Utilities At Issue - February 2021

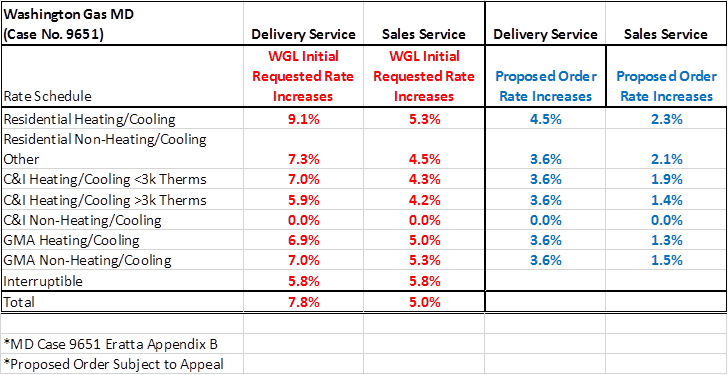

Maryland Public Utility Law Judge Reduces WGL’s Request for a $28.4 Million Rate Increase to $12.97 – Case No. 9651

- The Public Utility Law Judge issued a decision on February 12, 2021 which was revised on February 19, 2021 and granted WGL a $12,973,00 increase in base rates based on a Return on Equity of 9.7% and an overall Rate of Return of 7.08%.

Background

- Washington Gas Light Company filed an Application on August 28, 2020 requesting authorization to increase its rates for gas service in Maryland which would be effective for service beginning March 26, 2021. Washington Gas has proposed to increase its annual distribution operating revenues by $28.4 million, (approximately 7.82%), with approximately $5.8 million of the request relating to costs associated with the Strategic Infrastructure Development Enhancement (STRIDE) Plan, for a net incremental increase in base rates of approximately $22.6 million.

- Washington Gas is requesting an overall Rate of Return (ROR) of 7.73%, which the Company claims it needs to meet the cost of providing service in Maryland and a Return on Equity (ROE) of 10.45%.

- Washington Gas filed its last rate case in Maryland on April 22, 2019 (Maryland Case No. 9605) with rates effective October 15, 2019. In that case WGL requested a $35.9 million increase in revenues and received a $27.0 million base rate increase and a ROE of 9.7%.

- AOBA has analyzed the Washington Gas Application, intervened in the proceeding, and filed the testimony of two expert witnesses on November 20, 2020.

- AOBA’s testimony urged the PSC not to increase WGL’s rates by more than $8.6 million based on the combination of AOBA’s proposed capital structure, a cost of equity of 9.6%, a rate of return of 6.86% and several operating expense recommendations. AOBA’s testimony is consistent with the testimony of the PSC Staff which also found that an increase of no more than $8.6 million was appropriate.

- Hearings were held virtually from January 7-11, 2021 and briefs were filed January 26, 2021.

- AOBA appealed the PULJ decision to the full Commission on February 26, 2021. A final decision will be issued by the Commission on March 26, 2021, with new rates effective on and after the date that date.

- AOBA Testimony November 20th

- Maryland Case No. 9651

PULJ Order Case 9651

WG Proposal Wagner Schedule C

WG’s increases in customer class rates. Reminder these are class averages and individual account impacts will vary.

Washington Gas Virginia

New rate case expected to be filed in 2021. In Virginia, new rates are effective, subject to refund, 5 months after the date of filing the Application.

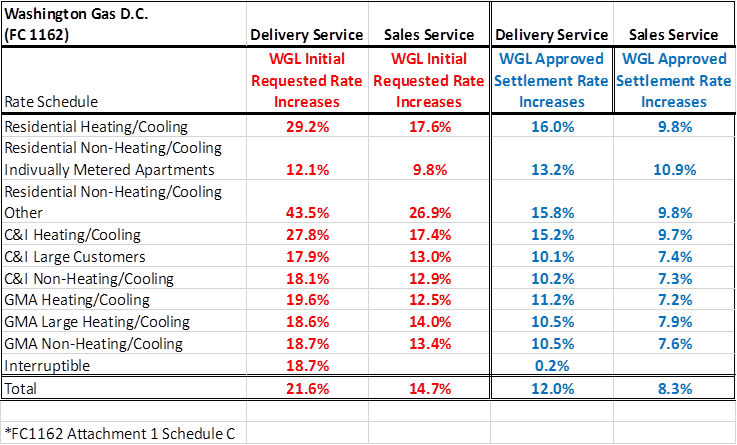

The District of Columbia Public Service Commission Approved a Settlement Reducing WGL’s $35.2 Million Rate Increase Request to $19.5 Million – Formal Case No. 1162

- AOBA negotiated a settlement of this proceeding with WGL, OPC and other parties just prior to hearings which was submitted to the Commission on December 8, 2020. The settlement provides for WGL to receive an increase in revenues of $19.5 million, which includes a transfer of $8.3 million currently collected through the PROJECTpipes surcharge and in customers’ bills, resulting in a net change in revenue of $11.2 million. Further, the settlement includes a 9.25% Return on Equity, in lieu of the 10.4% ROE that WGL originally requested and does not include adoption of WGL’s Revenue Normalization Adjustment. The Commission held a Public Interest hearing on January 27, 2021 and Public Comments were filed February 8, 2021. On February 24, 2021, the DC PSC approved the settlement. New rates will become effective April 1, 2021. Formal Case No. 1162 Update

Background

- Washington Gas originally filed an application on January 13, 2020 requesting authorization to increase its rates for gas service in the District of Columbia effective for usage beginning with the January 2021 billing cycle. WGL proposed to increase its annual operating revenues $35.2 million with approximately $9.1 million of the request relating to costs associated with the PROJECTpipes surcharge, for a net incremental increase in base rates of approximately $26.1 million.

- Washington Gas requested an overall Rate of Return (ROR) of 7.56%, to meet the cost of providing service in the District of Columbia and a Return on Equity (ROE) of 10.4%. Additionally, Washington Gas proposed a Revenue Normalization Adjustment (RNA), which is a monthly billing adjustment that reflects the difference between actual revenues earned by Washington Gas and the level of revenue that the Company is authorized to receive. Washington Gas stated that this RNA is needed and will provide customers with more stable and predictable invoices. AOBA challenged WGL’s RNA proposal in its last rate case (Formal Case No. 1137). The PSC agreed with AOBA and declined to implement such a charge. WGL is proposing essentially the same RNA as it did in its last case which was rejected.

- Washington Gas filed its last rate case in the District on February 26, 2016 (Formal Case No. 1137) with rates effective March 24, 2017 but had agreed not to file any rate cases since that time as one of the Commitments in the Washington Gas/AltaGas merger settlement, filed on May 8, 2018 (Formal Case No. 1142). As part of that settlement, Washington Gas agreed that it would not file a rate case for 34 months (i.e., no earlier than January 3, 2020).

AOBA Direct Testimony filed August 14, 2020

WG Proposed Settlement Agreement

Settlement Tariff Changes

Final Order FC 1162

WGL’s increases in customer class rates.

Reminder these are class averages and individual account impacts will vary. For non-residential rate classes, the revenue increases will be distributed on an equal percentage basis to all charges.

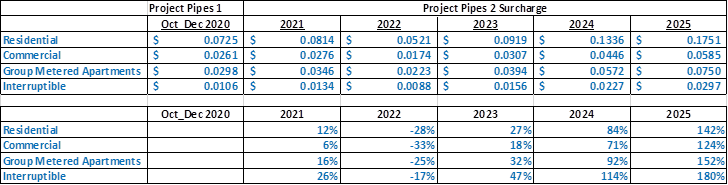

Washington Gas Pipe Replacement Plan 2 in the District Requests to Increase Expenditures from $135 Million Over Five Years to $374 Million Over the Next Five Years Beginning January 2021

The DC PSC Reduces WGL’s Request to $177.4 Million Over 3 Years – Formal Case Nos. 1115, 1142, and 1154

- A Commission decision was issued on December 11, 2020 in Order No 20671 agreeing with many points raised by AOBA. The PSC substantially revised WGL’s application which requested approval of a five-year program consisting of ten distribution programs and five transmission programs. The PSC Order approves a three-year program limited to six programs for a total expenditure of $177.4 million rather than the WG requested $374 million. Update

Background

- Washington Gas recently updated its initial request to adopt a new and expanded “Projectpipes 2 Plan” in the District of Columbia. Washington Gas is now proposing to:

…continue to replace relatively higher infrastructure at an accelerated pace through its proposal to increase total expenditures from approximately $135 million, including extension periods under the current PIPES 1 Plan, to approximately $374 million over the next five (5) years (October 1, 2020-December 31, 2025). WG FC 1115, 1142, 1154 Direct Testimony (filed April 23, 2020) - AOBA filed direct testimony in the Washington Gas D.C. ProjectPipes 2 Plan proceeding on June 15, 2020, that questions the performance of Washington Gas in recent years in replacing its aging pipe infrastructure in the District. AOBA’s testimony states that the initial Washington Gas Project Pipes 1 plan has neither accelerated pipe replacement nor enhanced the safety of the District of Columbia distribution system, which was the driving force behind the passage of the plan in 2010. Additionally, the number of hazardous leaks has increased and the replacement of miles of mains on the distribution system has decreased. In fact, Washington Gas’ Cast Iron main replacement record in the District since 2010 ranks as the worst in the industry. AOBA Direct Testimony FC 1115, 1142, 1154

- The key findings in AOBA’s testimony are:

- The number of hazardous leaks has doubled between 2010 and 2019

- Washington Gas’ 2019 ratio of hazardous leaks per mile of mains is the 3rd highest in the country for similar sized utilities

- Washington Gas claims that its replacement activity has reduced Greenhouse Gas Emissions but ignores the fact that leaks are increasing at a faster rate than its replacement efforts

- Washington Gas’ estimated costs for replacement of Cast Iron and Bare Steel mains are as much as two to three times greater than in other major cities in the eastern U.S.

- The number of hazardous leaks has doubled between 2010 and 2019

- AOBA urged the DC PSC to approve replacement of the highest priority and riskiest mains for safety considerations and find the Washington Gas proposed plan uneconomic and inadequately focused on the safety of the distribution system. Washington Gas’ proposed rate of replacement is insufficient to keep pace with the aging infrastructure. AOBA also asked the Commission to restrict Washington Gas from making dividend payments to its parent Company, Alta Gas, until it has met the equity funding requirements necessary to support the minimum annual pipe replacement requirements.

- AOBA recognizes the importance of safely in maintaining the Washington Gas distribution system through the replacement of its riskiest leak prone pipes (i.e., Cast Iron and Bare Steel), and other efforts to ensure the safety its distribution system. Washington Gas’ recent proposed pipe replacement plans do not adequately address the issue, the proposed costs are prohibitive and would be an undue burden on WG’s multifamily and commercial customers.

- Hearings were scheduled for August 18 and 19, 2020, with a PSC decision expected before the end of the year. However, the Commission stated in Order No, 20615 that “there “there were no material issues of fact in dispute that warrant an evidentiary hearing in this proceeding” and determined that briefs should be filed by October 23, 2020. In the interim by Order No. 20621, the PSC has extended the current PROJECTpipes 1 Plan for another 90 days until December 31, 2020 at a cost not to exceed $6.25 million.

- If the Washington Gas request for approval of a $374 Projectpipes 2 Plan was approved, gas distribution rates would rise approximately 33% by the end of the five-year plan. This would be in addition to any rate increase WGL was granted by the DC PSC.

- WG Testimony April 23, 2020

WG Proposed Rates

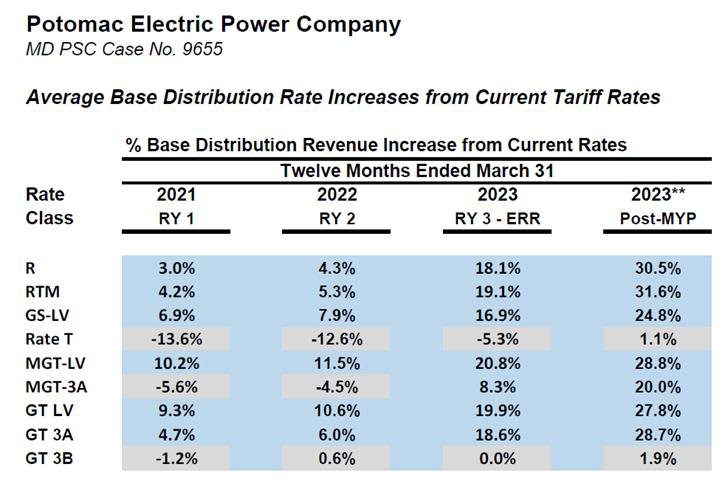

Pepco Files Multi-year Rate Plan Request for $110 Million Increase in Revenue in Maryland – Case No. 9655

- Pepco filed a Multi-year Plan (“MYP”) on October 26, 2020 in Maryland in which Pepco is seeking a $44 million increase in revenues beginning April 2021, a $34 million increase in revenues beginning April 2022 and a $32 million increase in revenues beginning in April 2023 for a combined total of $110 million over three years.

- AOBA has been granted intervenor status in this case and was scheduled to file its initial testimony on January 27, 2021, with rebuttal and surrebuttal testimony also scheduled on February 24, and March 16, 2021, respectively. Hearings were to begin the week of March 22, 2021 with a decision by May 24, 2021.

- However, as in the District of Columbia, Pepco has now stated that it must file an “update” to its Multi-year rate design and bill impacts to incorporate material corrections to the forecast billing determinants used in the Company’s original MYP rate design. Pepco and the PSC Staff filed a Joint Request to Extend Procedural Schedule, Voluntary Extension of the Operation of Law Date and Request for Expedited Treatment.

- The PSC granted the Joint Request on January 12, 2021 and extended all previously established dates by five weeks with a PSC decision due June 28, 2021. New rates would be effective shortly thereafter.

- AOBA is now in the process of preparing the testimony of two expert consultants in response to Pepco’s new “corrected” filing to challenge Pepco’s request before the Maryland Commission.

- AOBA’s preliminary determination of the effects of Pepco’s proposals on AOBA’s members are as follows:

Pepco Maryland Filing Case 9655

Pepco Misleads Ratepayers by Stating the Company Will “Freeze DC Customer Energy Delivery Rates Until 2022” in its Application to Increase Electricity Rates – Formal Case No. 1156

- Although Pepco’s current multi-year rate case (MRP) has been under consideration by the District of Columbia Public Service Commission since May 30, 2020 when the Company first requested a $162 million increase in its rates and briefs and reply briefs were submitted to the Commission on December 9, 2020 and December 23, 2020 respectively, no decision has been issued by the Commission at this time.

Background

- Pepco’s current multi-year rate case (MRP) has been under consideration by the District of Columbia Public Service Commission since May 30, 2020 when the Company first requested a $162 million increase in its rates. However, challenging Pepco’s requested MRP proposal in this proceeding is akin to shooting at a constantly moving target. After Pepco first requested in its initial application a $162 million rate increase, the Company then revised that request to $160 million. Then again, Pepco was forced to revise its request to $157.9 million when the PSC determined that Pepco’s request violated the terms of a settlement agreement that AOBA and other parties entered in Pepco’s previous rate case (Formal Case No. 1150).

- After Pepco’s three rounds of testimony, AOBA and all parties to the case filed their initial testimony on March 6, 2020 all strongly opposing the adoption of Pepco’s multi-year rate plan in the District. All parties, other than Pepco, agreed stating that there are no benefits to ratepayers from approval of Pepco’s proposed MRP or the adoption of its proposed Performance Incentive Mechanism proposals.

- AOBA’s testimony urged the Commission to reduce Pepco’s requested Return on Equity from 10.3% to 8.5%. Further, AOBA urged the Commission not to allow Pepco to earn any more than an additional $50 million in revenue if an MRP is not adopted. AOBA also urged the PSC to finally end the negative rates of return by the residential class and assign all any approved revenue increase to that class.

- And yet again and for the fourth time, after AOBA and all parties urged rejection of the Pepco plan, Pepco submitted another round of testimony, this time requesting $147.2 million.

-

Pepco’s Initial ApplicationMay 30, 2019$162.0 million

-

Pepco’s Supplemental TestimonySeptember 16, 2019$160.0 million

-

Pepco’s Supplemental TestimonyFebruary 20, 2020$157.9 million

-

Pepco’s Rebuttal TestimonyFebruary 20, 2020$147.2 million

-

Pepco’s Enhanced MRP TestimonyJune 1, 2020$135.9 million

- After Mayor Bowser issued a Public Health Emergency and the District of Columbia was essentially shut down, it became clear that the financial position of District residents, businesses, as well as the DC Government were severely affected by the COVID-19 pandemic, AOBA, in conjunction with other parties on April 13, 2020 filed an Emergency Motion to Suspend the Rate Case During the Pendency of the COVID-19 Crisis. All parties urged the PSC to take a pause and reconvene at a later date after review of the financial situation of the District, as well as its residents, and the wisdom of establishing rates for three years going forward based on a past test year and Pepco’s projections of required future capital spending based on projected sales and revenues made before the COVID-19 crisis. The PSC denied the Emergency Motion.

- After four rounds of testimony changing its requested revenue increase by Pepco, AOBA and all parties agreed in the testimony of their respective expert witnesses, that Pepco’s plan was not in the best interests of any of Pepco’s ratepayers in the District, Pepco threw a curveball into the proceeding exactly one year after it filed its original request by completely revising its proposal just prior to hearings. In its June 1, 2020 testimony, Pepco requests a new and substantially different “Enhanced” MRP as an alternative, and in addition to, its original plan. In the new “Enhanced” MRP Pepco states it is requesting a $135.9 million increase in revenues.

- In order to convince the public and the Commission that the Pepco Enhanced Plan was in the best interests of the District’s ratepayers, Pepco issued a June 1, 2020 misleading Press Release which stated: Press Release

In support of its customers, Pepco has made several enhancements to its multi-year plan, which is pending with the Public Service Commission of the District of Columbia, to 'freeze' energy delivery rates for all customers until January 2022.

Pepco’s New “Enhanced Multi-year Rate Plan”

Hides Rate Increase and Misleads Customers

- Pepco claims that the purported rate freeze is the Company’s effort to ease the financial impact of the Covid-19 virus pandemic on the lives and livelihoods of residents and businesses in the District of Columbia. Further, Pepco contends that the Company’s 2022 rate increase will be modest. This is false. Under Pepco’s Enhanced MRP, customer rates will increase by $135.9 million beginning in 2020 through 2022. Pursuant to a settlement agreement (in Formal Case No. 1150, referred to supra), Pepco is merely offsetting its rate increase with funds owed to customers by accelerating the amortization of those funds. In other words, Pepco is using customer money that it must return to customers to offset part of its requested $135.9 increase. This is nothing more than misleading accounting. Further, Pepco has stated that it will file another rate increase in 2022, which will be effective in 2023. In other words, District ratepayers will pay Pepco $135.9 million beginning in 2020 through 2022 and another increase in 2023.

- As a result of Pepco’s new “Enhanced” proposal, the PSC allowed the parties to file testimony addressing Pepco’s new plan on July 27, 2020, a fourth round of testimony by AOBA and all other parties. It is important to recognize that all Pepco customers, but in reality, Pepco’s commercial customers, pay for all of Pepco’s, the Office of People’s Counsel (OPC) and the Commission’s rate case expenses. These increased filing requirements cost District ratepayers, and mostly AOBA members, additional dollars. However, since Pepco’s filing is so costly, onerous, and unwarranted and will change the manner in which rates are set for many many years to come, AOBA is proactively working with all of the other parties to change Pepco’s proposals and reduce Pepco’s requested revenues.

DC PSC Denies AOBA, OPC and Other Parties

Motion for Summary Judgment

- AOBA, again in conjunction with other parties on June 8, 2020, filed another Joint Motion to Strike and for Summary Judgment in this case. In this motion the parties sought to strike Pepco’s new testimony that introduced a new multi-year rate plan which is not in the best interests of ratepayers, especially commercial customers, in the District. This motion also seeks summary judgment regarding Pepco’s original proposed multi-year rate plan. Again, the DC PSC denied the motion on June 18, 2020 and ordered that even more testimony needed to be filed in this case and postponed hearings. This will be the fourth round of testimony by AOBA, and all parties required by the DC PSC in response to the five rounds of testimony submitted by Pepco.

- June 8th Joint Motion to Strike

- Although Pepco claims in press releases and other filings, that no customer will get a rate increase until January 2022, that is false. Pepco’s proposals will in fact raise rates for commercial customers starting in 2021, or upon issuance of a PSC decision. Further, Pepco’s claimed forbearance on instituting a rate increase on all ratepayers is based on Pepco’s creative accounting and by off-setting current increases in expenses with funds that were scheduled to be credited to ratepayers in future years.

Pepco Claims in a July 28, 2020 “Errata” Filing that its

MRP Request was Based on Incorrect Data

- In a surprising turn of events, after fourteen months of litigation, in response to Commission Staff discovery, Pepco claims that the forecasted billing determinants it used in its rebuttal and surrebuttal testimonies were computed incorrectly. This means that the billing determinants Pepco has been using from the start of the case to determine its proposed charges for multiple commercial classes were incorrect. Pepco then on July 28, 2020 filed Errata Testimony. Pepco’s Errata Testimony purportedly corrected its Original MRP and Enhanced Proposals.

- Again, AOBA and other parties filed a Joint Protest to Pepco’s Errata Testimony and Motion to Dismiss Pepco’s Application and Enhanced MRP on August 11, 2020. August 11th Joint Motion To Strike In Order No. 20632 issued September 24, 2020, the PSC denied the Motion and ordered the Parties to file another round of testimony on October 9, 2020. Hearings were held on October 26th and October 27th. Briefs and Reply Briefs were filed December 9, and December 23, 2020, respectively. A PSC decision is expected by the end of the first quarter 2021.

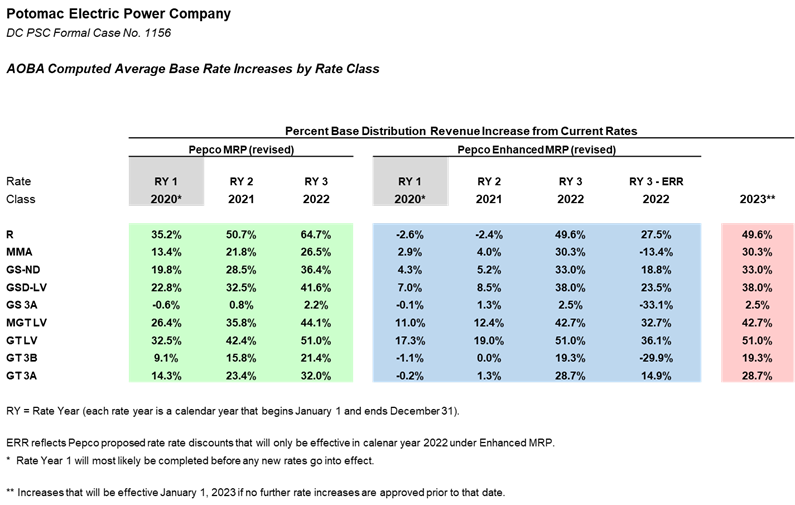

- Please be aware that Pepco has issued notices where they state that there will be no increases in 2020 and 2021, and only slight increase in 2022. These numbers are grossly misleading. Please see the chart below which shows the increases that Pepco is proposing beginning in 2020 through 2023.

Increases to Commercial Customer Classes

Effective End of Q1 2021

- AOBA’s review of Pepco’s filings has found that Pepco will not actually freeze its charges for electric service until January 2022. Rather, Pepco’s proposals will increase the Company’s charges for commercial electric service customers in the District during the alleged “rate freeze” period. Upon approval of Pepco’s proposals, (possibly as early as January 2021), commercial rates will increase. For small commercial accounts, the Company’s increases in base rate charges for electric distribution service will rise by an average of 5.2% for non-demand metered accounts and 8.5% for small demand metered accounts. For medium and large commercial customer accounts, Pepco’s proposed increases will average 12.5% and 19.0% respectively.

- On January 1, 2022, electric utility rates will increase once again. Those increases, even after Pepco’s proposed Economic Recovery and Relief (“ERR”) Rider Credits, will be even more dramatic. Small commercial non-demand metered customers will see their charges rise by an average of 18.8% over the rates they presently pay, and Small commercial demand metered customers will be hit with base rate increases averaging 23.5%. Medium and large commercial accounts will experience average rate increases of 32.7% and 36.1% respectively over the rates they are currently paying.

- And, on December 31, 2022, the Company’s proposed ERR credits will expire, and AOBA members will see their base rate charges from Pepco increase by at least 33%-38% for small commercial customers and 42.7% and 51% respectively for medium and large commercial accounts. However, Pepco’s customers in the District are likely to see even greater increases in 2023 due to the Company’s plans to file another rate increase request in 2022. Although Pepco claims to have lowered its rate increase request, it has actually used a series of accounting gimmicks and manipulation to simply defer its cost recovery to future periods while continuing to seek an increase in its allowed rate of return.

- Monthly BSA filings made by Pepco clearly indicate that electricity use by commercial customers in the District has been significantly impacted by Covid-19. Since the end of March 2020, Pepco revenue collections from commercial rate classes have fallen nearly 26% below the Company’s targets. Pepco’s position is that all classes remain responsible for the levels of revenues the Company expected to receive from each class in the absence of the pandemic. If Pepco prevails on this matter, it will place even greater rate burdens on commercial customers in the District. AOBA has recommended that any losses of revenue by Pepco due to curtailments of business activities in response to COVID-19-related governmental restrictions must be viewed as a societal cost and spread more evenly over all classes of customers.

Pepco Proposed Rates

DC Publishes Building Energy Performance Standards Regulations

- On December 4, 2020, the DC Register published the proposed Building Energy Performance Standards (BEPS) and updated benchmarking rules. BEPS is open for public comment until February 2, 2021.

- For buildings that can receive an ENERGY STAR score, a building will not meet the standards if, based on its 2019 energy benchmarking data, its score is less than the ENERGY STAR score standard listed for their property type.

- The Median ENERGY STAR score for Office Buildings is 71

- The Median ENERGY STAR score for Multifamily Housing is 66

- Buildings with an ENERGY STAR score equal to or above the median are in compliance for BEPS Cycle I and do not have to do anything to be in compliance for the 1st cycle.

- Buildings below the median will have to make energy efficient improvements in their buildings through one of four approved pathways.

- Performance pathway. Buildings must achieve greater than a 20% decrease in site EUI. To set their baseline, buildings must use an average site EUI taken from the two years preceding the first compliance cycle (2018 and 2019). To determine compliance, buildings must demonstrate the aforementioned decrease by averaging the site EUI during the last two years of a compliance cycle (2025–2026).

- Standard target pathway. Buildings must meet the reported standard for their property type.

- Prescriptive pathway. DOEE is developing a set of energy efficiency measures that a building would invest in during the initial BEPS cycle and if completed, as directed, the building would be in compliance at the end of the initial BEPS cycle.

- Alternative compliance pathway. DOEE would have to approve a compliance pathway that is outside of the other three available pathways listed above.

- Building owners whose buildings fall below the BEPS for the first compliance cycle will be required to select a compliance pathway no later than February 1, 2023.

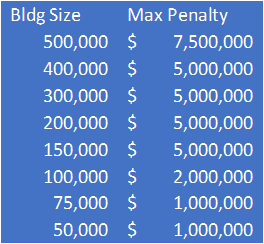

BEPS Penalties and New Benchmarking Requirements

- The regulations included the penalty structure for non-compliance, and they are significant.

- These represent the maximum penalty; however, these penalties will be reduced relative to the building’s performance towards achieving the goal.

- Additionally, all buildings in the District greater than 25,000 square feet will need to benchmark their energy performance beginning January 1, 2021.

- The benchmarking for all buildings will need to be third party verified as well.

- The link below details the new benchmarking rules

Benchmarking Rules

AOBA Response to BEPS Regulations

- Public comments on the new Benchmarking rules were due on January 4, 2021. AOBA filed comments on behalf of its members and a link to the filing is below.

- In its comments AOBA made four recommendations on the new rules

- Adoption of the benchmarking regulations should be delayed

- Building owner employees, who are properly licensed, credentialed, or certified, should be permitted to act as a district data verifier

- Buildings receiving an ENERGY STAR Certification should be exempt from the verification requirements

- Data verification should be performed every five years instead of three

AOBA’s full comments are linked below. AOBA Comments on Benchmarking

- AOBA is preparing its comments on the BEPS regulations, which are due February 2, 2021 and will share with members.

- AOBA encourages all members to review the regulations and provide public comments to DOEE by February 2, 2021. Comments can be sent to info.BEPS@dc.gov.