At Issue MD - Evaluating the Effectiveness of Policy Approaches to Reducing Evictions & Homelessness

Evaluating the Effectiveness of Various Policy Approaches to Reducing

Evictions and Homelessness

New research out of Stanford University’s Department of Economics provides a very helpful examination of the effectiveness of different approaches to reducing evictions and homelessness. The study produced a number of very telling findings to help inform policymakers as they seek to address housing issues emerging from the COVID-19 pandemic and over the longer term.

In “The Welfare Effects of Eviction and Homelessness Policies,” Boaz Abramson examines the efficacy of different approaches to reducing evictions. Of particular note, rental assistance programs have proven extremely effective at addressing housing insecurity, in that they lower the likelihood that tenants will default in the first place. In contrast, other policies which seek to discourage evictions by elongating the process or adding costs to housing providers often fail to actually prevent evictions and even contribute to a long-term increase in rents and homelessness.

Summarized below are a few of the study’s key findings:

Defaults on rent are overwhelmingly driven by persistent income

shocks

Abramson’s study focuses on eviction cases that result from a default on rent. Default on rent has been shown to account for the overwhelming majority (approximately 92%) of eviction cases, as documented in Matthew Desmond’s national eviction lab database.

By examining Desmond’s survey data, Abramson determined that the vast majority of defaults are instigated by persistent income shocks. Some 68% of default spells begin with a negative persistent income shock. Another 30% are attributable to the combination of a negative persistent shock and a negative transitory shock. Only 2% are driven by a transitory shock alone. This highlights the rarity of the “one bad day” scenario in which a tenant suffers a temporary financial setback such as an illness or vehicle repair, leading to eviction and ultimately snowballing towards homelessness.

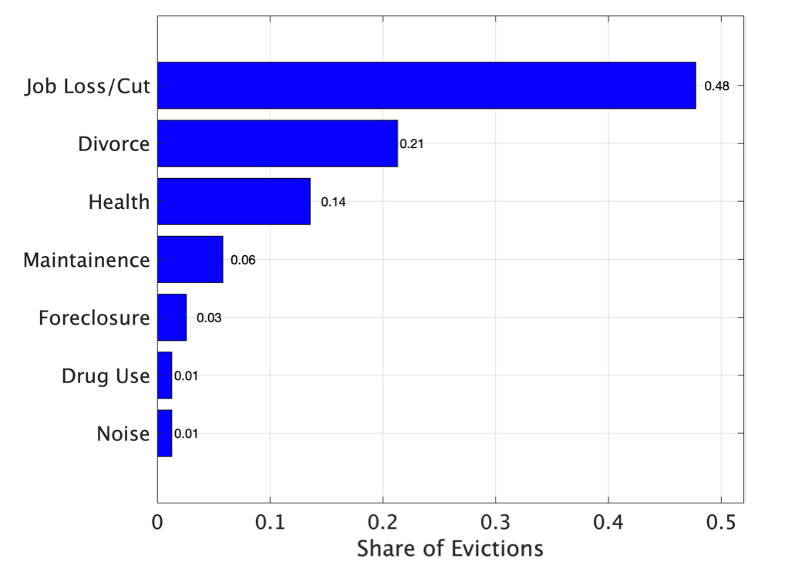

The main risk factors leading to defaults on rent, Abramson finds, are job loss and divorce. These are both associated with persistent drops in income. As depicted above, 48% of evictions are linked to a job loss or job cut; 21% are associated with divorce; 14% are associated with health; 6% are associated with maintenance issues; 3% are related to foreclosure; 1% of evictions are tied to drug use; and 1% are attributable to noise violations. Young and poor renters are more susceptible to eviction as they are more prone to job loss and divorce risk. Abramson additionally finds a strong negative association between education levels and eviction risk.

The main risk factors leading to defaults on rent, Abramson finds, are job loss and divorce. These are both associated with persistent drops in income. As depicted above, 48% of evictions are linked to a job loss or job cut; 21% are associated with divorce; 14% are associated with health; 6% are associated with maintenance issues; 3% are related to foreclosure; 1% of evictions are tied to drug use; and 1% are attributable to noise violations. Young and poor renters are more susceptible to eviction as they are more prone to job loss and divorce risk. Abramson additionally finds a strong negative association between education levels and eviction risk.

Policy approaches aimed at making it harder to evict only delay,

rather than prevent eviction

“The income shocks that drive tenants to default are persistent in nature. When risk is persistent, making it harder to evict is ineffective in preventing evictions of delinquent renters, because these tenants continue defaulting until they are eventually evicted.”

As an example, Abramson points to San Diego’s “right to counsel” program. On average, the presence of attorneys representing tenants prolongs the eviction process by approximately two weeks. In spite of this, the drop in the eviction-to-default rate is negligible, lowering from a baseline of 97% to 94%. That is to say, 94% of default cases still result in eviction, even when the tenant is given additional time to come into good standing.

The ultimate takeaway from this is that “when default is driven by persistent shocks, delinquent tenants are unlikely to bounce back and repay their debt, even if they have longer periods of time to do so.”

Policies with higher default costs to housing providers lead to higher

equilibrium rents, lower housing supply, and increased homelessness

Market rent levels tend to adjust for risk factor. Accordingly, the Stanford University study finds that the default premia is higher when it is harder and more costly to evict delinquent tenants. This can then lead to an increase in homelessness as lower income tenants are priced out of the market and rendered unable to secure rental housing.

Abramson again cites that “right to counsel” programs drive up costs, and therefore rents so much that homelessness increases by a staggering 15%. Similarly, research published in 2019 by the American Economic Review shows that rent control reduces the rental housing supply by 15%. Thus, lost rental housing supply drives up market rents in the long run, ultimately undermining the goals of such laws.

Rental assistance programs are the most efficient way of reducing

homelessness and evictions

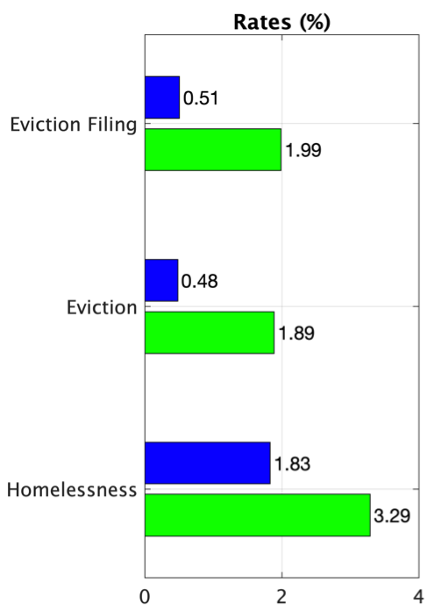

Abramson’s study finds that means-tested rental assistance is a promising solution to the housing insecurity crisis. Rental assistance lowers the likelihood that tenants will default in the first place, as opposed to policies that seek to make it harder to evict tenants who have already defaulted. In doing so, rental assistance programs lower tenants’ default risk, and as a result, reduce homelessness by as much as 45% and evictions by 75%. In fact, using San Diego, California as a case study, rental assistance more than pays for itself, with the savings in terms of expenditure on homelessness outweighing the cost of subsidizing rent.

As depicted above, rental assistance makes a substantial impact on reducing overall eviction filings, actual evictions and homelessness.

At Issue is compiled by the Apartment and Office Building Association (AOBA) of Metropolitan Washington, and is intended to help inform our elected decision-makers regarding the issues and policies impacting the commercial and multifamily real estate industry.

AOBA is a non-profit trade organization representing the owners and managers of approximately 172 million square feet of office space and over 400,000 apartment units in the Washington metropolitan area. Of that portfolio, approximately 61 million square feet of commercial office space and 151,000 multifamily residential units are located in Montgomery and Prince George’s County, Maryland. Also represented by AOBA are over 200 companies that provide products and services to the real estate industry. AOBA is the local federated chapter of the Building Owners and Managers Association (BOMA) International and the National Apartment Association.

Along with input provided by AOBA member companies, the following data sources and references were used in compiling the attached report:

- Boaz Abramson. The Welfare Effects of Eviction and Homelessness Policies. Stanford University Department of Economics. December 15, 2021.

- Eviction Lab national database, version 1.0. Princeton University. 2018

- Rebecca Diamond, Tim McQuade, and Franklin Qian. “The Effects of Rent Control Expansion on Tenants, Landlords, and Inequality: Evidence from San Francisco.” American Economic Review 2019, 109(9): 3365-94.

AOBA strives to be an informational resource to our public sector partners. We welcome your inquiries and feedback. For more information, please contact our Senior Vice President of Government Affairs, Brian Gordon.