Utilties At Issue - January 2019

2018 began with a series of rate decreases and rate credits. 2019 however, will be a year of rate increases and proposed substantial changes in the utility paradigm.

Rate Case Expectations:

Pepco District of Columbia – New rate case expected after May 1, 2019

Pepco Maryland – Rate case filed January 15, 2019

Washington Gas DC – Next rate case expected after January 2, 2020

Washington Gas MD – New rates in effect December 11, 2018

Next rate case is expected within two years

Washington Gas VA – Rate case currently in progress, new rates effective

January, 2019 subject to refund

Dominion’s next review of rates will be the Triennial Review in 2021

Mayor Bowser Signs Clean Energy Act – 100% Renewable Electricity Supply by 2032

On January 18, 2019, Mayor Muriel Bowser signed the Clean Energy D.C. Omnibus Amendment Act of 2018 into law. The bill contains sweeping changes to the energy landscape in the District and includes several changes to the existing Renewable Portfolio Standards (“RPS”) program. Its impact includes a significant increase in the existing RPS and will require a 100% clean energy supply for all customers in the District by 2032 which includes a provision for 10% from solar by 2041. The bill also established a task force charged with forming building energy performance standards in the District. The goal of the task force is to maximize energy efficiency.

The bill increased funding for local sustainability initiatives. The Sustainable Energy Trust Fund (“SETF”), will be triple the natural gas assessment, double the electricity assessment for dirty energy while exempting electricity from renewable sources, and applies a new 8.4 cents per gallon assessment on sales of heating and fuel oil. This revenue would be used to finance the Green Finance Authority (commonly known as the District’s Green Bank) and strengthen funding available for low-income energy assistance.

The bill also establishes a new building performance standard equal to or greater than DC’s median ENERGY STAR score for designated buildings. In addition, it provides pathways to achieve these new standards. The established Building Energy Performance Standard Program for privately-owned and District government buildings would be the first of its kind in the country.

The bill now is subject to a 30-day Congressional review before it becomes law. This will determine the effective date of the legislation and the deadline for contracts for the grandfathering provision. As a reminder, AOBA successfully lobbied to include a grandfathering provision for current electricity supply contracts that would extend the current RPS standards through December 31, 2021.

Please be advised that for 3 years after January 1, 2019, this subsection shall not apply to any contract entered into before the effective date of the Clean Energy DC Omnibus Amendment Act of 2018, as introduced on July 10, 2018 (Bill 22-904); provided, that subsection shall apply to an extension or renewal of such a contract.

Based on current market conditions, new contracts for electricity supply for 2019-2021 could see an estimated increase of $2.00/ mwh ($0.002/kwh) or more for customers in the near term, unless the building is under an existing contract prior to the effective date of the legislation. The effective date of the legislation could be as early as mid-February.

Pepco Requests $29,990,00 Increase in Distribution Rates in Maryland on January 15, 2019

Last year, on January 2, 2018, Pepco filed an application requesting authority to increase electric distribution rates by $41,439,000 and an additional “phase-in of revenue associated with reliability plant not to exceed $15,000,000.” (Case No. 9472). AOBA was able to successfully resolve that case by a settlement agreement in which Pepco agreed to reduce distribution rates for its Maryland customers by $15,000,000 effective for service on and after June 1, 2018, without Pepco’s proposed additional $15,000,000 phase-in of revenue. The Settlement Agreement also provided that the Tax Cuts and Jobs Act of 2017 (“TCJA”) regulatory liability accrued from January 1, 2018, to May 31, 2018, $9.7 million would be distributed to customers in each class in the form of a one-time bill credit to be issued by July 31, 2018.

Last year, on January 2, 2018, Pepco filed an application requesting authority to increase electric distribution rates by $41,439,000 and an additional “phase-in of revenue associated with reliability plant not to exceed $15,000,000.” (Case No. 9472). AOBA was able to successfully resolve that case by a settlement agreement in which Pepco agreed to reduce distribution rates for its Maryland customers by $15,000,000 effective for service on and after June 1, 2018, without Pepco’s proposed additional $15,000,000 phase-in of revenue. The Settlement Agreement also provided that the Tax Cuts and Jobs Act of 2017 (“TCJA”) regulatory liability accrued from January 1, 2018, to May 31, 2018, $9.7 million would be distributed to customers in each class in the form of a one-time bill credit to be issued by July 31, 2018.

This case was filed on the heels of Pepco’s previous request (Case No. 9443, filed March 24, 2017) for a base rate increase in Maryland of $68,619,000, in which the MD PSC reduced Pepco’s request by approximately 50% to $33,967,000 million, with rates effective for service on and after October 20, 2017.

Twelve months after Pepco’s last rate request, on January 15, 2019, Pepco has filed its third request in three years for an increase in base distribution revenues of $29,990,000, approximately a 7% increase in distribution revenues, i.e., Case No. 9602. Pepco is also requesting an increase in its return on equity from 9.5% to 10.3%. Pepco’s proposed increases by customer class in Maryland are shown in the chart below and will be effective on August 13, 2019.

| Pepco Rate Schedule |

Proposed Increases to Distribution Rates |

| Residential | 6.46% |

| RTM | 5.76% |

| GS LV | 5.76% |

| MGT LV | 4.54% |

| MGT 3A | 6.46% |

| GT LV | 4.54% |

| GT 3B | 0.00% |

| GT 3A | 6.46% |

| TM RT | 6.46% |

| SL | 7.15% |

| SSL | 6.46% |

| TN | 0.00% |

| Total | $29,990,000 |

AOBA has intervened in this case and will provide more information as this case progresses. However, we do expect that new rates will be effective in August 2019.

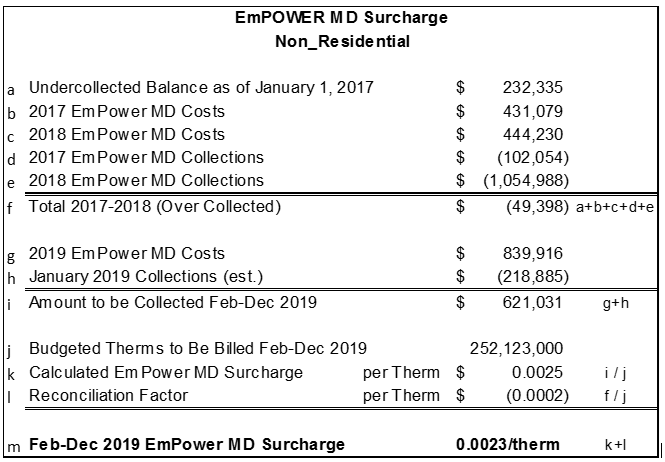

Washington Gas Filed its Revised EmPOWER Surcharge Provision for 2019

On January 14, 2019, WGL filed its revised EmPOWER surcharge provision for Program Years 2018-2020. In April 2008, Maryland enacted the EmPOWER Maryland Energy Efficiency Act setting a state goal of achieving a 15% reduction in per capita electricity consumption and per capita peak demand (Case 9362). The EmPOWER activities of all Maryland utilities are reviewed annually by the Maryland Public Service Commission. Washington Gas submits actual costs and collections incurred during the previous year and adjusts the EmPOWER surcharge for the upcoming year. The revised surcharge rate will go into effect with the February 2019 bill cycle. The 2019 surcharge will be $0.0023/therm, a reduction from last year’s surcharge of $0.0048/therm(Case No. 9494).

On January 14, 2019, WGL filed its revised EmPOWER surcharge provision for Program Years 2018-2020. In April 2008, Maryland enacted the EmPOWER Maryland Energy Efficiency Act setting a state goal of achieving a 15% reduction in per capita electricity consumption and per capita peak demand (Case 9362). The EmPOWER activities of all Maryland utilities are reviewed annually by the Maryland Public Service Commission. Washington Gas submits actual costs and collections incurred during the previous year and adjusts the EmPOWER surcharge for the upcoming year. The revised surcharge rate will go into effect with the February 2019 bill cycle. The 2019 surcharge will be $0.0023/therm, a reduction from last year’s surcharge of $0.0048/therm(Case No. 9494).

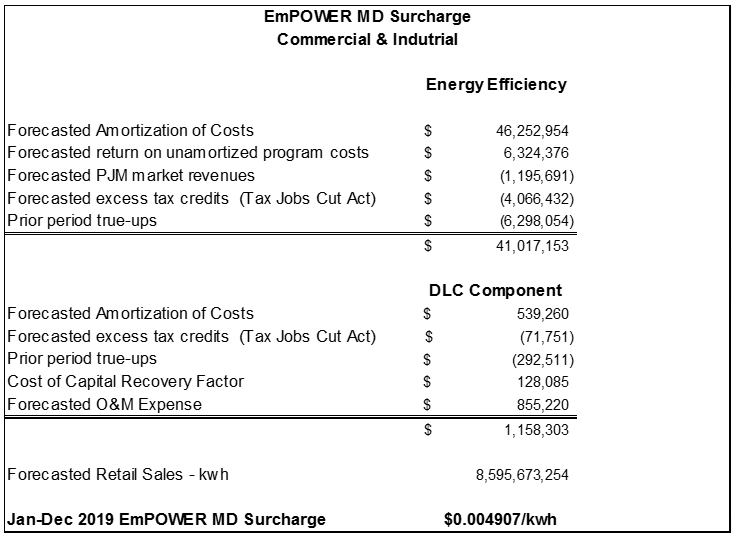

Pepco-Maryland Filed its EmPOWER Surcharge Provision for 2019

On December 19, 2018, Pepco filed its EmPOWER surcharge provision for 2019. In April 2008, Maryland enacted the EmPOWER Maryland Energy Efficiency Act setting a state goal of achieving a 15% reduction in per capita electricity consumption and per capita peak demand (Case 9362). The EmPOWER activities of all Maryland utilities are reviewed annually by the Maryland Public Service Commission. The EmPOWER Maryland charge reflects the demand-side management program costs at Pepco. These programs include lighting rebates and energy efficiency services as well direct load control which allows Pepco to manage demand by cycling off and on central air conditioners in the peak summer days. The revised surcharge rate will go into effect with the January 2019 bill cycle. The surcharge for bills in 2019 will be $0.004907/ kwh, a reduction from last year’s surcharge of $0.006588/ kwh (Case No. 9494).

On December 19, 2018, Pepco filed its EmPOWER surcharge provision for 2019. In April 2008, Maryland enacted the EmPOWER Maryland Energy Efficiency Act setting a state goal of achieving a 15% reduction in per capita electricity consumption and per capita peak demand (Case 9362). The EmPOWER activities of all Maryland utilities are reviewed annually by the Maryland Public Service Commission. The EmPOWER Maryland charge reflects the demand-side management program costs at Pepco. These programs include lighting rebates and energy efficiency services as well direct load control which allows Pepco to manage demand by cycling off and on central air conditioners in the peak summer days. The revised surcharge rate will go into effect with the January 2019 bill cycle. The surcharge for bills in 2019 will be $0.004907/ kwh, a reduction from last year’s surcharge of $0.006588/ kwh (Case No. 9494).

Washington Gas Requested a $56.3 Million Increase in Maryland – MD PSC Authorized a $28.6 Million Increase in Distribution Rates on or after December 11, 2018

![]() On May 15, 2018, WG filed a request for a $56.3 million increase to the company’s Maryland annual base rate revenues. The WGL family of companies (Washington Gas, WGL Energy, WGL Midstream and Hampshire Gas) are indirect, wholly-owned subsidiaries of AltaGas Ltd. The proposed base rate increase includes $15 million of cost currently being collected through surcharges associated with Washington Gas’s (WG) STRIDE plan. AOBA, Washington Gas and other parties filed several rounds of testimony and hearings were held from October 1, 2018, through October 9, 2018. The PSC decision was issued December 11, 2018, and new rates were effective as of that date. Even though this is the first base rate case that Washington Gas has filed in Maryland in approximately five years, the MD PSC denied 50% of the Washington Gas rate request and authorized a $28,602,000 increase in distribution rates. (Case No. 9481).

On May 15, 2018, WG filed a request for a $56.3 million increase to the company’s Maryland annual base rate revenues. The WGL family of companies (Washington Gas, WGL Energy, WGL Midstream and Hampshire Gas) are indirect, wholly-owned subsidiaries of AltaGas Ltd. The proposed base rate increase includes $15 million of cost currently being collected through surcharges associated with Washington Gas’s (WG) STRIDE plan. AOBA, Washington Gas and other parties filed several rounds of testimony and hearings were held from October 1, 2018, through October 9, 2018. The PSC decision was issued December 11, 2018, and new rates were effective as of that date. Even though this is the first base rate case that Washington Gas has filed in Maryland in approximately five years, the MD PSC denied 50% of the Washington Gas rate request and authorized a $28,602,000 increase in distribution rates. (Case No. 9481).

Washington Gas proposed increases to distribution rates by customer class are shown in the chart below. The increases requested for interruptible customers are substantial. The proposed distribution charges for interruptible customers for the first 75,000 therms are proposed to increase by approximately 29% and the proposed distribution charges for therms used over 75,000 are proposed to increase by approximately 40%.

Washington Gas proposed increases to distribution rates by customer class are shown in the chart below. The increases requested for interruptible customers are substantial. The proposed distribution charges for interruptible customers for the first 75,000 therms are proposed to increase by approximately 29% and the proposed distribution charges for therms used over 75,000 are proposed to increase by approximately 40%.

However, after AOBA filed supplemental direct testimony, WG substantially revised its testimony and cost of service study in accordance with the recommendations of AOBA’s expert consultant Bruce R. Oliver. The Company’s further corrected class cost of service study results shown in Chart A below yield important and substantial changes in the relative rates of return for several classes impacting AOBA members, which would ameliorate the impact of any rate increase on AOBA members. Further complicating this proceeding, WG stated that it did not have time to file a rate design. Unproductive settlement discussions were held, and final briefs were filed November 9, 2018.

CHART A

| Surrebuttal Table 1 Comparison of Class Relative Rates of Return |

||||

| Case No. 9481 | ||||

| WG Errata Filing Exhibits ABG - |

WG Rebuttal Exhibits ABG - |

|||

Class |

SUP5 CP |

SUP6 NCP |

R8 CP |

R9 NCP |

| Res Heat/Cool | 1.27 | 1.27 | 0.97 | 0.98 |

| Res Non-Heat | 1.63 | 1.59 | 1.20 | 1.16 |

| C&I Heat < 3000 | 1.53 | 1.44 | 1.59 | 1.52 |

| C&I Heat > 3000 | 0.64 | 0.65 | 1.00 | 1.01 |

| C&I Non-Heat | 1.67 | 1.67 | 1.85 | 1.84 |

| GMA Heat | 0.90 | 0.88 | 1.24 | 1.23 |

| GMA Non-Heat | 1.89 | 1.72 | 1.88 | 1.75 |

| Non-Firm | -0.54 | -0.53 | 0.41 | 0.41 |

In its Order issued December 11, 2018, the MD PSC agreed with AOBA and adopted almost all AOBA’s revenue requirement, cost of service and rate design recommendations. However, Washington Gas’ Compliance Filing of December 21, 2018, did not accurately implement the findings in the PSC Order. AOBA, Staff and Washington Gas have all filed motions requesting rehearing before the Commission.

On January 16, 2019, Washington Gas filed a revised Compliance Filing with new proposed results shown in Chart B below. A hearing was held on January 30, 2019. At this time, no final rates have been approved by the Commission.

CHART B

| Customer Class |

Proposed Increases to Distribution Rates Delivery Only |

Proposed Increases to Distribution Rates Total Bill Impact |

WGL 1/16/2019 Compliance Filing Delivery Only |

WGL 1/16/2019 Compliance Filing Total Bill Impact |

| Residential Heating /Cooling | 19.77% | 10.67% | 11.36% | 6.04% |

| Residential Non-Heating/Non-Cooling | 15.17% | 8.86% | 9.24% | 5.38% |

| C&I Heating/Cooling < 3,000 | 9.73% | 5.95% | 8.30% | 5.06% |

| C&I Heating/Cooling > 3,000 | 19.95% | 13.08% | 7.34% | 4.84% |

| C&I Non-Heating/Non-Cooling | 9.53% | 6.02% | 0.0% | 0.0% |

| GMA Heating/Cooling | 15.36% | 11.46% | 8.79% | 6.49% |

| GMA Non-Heating/Non-Cooling | 9.50% | 7.17% | 0.0% | 0.0% |

| Interruptible | 16.96% | 16.96% | 5.01% | 5.01% |

| Total Revenue | 9.53% | 5.63% |

Washington Gas Files Application for New STRIDE Plan in Maryland

On June 15, 2018, WG filed its Application for approval of a new gas system Strategic Infrastructure Development and Enhancement Plan (“STRIDE 2”) and an accompanying cost recovery mechanism to become effective January 1, 2019. The estimated cost of the initial five-year period of Washington Gas’ gas system infrastructure replacement plan (2019 to 2023) is approximately $393.6 million. WG proposes to fund the costs of the accelerated infrastructure replacement through a surcharge cost recovery mechanism, the STRIDE surcharge.

On June 15, 2018, WG filed its Application for approval of a new gas system Strategic Infrastructure Development and Enhancement Plan (“STRIDE 2”) and an accompanying cost recovery mechanism to become effective January 1, 2019. The estimated cost of the initial five-year period of Washington Gas’ gas system infrastructure replacement plan (2019 to 2023) is approximately $393.6 million. WG proposes to fund the costs of the accelerated infrastructure replacement through a surcharge cost recovery mechanism, the STRIDE surcharge.

A PSC decision was issued December 11, 2018, with new surcharges effective January 1, 2019. The approved monthly STRIDE surcharges and Surcharge Cap by customer class are shown in the chart below.

| Billing Class | Estimated Monthly Surcharge | Approved Monthly Surcharge | STRIDE Factor Surcharge Cap |

| Residential Heating/Cooling | $0.37 | $0.48 | $2.00 |

| Residential Non-Heating/Non-cooling | $0.19 | $0.29 | $1.21 |

| C&I Heating/Cooling <3,000 therms | $0.59 | $0.73 | $3.02 |

| C&I Heating/Cooling >3,000 therms | $3.99 | $5.40 | $22.38 |

| C&I Non-Heating/Non-Cooling | $1.50 | $1.63 | $6.75 |

| GMA Heating/Cooling | $4.87 | $7.16 | $29.66 |

| GMA Non-Heating/Non-Cooling | $1.06 | $1.12 | $4.65 |

| Interruptible | $48.15 | $56.50 | $234.10 |

Washington Gas Requested a $37.6 Million Increase in Virginia

Washington Gas filed an application on July 31, 2018, requesting authorization to increase its rates and charges and to revise the terms and conditions applicable to gas service effective for usage beginning with the January 2019 billing cycle, subject to refund. WG has proposed to increase the annual operating revenues of Washington Gas by $37.6 million with approximately $14.7 million of the request relating to costs associated with the SAVE Plan. WG states that the revenue requirement reflects a $16.3 million reduction for lower tax expense due to the implementation of the Tax Cuts and Jobs Act of 2017 (“TCJA”) and does not include any costs related to the acquisition of WG by AltaGas. The SCC will consider the effects of the accrued liability resulting from the “TCJA” beginning January 1, 2018, as well as the effect on future gas rates going forward in this new proceeding. WG filed its last application for a general rate increase on June 30, 2016, with rates effective November 28, 2016, subject to refund.

Washington Gas filed an application on July 31, 2018, requesting authorization to increase its rates and charges and to revise the terms and conditions applicable to gas service effective for usage beginning with the January 2019 billing cycle, subject to refund. WG has proposed to increase the annual operating revenues of Washington Gas by $37.6 million with approximately $14.7 million of the request relating to costs associated with the SAVE Plan. WG states that the revenue requirement reflects a $16.3 million reduction for lower tax expense due to the implementation of the Tax Cuts and Jobs Act of 2017 (“TCJA”) and does not include any costs related to the acquisition of WG by AltaGas. The SCC will consider the effects of the accrued liability resulting from the “TCJA” beginning January 1, 2018, as well as the effect on future gas rates going forward in this new proceeding. WG filed its last application for a general rate increase on June 30, 2016, with rates effective November 28, 2016, subject to refund.

The proposed increases to distribution rates by customer class are shown in the chart below. For 2019 budget considerations, members need to budget for the full increases to be effective with the January 2019 billing cycle. The full rates will be implemented at that time, subject to refund, pending an SCC decision.

| Customer Class | Proposed Increases to Distribution Rates Distribution Only |

Proposed Increases to Distribution Rates Total Bill Impact |

| Residential Heating /Cooling | 10.65% | 6.09% |

| C&I Heating/Cooling | 18.34% | 9.99% |

| C&I Non-Heating/Non-Cooling | 9.64% | 5.14% |

| C&I Large Customers | 16.74% | 14.40% |

| GMA Heating/Cooling | 21.08% | 12.94% |

| GMA Non-Heating/Non-Cooling | 9.52% | 6.32% |

| GMA Large Customers | 22.51% | 14.22% |

| Interruptible | 22.94% | 7.27% |

| Total | 12.57% | 7.20% |