Utilities At Issue - January 2017

The 2017 Pepco and Washington Gas Rate Case Horizon

Below is an update for the 2017 regulatory year. This past year has included a number of filings by the electric and natural gas utilities that will impact future rates paid by AOBA members.

Rate cases have been or may be filed according to the following timeline:

Pepco:

MD – Application for a rate increase filed April 19, 2016; Decision issued November 15, 2016, rates effective as of November 15, 2016. Another Pepco rate case may be filed by the 2nd quarter 2017.

Washington Gas:

VA – Application for a rate increase filed June 30, 2016; rates effective November 28, 2016 with the December 2016 billing month, subject to refund

MD:

– The STRIDE Case, Case No. 9335, requires WG to file a rate case prior to 2019. WG has stated in its regulatory filing that the Company plans to file a rate case in its fiscal third quarter 2018.

– Petition for Approval of tariff revisions to facilitate natural gas expansion for unserved or underserved customers filed on December 7, 2016. Hearings are scheduled for May 1st and 2nd.

WGL announced on January 25, 2017 it will be acquired by AltaGas.

Pepco Granted Significantly Lower Than Requested Increase for Maryland Customers – Case No. 9418

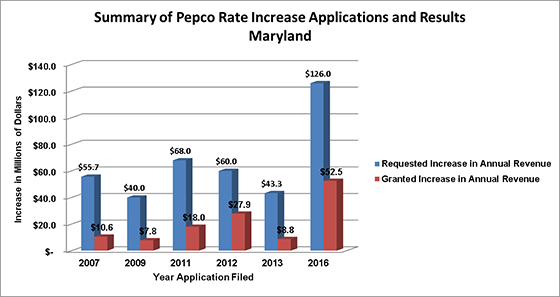

On April 19, 2016, Pepco filed an application requesting a $126,784,000 increase in its Maryland distribution rates and an authorized return on equity of 10.60%. During the course of the proceeding, Pepco reduced its requested increase to $102,751,000. Pepco stated that the primary reason for the rate increase was the need to recover investments in the Company’s electric distribution infrastructure and to recover other costs necessary to improve and maintain system reliability and customer service.

On November 15, 2016, the MD PSC issued its decision on Pepco’s requested increase and reduced Pepco’s request of $126,784,000 to $52,535,000. AOBA submitted testimony and filed pleadings recommending a revenue requirement of no more than $51,462,000. Further, the PSC denied Pepco’s request for an extension of its Grid Resiliency Program for a surcharge to concurrently recover costs in the amount of $31.6 million for 2 years, which would add approximately another $15.8 million a year to rates. Additionally, Pepco requested an increase in its authorized return on equity from 9.6% to 10.60%. The PSC disagreed that Pepco’s cost of equity had increased and in fact reduced Pepco’s return on equity to 9.55%. When applied to the Company’s capital structure, the approved rate of return is 7.49% which was reduced from Pepco’s 8.01% requested rate of return.

For budgeting purposes, Pepco’s approved rates are set forth in the chart below. Please remember that the below increases are only on distribution rates which on average are approximately one third of your total electric bill, depending on your load factor and your competitive energy supply contracts.

| Rate Schedule | Proposed Increase | Approved Increase |

| Residential | 34.18% | 13.60% |

| RTM | 37.0% | 13.60% |

| GS_LV | 28.75% | 13.60% |

| MGT_LV | 22.0% | 9.97% |

| MGT_3A | 22.0% | 9.97% |

| GT_LV | 22.0% | 9.97% |

| GT_3B | 0.0% | 0.00% |

| GT_3A | 22.0% | 9.97% |

| TM_RT | 22.0% | 9.97% |

| SL | 27.7% | 9.97% |

| SSL | 22.0% | 9.97% |

| TN | 0.0% | 0.00% |

| Total | 29.1% | 12.1% |

A summary of Pepco’s Maryland rate requests and results are shown in the chart below.

Pepco Requests an $85,477,000 Rate Increase in the District of Columbia – Formal Case No. 1139

AOBA intervened in the case and has vigorously opposed the requested rate increase by filing the expert witness testimony of Revilo Hill Associates. Evidentiary hearings will begin March 15, 2017. AOBA anticipates that any potential increase will most likely be effective on or about July 25, 2017.

Pepco’s proposed increases to distribution rates for each customer class are shown in the chart below.

A summary of Pepco’s District of Columbia rate requests and rate approvals are shown in the chart below.

Washington Gas Rates Will Rise in the District of Columbia, Formal Case No. 1137

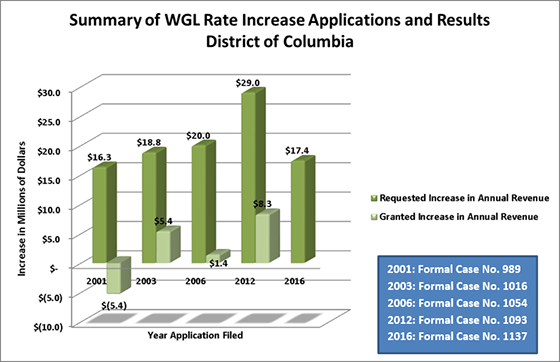

On February 26, 2016, WG filed a request to increase existing rates and charges for gas service for customers in the District of Columbia. WG seeks an increase in the Company’s weather-normalized annual revenue of $17.4 million. Of the $17.4 million revenue increase request, $4.5 million represents costs associated with system upgrades previously approved by the DCPSC; costs that are currently recovered from customers in surcharges (the PROJECTpipes and Mechanical Coupling surcharges).

The requested rate increase is designed to collect approximately $171.7 million in total annual revenues and includes a proposed 25% increase to customer charges for all rate classes. WG is requesting to earn an overall rate of return of 8.23%, including a return on equity of 10.25%. If approved by the Commission, the new rates will be effective on or about March 16, 2017.

In addition, WG proposed a new rate design for Group Metered Apartment (GMA) customers. Under the current rate design, C&I and GMA customers are billed on the same rate schedule which reflects the same charges. WG now proposes a separate rate schedule for C&I and GMA customers, under which C&I customers would be billed under Schedules 2 (delivery service) and 2A (sales service) and GMA customers would be billed under Schedules 2B (delivery service) and 2C (sales service).

WG also proposed a Revenue Normalization Adjustment (RNA). The RNA is a billing adjustment which would calculate a credit or a charge to monthly distribution charges for firm customers based on the difference between the actual revenue received by WG and the level of revenue the Company is allowed to collect. WG proposed a similar adjustment in an earlier case, with strong opposition from AOBA. The DCPSC agreed with AOBA and rejected the proposed adjustment in the earlier case.

AOBA intervened in the case to protect member interests and filed testimony challenging many aspects of the WG request. Hearings concluded November 2, 2016. A decision is expected on or about March 16, 2017.

WG’s proposed increases per customer class are shown in the chart below:

| Description |

Operating Revenues (Delivery Service) |

Operating Revenues (Sales Service) |

| Proposed Increase % | Proposed Increase % | |

| Residential | ||

| Heating and/or Cooling | 17.4% | 10.3% |

| Non-heating and Non-cooling | 21.7% | 16.4% |

| Individually Metered Apartments | 21.7% | 11.4% |

| Commercial & Industrial | ||

| Heating and/or Cooling | ||

| Less than 3,075 therms | 11.2% | 7.0% |

| 3,075 therms or more | 5.9% | 4.3% |

| Non-heating and Non-cooling | 3.3% | 2.3% |

| Group Metered Apartments | ||

| Heating and/or Cooling | ||

| Less than 3,075 therms | 4.0% | 2.6% |

| 3,075 therms or more | 7.8% | 5.9% |

| Non-heating and Non-cooling | 5.6% | 4.1% |

| Interruptible | 0.4% | 0.4% |

| Total Sales/Delivery Revenue | 11.5% | 7.6% |

| Total Operating Revenue | 7.6% |

A summary of WG’s rate increase requests and results are shown in the chart below.

Washington Gas Files Petition for Gas Expansion in Maryland, Case No. 9433

On December 7, 2016, Washington Gas filed a petition for approval of revised tariffs that would facilitate access to natural gas for customers that are currently unserved or underserved by Washington Gas, which would be financed by current ratepayers. AOBA has intervened in the case to protect members’ interests and will file testimony of its expert witness on March 1, 2017. Hearings are scheduled for May 1st and 2nd. AOBA will keep members informed as the case progresses.

Washington Gas Request for Rate Increase in Virginia for $45.6 million, CASE NO. PUE-2016-00001

On June 30, 2016, Washington Gas Light Company (WG) filed an application for authority to increase its existing rates and charges for gas service for its Northern Virginia and Shenandoah Gas Customers. WG requested an increase of $45.6 million, of which $22.3 million relates to costs associated with investments in infrastructure replacements made pursuant to the SAVE Plan. New rates were effective November 28, 2016, with the December 2016 billing cycle, subject to refund. Refunds may not be issued before 4th quarter 2017 and perhaps not until 1st quarter 2018.

Testimony filed by WG witnesses requested an overall rate of return of 8.21% on rate base, including a return on common equity of 10.25%. WG proposed to increase firm service charges by 25% for most customer classes.

WG also proposed a Revenue Normalization Adjustment (“RNA”) to replace its existing Weather Normalization Adjustment (“WNA”) and Care Rate Making Adjustment (“CRA”) The RNA is a billing adjustment which would calculate a credit or a charge to monthly distribution charges for firm customers based on the difference between the actual revenue received by WG and the level of revenue the Company is allowed to collect, based on this rate case. The RNA is similar to Pepco’s Bill Stabilization Adjustment (BSA). In its application, WG also proposed to fund research and development programs managed by the Gas Technology Institute (“GTI”) that, according to WG, would “benefit natural gas customers and improve Company operations.”

AOBA intervened in the case to protect member interests and will file testimony on January 31, 2017. A public hearing is scheduled for April 18, 2017 in Richmond.

AltaGas to Acquire Washington Gas Light for $6.4 Billion

On January 25, 2017 WGL Holdings, Inc. and AltaGas Ltd. announced that the Board of Directors for both companies have approved an agreement and merger plan for AltaGas to acquire WGL for $6.4 billion. WGL has stated it will retain its headquarters in Washington DC to manage its utility business and will remain regulated by the Commissions in DC, MD, and VA.

HB1106 Proposes to Increase Renewable Portfolio Standards for Maryland Customers

Legislation pending before the Maryland General Assembly, HB1106, proposes to alter the renewable portfolio standard percentage for energy derived from a solar source and also alter the compliance fees for suppliers that fail to meet the renewable portfolio standards.

Governor Hogan vetoed this legislation last year however the State House and Senate may override the Governor’s veto. The Senate special ordered the consideration of the override of the Governor’s veto until February 2, 2017. If the override were to be granted, the legislation would take effect 30 days from the date of the override.

The legislation does include a provision that would grandfather customer supply contracts existing before the effective date of the legislation. AOBA is monitoring the progress of this legislation closely and will keep members informed of any developments as well as potential cost impacts.

DC Renewable Energy Portfolio Standard Legislation Effective October 8, 2016 with Grandfathering Amendment

AOBA urged an amendment that would grandfather the gradual decrease in compliance fees under the current Renewable Energy Portfolio Standard Act for existing customer supply contracts for five years from the law effective date. The law was approved by Congress and became effective in October with the grandfathering amendment included.

Save the Date for AOBA’s Utility & Energy Market Update

AOBA will also hold a Utility and Energy Market Update on Wednesday, February 15, 2017 at the AOBA office from 11:30 am – 1:00 pm. Lunch will be provided. Meeting topics will include DC Water rates, an energy market briefing, and utility updates for electricity and natural gas in the District of Columbia, Maryland, and Virginia.