July 1, 2017 rate of 2.383 cents per kilowatt-hour to 2.719 cents per kilowatt-hour effective for usage on and after July 1, 2018, a 13% increase.

Transmission Reallocation Costs to Impact Supply Costs

FERC issued an Order on May 31, 2018 (Docket Number EL05-121-009) approving a settlement for a reallocation of large scale transmission facilities related costs from PJM-West to PJM-East. The order changes the cost allocation method of certain transmission projects, approved by PJM prior to February 1, 2013, 500kV and above built in eastern PJM, that have been partially allocated to western PJM based on their load ratio. These reallocations will result in credits or charges to all utilities and suppliers in the PJM zone. Customers with accounts behind the Pepco, BGE, and the Potomac Edison utilities will receive additional charges. The new transmission reallocation costs, knows as “TEC” or “TEAC,” will be billed on the supply portion of customer’s monthly electricity bills.

The TEAC charges will impact all suppliers. However, the method in which each supplier will pass through the costs to their individual customers will vary. AOBA has learned some suppliers plan to pass through the new charges to ALL customers, where as another supplier is electing NOT to pass the charges through to customers on a fully fixed supply contract. We encourage you to speak to your energy supplier about how they plan to pass through these new TEAC charges to your companies. Customers should begin to see these new transmission costs on their August bills.

The Joint Merger of AtlaGas Ltd and WGL Holdings Approved in the District of Columbia, Maryland and Virginia

The Maryland Public Service Commission approved the Joint Merger Application of AtlaGas Ltd and WGL Holdings, Inc. on April 4, 2018, Case No 9449. In its decision, the Commission stated the merger is “consistent with the public interest, convenience and necessity; we have adequately mitigated any potential harms to consumers; and it benefits both Washington Gas customers and consumers generally”. As part of the merger approval, the Commission revised the conditions outlined in the settlement entered into by WGL, AltaGas, and Montgomery and Prince George’s Counties. After AOBA presented testimony and argued during hearings that non-residential customers were entitled to a rate credit, the PSC agreed and approved an $8.8 million rate credit for WG non-residential customers.

The State Corporation Commission of Virginia approved the WG acquisition on October 23, 2017. The process and legal standard for acquisition review is different in Virginia, unlike in Maryland and DC, formal evidentiary hearings are not required and were not held. There are no rate credits for any of Washington Gas' customers in Virginia.

In the District, AOBA, WG the Office of People’s Counsel and all parties entered into a Unanimous Settlement Agreement on May 8, 2018, Formal Case No. 1142. As part of the Agreement, AltaGas agreed to fund $5,422,582 for one-time rate credits for WG non-residential customers in the District. The amount of each customer’s credit will be determined on a volumetric basis. The non-residential rate credits will be provided within 60 days after the merger closing and will be based on active customer accounts as of the billing cycle 30 days after the merger closing. Importantly, no portion of the rate credits will be recovered in utility rates. WG’s last rate case was decided on March 3, 2017 and granted WG an $8,510,251 increase in rates. Of the $8.5 million approved, non-residential rates were increased by $2,738,000. Essentially, this rate credit offsets approximately two years of the rate increase granted in March, 2017.

Additionally, the Settlement Agreement provides for the AOBA Educational Foundation (AEF), beginning upon AEF’s qualification for 501(c)(3) status, to receive $250,000 per year for 7 years post-merger close, for a total of $1,750.000. Further, the DC Attorney General and OPC have stated in a press release that “In a separate matter, Washington Gas has agreed that it will not seek recovery of any costs beyond a previously agreed upon cap of $28 million in connection with the replacement of obsolete infrastructure in the District. This infrastructure replacement is pursuant to a previous Public Service Commission order. The agreement ensures that ratepayers won’t be responsible for cost overruns associated with the project.” AOBA submitted testimony in support of the Settlement Agreement on May 25, 2018.

And finally, AtlaGas has agreed that WG will not file a new application requesting an increase in base rates in the District of Columbia until after January 3, 2020.

On June 28, 2018, the DC PSC conditionally approved the Joint Merger of AtlaGas Ltd and WGL Holdings set forth in the Settlement Agreement entered into by AltaGas, WGL Holdings, AOBA, the DC Government and the Office of People’s Counsel. AltaGas and WGL Holdings have accepted the terms of the conditions of the DC PSC and the merger closed on July 6, 2018.