Virginia At Issue - April 2023

Governor Signs Slew of AOBA-Supported Bills into Law

Closing out a successful 2023 General Assembly session for commercial and multifamily members, Governor Youngkin signed several bills on AOBA’s high-priority legislative agenda. AOBA amassed a great success rate in securing passage of bills supported by the industry and amending or defeating those which sought to layer additional costs or administrative burdens on property owners.

Proactive Legislation Signed by the Governor

AOBA carried two proactive bills during the 2023 Virginia General Assembly that have been signed into law by Governor Younkin, representing two big victories for the industry. They will become effective on July 1, 2023, and include the following:

H.B. 1836 and S.B. 1089: With AOBA’s support, Delegate Jenkins and Senator Ebbin introduced legislation to require Sheriff’s Offices to return executed writs to the issuing court, and for the Supreme Court of Virginia to track and report the number of executed writs annually beginning July 1, 2023. This is extremely consequential for AOBA as the General Assembly has based much of its action on housing policy over the last five years on incomplete data compiled by groups such as Eviction Lab, who only report the number of Unlawful Detainer filings, grossly skewing perceptions about the prevalence of evictions in Virginia.

H.B. 1725: Delegate VanValkenburg introduced this bill, which penalizes businesses that provide fraudulent documentation to renters misrepresenting themselves as needing an emotional support animal to circumvent no-pet policies and avoid paying pet fees. Any documentation that lacks a therapeutic relationship with a provider shall subject providers of such documentation to the provisions of the Virginia Consumer Protection Act.

Bills Defeated or Amended by AOBA

AOBA also worked along with a coalition of real property organizations to defeat or favorably amend several bills that would have negatively impacted members. These measures included bills to:

- nearly triple the pay-or-quit notice period from 5 to 14 days.

- establish electric vehicle charging infrastructure standards for multifamily residential housing construction projects consisting of more than 25 residential dwelling units approved after January 1, 2024.

- create significant restrictions for data center sites to only be approved in certain, limited areas.

- allow a locality to adopt rent stabilization provisions, require housing providers to give up to two months written notice of a rent increase, and prohibited them from increasing the rent by more than the locality's arbitrarily determined rent stabilization allowance during any 12-month period.

- require a landlord to offer tenants a payment plan, under which the tenant must pay in equal monthly installments over a period of six months, before terminating a rental agreement.

A more comprehensive summary of AOBA’s successes in the 2023 Virginia General Assembly Session is available here.

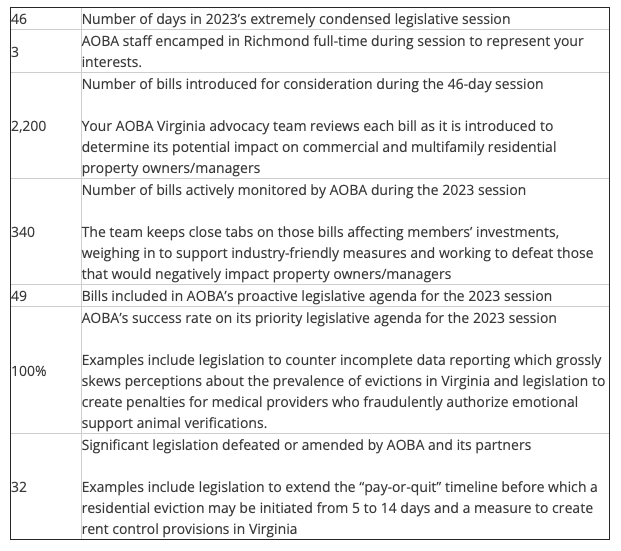

AOBA’s Virginia Advocacy Program by the Numbers

Each year, the Virginia General Assembly considers and acts upon a hefty slate of proposed legislation in an extremely condensed and hectic timeline. AOBA is your advocate in Richmond, working to preserve Virginia as a hospitable environment for the apartment and office building industries to conduct business. Provided below is a snapshot of AOBA’s scope of work during the 2023 legislative session.

AOBA Provides Comment on Regional Fair Housing Plan

The Metropolitan Washington Council of Governments (MWCOG) is working with eight local jurisdictions, including five in Northern Virginia, to develop a Regional Fair Housing Plan to help each locality and the region as a whole to meet fair housing targets. MWCOG released plan drafts for each region earlier this year and opened a 60-day comment period ending in March.

AOBA provided comments supporting the draft plans’ regional and local goals regarding increasing housing attainment and reversing historical patterns of segregation in our region. We also offered our expertise, drawn from our members’ daily work providing and operating housing, to help inform the plan’s strategies for creating a fairer and more equitable housing market throughout Metropolitan Washington.

In our comments, we encouraged the creation of housing supply across the income spectrum and expressed opposition to restrictive development policies, such as dogmatic and aggressive income targeting, which would inhibit the delivery of badly needed apartment homes. Similarly, we noted that providing financial incentives and flexibility is a better approach for preserving affordable housing than rent regulations or unilateral extensions of affordability commitments. Our comments concluded with suggesting the creation and funding of additional demand-side assistance, such as state and local voucher programs, and recommended ensuring that well-intended regulations don’t result in additional pass-through costs for market-rate tenants that raise the cost of housing overall.

Loudoun County is First to Approve FY 2024 Budget and Tax Rates

On Tuesday, April 4, the Loudoun County Board of Supervisors adopted its FY 2024 budget. The Board adopted a real estate tax rate of $0.875 per $100 of assessed value. This rate is a 1½ cent decrease from last year’s rate but is half a cent higher than the rate proposed by the County Administrator in February. Notwithstanding the decrease in the real estate tax rate, members with residential interests in Loudoun may expect to receive higher property tax bills due to increased assessments. Loudoun County’s total multifamily valuation increased by 8.9% this year. On the commercial side, office property values increased by only 1.1%, so the decline in the tax rate may offset some property tax bills for office members.

The other notable change from last year is a 5-cent decline in the business personal property tax rate to $4.15 per $100 value. The adopted budget does not change the BPOL tax or any of Loudoun County’s utility tax rates. Click here to view the adopted tax rates and fee schedules for Loudoun County in Fiscal Year 2024.

Loudoun was the first locality in Northern Virginia to adopt its FY 2024 budget, and the rest will soon follow suit. Arlington’s County Board will adopt its budget Saturday, April 22, while the Prince William Board of County Supervisors will do so on Tuesday April 25. The AlexandriaCity Council and Fairfax County Board of Supervisors will follow in the first and second weeks of May, respectively. Click on the links to see the proposed tax rates in each jurisdiction. AOBA will provide a review of each jurisdiction’s tax rates as they are adopted.

AOBA Seeks Equal Treatment for Apartments in New Arlington Stormwater Utility Funding System

Starting in 2024, Arlington County is going to change how it funds its stormwater infrastructure from an ad valorem tax to a utility fee model. The utility model, which the City of Alexandria uses, does a better job of aligning the costs of maintaining the stormwater system with the quantity of runoff generated by each property. For example, high-rise apartments and office buildings are amongst the highest assessed properties in the county and thus pay higher stormwater tax under the current system despite having relatively small impervious footprints that produce less runoff.

However, while the County is proposing to charge most properties based on their impervious area, it is proposing to charge high-rise apartment buildings based on the number of units, regardless of the building’s impervious footprint. Arlington County’s intent is noble: many of Arlington’s committed and market-rate affordable units are in garden-style buildings, which have a higher impervious area per unit than high rises, which tend to have market-rate units. However, not all lower-rent units are in garden apartments, and not all garden apartments have lower rents. Moreover, the proposed structure places the burden of supporting affordable apartments exclusively with other apartment residents – single family homeowners are not asked to share any of the burden.

AOBA has been engaged in this process as a member of the Arlington Stormwater Utility Community Advisory Group since early 2022 and has raised concerns about this issue. Ahead of tomorrow’s vote to adopt the stormwater utility plan, AOBA wrote to the County Board requesting high-rise apartment buildings be assessed using the same runoff calculation as other properties in the county and urging the exploration of alternative means of aiding affordable properties supported by the entire community.