Utilities At Issue - March 2020

Coronavirus Update

In light of the Coronavirus Pandemic, AOBA has been advised that Pepco, Washington Gas and Dominion have temporarily suspended all service disconnections for nonpayment. Pepco and Washington Gas have further agreed to suspend late fees and interest charges on unpaid balances for commercial customers.

For Washington Gas, this applies to any late fees incurred after March 13, 2020.

Pepco has stated that the policy will be in effect at least through May 1, 2020.

https://www.pepco.com/SafetyCommunity/Safety/Pages/coronavirus.aspx

https://www.washingtongas.com/media-center/coronavirus

https://www.dominionenergy.com/company/coronavirus

Maryland General Assembly – Community Choice Energy Bill – Update

On February 4, 2020, bills entitled Electric Industry – Community Choice Energy (House Bill 561 (“HB561”) and cross-filed Senate Bill 315 (“SB315”)) were filed in both the Maryland House and the Senate.

HB561/SB315 would allow a county or municipality to serve as an electric aggregator for the purpose of purchasing electric generation from an electric supplier or providing electricity from a generating facility owned by the county/municipality aggregator.

As part of this legislation, all Maryland electric companies (Pepco, BGE, Delmarva) must provide to any counties or municipal corporations, all customer pre-enrollment usage data (including usage, rate class, payment history, account numbers, address, phone numbers and existing supply contract) for every customer in the county or municipality. This is a mandatory provision in the legislation with no means of protecting customer usage data from sale or disclosure by the county or municipality unless the customer proactively “opts-out” within 30 days.

The legislation also provides that all customers would have to affirmatively “opt-out” of joining the county/municipality aggregation. Absent an “opt-out”, all customers would automatically be enrolled in the county/municipality aggregation as a participant. There are no protections in this legislation for confidential, proprietary customer information and no prohibitions against the sale or use of this confidential information for other purposes.

Currently, all utility rate payers must affirmatively choose, in writing, to receive service from a competitive energy provider. AOBA has always supported the right of an electric utility customer to participate in customer choice by prior written affirmative consent, i.e. “opt-in,” and not requiring the customer to “opt-out.” AOBA’s position is that non-residential energy customers, many of whom derive their energy supply from competitive energy suppliers under negotiated agreements, should be exempt from mandatory participation in county/municipality aggregation unless they affirmatively choose to “opt-in.” AOBA Staff and several members testified in both the House Economic Matters and Senate Finance Committees in opposition to these bills.

Update – Just prior to the end of the session, HB561 passed the House of Delegates, with amendments, that would have limited its applicability to Montgomery County. However, the Senate Finance Committee took no action on the bill prior to the end of session. If the Maryland General Assembly reconvenes for Special Session, AOBA Staff does not expect HB561 to be one of the limited items that the General Assembly takes up.

Maryland General Assembly - Clean and Renewable Energy Standard (CARES) – Update

On January 20, 2020, House Bill 363, Clean and Renewable Energy Standards (CARES) was filed in the Maryland House.

HB363 would increase and replace the current Renewable Portfolio Standard (RPS) in Maryland with the CARES standard and dramatically increase the percentage of renewable energy credits that would need to be purchased to be in compliance in 2021. The CARES standard would increase the Tier 1 percentage from 20.8% to 45.8% beginning in 2021.

Additionally, HB363 would also eliminate several current Tier 1 resources from the eligible supply of RECs providing generation sources. By shrinking the supply of Tier 1 RECs and increasing the demand for Tier 1 RECs, the cost of compliance would increase for members.

AOBA filed testimony in opposition to this bill urging the inclusion of a grandfathering provision to permit any contract entered into before the legislation is passed to be exempted from this increase through the term of each contract. Previous renewable energy legislation has provided for such grandfathering. The grandfathering provisions included in the past legislation have stated, “That a presently existing obligation or contract right may not be impaired in any way by this Act.”

Update – Both the House and Senate version of the CARES legislation died in committee in February 2020.

Pepco Request for a Multi-year Rate Increase of $162 Million in the District of Columbia, Formal Case No. 1156 – Update

District of Columbia Public Service Commission Authorizes Alternative Forms of Rate Regulation

The Public Service Commission of the District of Columbia adopted a drastically new – and alternative – paradigm for the regulation of public utilities providing service in the District in Pepco’s multi-year rate request (“MYP”) proceeding. Specifically, the Commission adopted a new “framework for alternative forms of regulation,” under which utilities may depart from well-settled and long-standing methodologies for establishing rates charged to customers. This new framework, referred to by the Commission as an Alternative Form of Regulation (“AFOR”) will fundamentally affect the way rates are proposed by public utilities, approved by the Commission, and recovered from customers in the District of Columbia.

Importantly for AOBA members, the adoption of AFORs will also eventually accelerate the recovery of costs by utilities from customers and may also increase rates above the utility’s cost of service if the Commission approves several Performance Incentive Mechanisms (“PIMS”) that Pepco is requesting. The adoption of PIMs would allow the Company to earn more money if the Company hits certain annual performance metrics.

The Commission decided to address the Multi-Year Rate Plan proposed by Pepco in Pepco’s current rate proceeding, Formal Case No. 1156. “Pepco,” the Commission explained, “has provided all the requirements for a traditional rate case as well as its proposal for an MRP.”

Update – AOBA, OPC, GSA and the District of Columbia Government all submitted testimony on March 6, 2020 strongly opposing the adoption of Pepco’s multi-year rate plan in the District stating that there are no benefits to ratepayers from approval of the Company’s proposed MYP or the adoption of its proposed Performance Incentive Mechanism (“PIMS”) proposals. The adoption of the Company’s proposed PIMs would allow Pepco to earn more money by essentially not doing much more than maintaining the status quo.

DC PSC Order 20273

Pepco DC Formal Case No. 1156, a Multi-Year Rate Plan

Pepco filed a request for a multi-year rate plan in the District of Columbia on May 30, 2020, which would increase rates in the District by $162 million over the three-year period beginning in May 2020. As part of the request, Pepco seeks to change its ratemaking from the traditional rate case filings, where Pepco files a request with the District of Columbia Public Service Commission (“DC PSC”) based on an historical test year when it wants to increase its rates, to a multi-year rate plan in which rates based on Pepco’s forecasts would increase automatically each year over the three-year period, 2020 through 2022.

Pepco proposes to raise rates in three steps, scheduled for May 1, 2020, January 1, 2021, and January 1, 2022. Pepco proposes to increase rates by $84.9 million in 2020, $40.4 million in 2021, and an additional $36.4 million in 2022. If the DC PSC does not approve the multi-year rate plan, Pepco asks, in the alternative, to increase its rates by $88.6 million in May 2020.

With the multi-year rate plan, Pepco is also asking the Commission to approve several performance incentive mechanisms (“PIMS”) that would allow the Company to earn more money if it hits certain annual performance metrics which could raise rates even further in 2021 and 2022 than what is estimated.

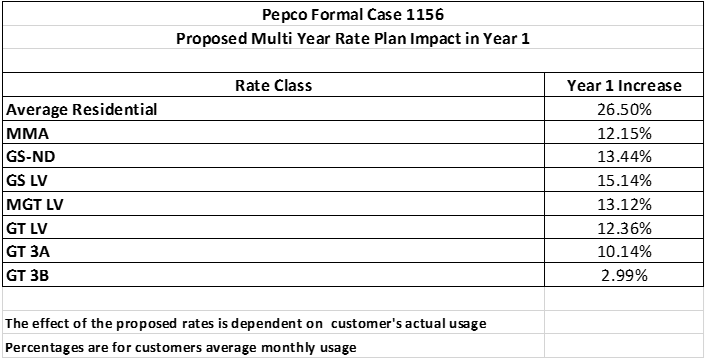

The table below shows Pepco’s calculated bill impact. The link to the DC PSC’s Public Notice of the rate increase is inserted below.

DC PSC FC 1156 Public Notice

Update – AOBA, as well as the Office of People’s Counsel (“OPC”), the District of Columbia Government (“DCG”) and GSA have all filed testimony challenging Pepco’s proposed multi-year rate plan, the amount of the Company’s proposed rate increase, and Return on Equity (“ROE”), as well as many other Pepco adjustments and proposals contained in the Company’s multi-year application.

AOBA’s testimony urges the PSC to reduce Pepco’s requested Return on Equity from 10.3% to 8.5%. Further, AOBA urges the Commission not to allow Pepco to earn any more than an additional $50 million in revenue if an MRP is not adopted. AOBA also urges the PSC to finally end the negative rates of return by the residential class and assign all of the approved revenue increase to that class.

The current schedule set by the DCPSC provides for a decision by the end of the year. Settlement discussions have resumed after ending in December 2019.

Maryland Public Service Commission Authorizes Alternative Forms of Rate Regulation – Case No. 9618

Alternative Form of Regulation

The Public Service Commission of Maryland announced its intention to “move forward cautiously in implementing an AFOR in Maryland.” AFOR is an acronym for “Alternative Form of Regulation,” which in the context of utility rate regulation, signals a departure from – or alternative to – the cost of service-historical test year methodology currently used by the Commission to establish rates charged by utilities. Under the traditional cost of service-historic test year methodology, the Commission reviews the costs incurred and investments undertaken by a utility in a recent 12-month period and uses such costs and investments as the basis for new rates. Thus, under the cost of service-historic test year rate setting methodology, the Commission establishes utility rates “by primarily looking backwards – using a historical approach.”

As per Order No. 89226, a Phase II Working Group process began on January 1, 2020. The purpose of the Working Group is to determine and propose appropriate incentive metrics for Maryland utilities to incorporate within a multi-year rate plan. By May 1, 2020 the Working Group is ordered to file a report and make recommendations regarding performance incentive metrics.

Maryland PSC Order No. 89226

Washington Gas Files $35.2 Million Rate Case in the District of Columbia – Formal Case No. 1162

Washington Gas filed an application on January 13, 2020 requesting authorization to increase its rates for gas service in the District of Columbia effective for usage beginning with the January 2021 billing cycle. WG has proposed to increase its annual operating revenues $35.2 million with approximately $9.1 million of the request relating to costs associated with the PROJECTpipes surcharge, for a net incremental increase in base rates of approximately $26.1 million.

Washington Gas is requesting an overall Rate of Return (ROR) of 7.56%, to meet the cost of providing service in the District of Columbia and a Return on Equity (“ROE”) of 10.4%. Additionally, Washington Gas is proposing a Revenue Normalization Adjustment (“RNA”), which is a monthly billing adjustment that reflects the difference between actual revenues earned by Washington Gas and the level of revenue that the Company is authorized to receive. Washington Gas states that this RNA is needed and will provide customers with more stable and predictable invoices. AOBA challenged WG’s RNA proposal in its last rate case (Formal Case No. 1137). The PSC agreed with AOBA and declined to implement such a charge.

Washington Gas filed its last rate case in the District on Feb. 26, 2016 (Formal Case No. 1137) with rates effective March 24, 2017, but had agreed not to file any rate cases since that time as one of the Commitments in the Washington Gas/AltaGas merger settlement, filed on May 8, 2018 (Formal Case No. 1142). As part of that settlement, Washington Gas agreed that it would not file a rate case for 34 months (i.e. no earlier than Jan. 3, 2020).

AOBA has begun its review of the WG application, intervened in the proceeding and submitted multiple data requests. An initial hearing was held on March 3, 2020. AOBA has filed a motion with the DC PSC which was joined by DC Government to consolidate the rate request with consideration of WG’s request for an extension of a Projectpipes 2 Plan. We will keep our members informed as the case progresses.

Formal Case No. 1162 Public Notice

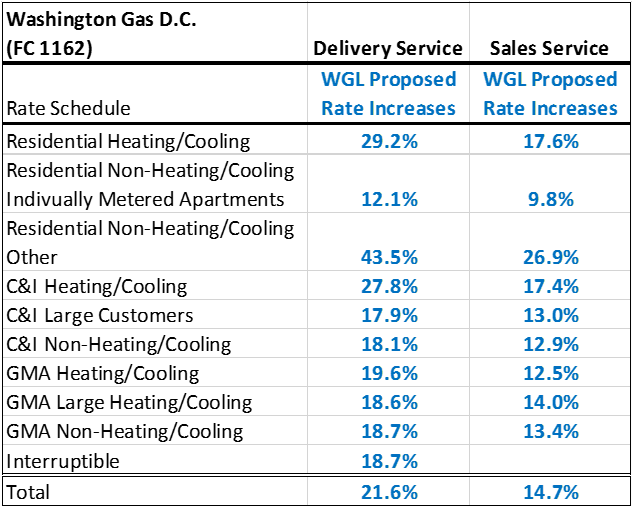

The chart below is the WG proposal to distribute its proposed revenue increase.

Washington Gas Request for a $37.6 Million Increase in Virginia Reduced – Case No. PUR-2018-00080 – Update

Update – The SCC issued its final decision on January 30, 2020 in Washington Gas’ request for a $37.6 million rate increase. The SCC denied WG’s entire rate increase request and only allowed WG to roll into base rates its SAVE Rider charges of $14.7 million.

The SCC ordered Washington Gas to issue refunds to customers for the additional revenue that WG collected from customers beginning January 1, 2019 within 90 days from the issuance of its January 30, 2020 Order. Further, the SCC ordered that Washington Gas return to customers $25.5 million to reflect the over-collection of taxes as a monthly bill credit over 12 months beginning within 90 days of the Commission’s Final Order, i.e., January 30, 2020.

Background

Washington Gas filed an application on July 31, 2018, requesting authorization to increase its rates and charges by $37.6 million per year, of which approximately $14.7 million relates to costs associated with the SAVE Plan, effective with the January 2019 billing cycle, subject to refund. The WG rate request was based on a Return on Equity (ROE) of 10.6% and a Rate of Return (ROR) of 7.94%.

The rate increase is significantly lower than the original Washington Gas request of $37.6 million when the case was initially filed on July 31, 2018. Additionally, Washington Gas had sought to return only $16.3 million to ratepayers based on the Tax Cuts and Jobs Act of 2017 (“TCJA”). AOBA intervened in this proceeding and submitted testimony stating that the WG rate request was overstated and that the requested increase in the ROE needed to be substantially reduced. AOBA also requested a refund in the form of a bill credit for over-collected income tax charges from the TCJA. Additionally, AOBA requested that the SCC consider and investigate the escalation of Grade 1 and other leaks and the overall effectiveness of the SAVE Plan.

Impact to WG Bill

- A tax refund of $25.5 million will be returned to customers to reflect the over-collection of taxes as a monthly bill credit over 12 months beginning within 90 days of the Commission’s Final Order, i.e., January 30, 2020;

- WG is entitled to a ROR of 7.22% and a ROE of 9.2%;

- WG’s revenue requirement shall be increased by $13.2 million to incorporate the costs previously reflected in the SAVE Rider prior to January 1, 2019;

- Rate refunds for rates implemented from Jan. 1, 2019 until the SCC’s Final Order January 30, 2020, will be made within 90 days of January 30, 2020 with interest;

- Roughly 60% of the rate increase approved will be returned to customers; and

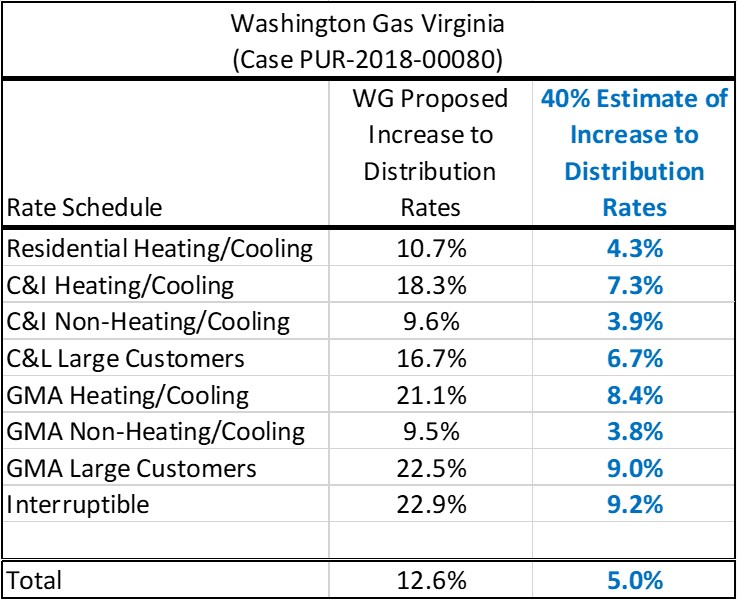

- New rates going forward will be approximately 40% of the initial January 1, 2019 approved rates, approximately $15 million.

The below chart is indicative of the increases by class.

Washington Gas Compliance Filing

AOBA Utility Update – Rate Case Expectations – Update

PSC decision currently scheduled for December 2020

Rate case filed January 15, 2019, Case No. 9602

New rates effective August 13, 2019

Multi-year rate plan expected after February 1, 2020

Rate case filed January 13, 2020 (Multi-year rate plan not filed) Formal Case No. 1162

New rates expected January 1, 2021

New rates effective Oct. 15, 2019