At Issue VA - Housing Costs Continue Grow Far Beyond the Rate of Inflation

The Washington metropolitan region is fully embroiled in a crisis of affordability, driven by a stark imbalance between our existing housing supply and that needed to accommodate current and future projected demand. Compounding this dilemma further are the skyrocketing costs of providing rental housing. As a result, even affordable housing providers, who have access to various sources of public financing, are struggling to access capital and financing needed to conduct major building-wide repairs and subsequently deciding to sell properties.

Source: DCist

Source: DCist

DC, Maryland and Virginia have all seen policy debates in the last year around restricting rent increases and limiting them to some function of inflation as measured by the Consumer Price Index (CPI). While this is intended as a nod to ensuring that property owners are able to sufficiently reinvest in a property to prevent the degradation of our housing stock, the needs of each building can vary widely, and CPI is a poor reflection of the costs of operating and maintaining rental housing.

CPI and CPI-W are used to track the changes in the price of consumer goods and services. While a helpful tool in predicting broader economic conditions and the costs of goods and services everyday consumers rely upon, one cannot directly extrapolate from it the costs of providing a particular service such as housing. In reality, the hyperinflationary conditions ushered in by the pandemic have driven up the costs of providing housing at a rate far beyond the Consumer Price Index (CPI) and other traditional measures.

Housing providers rely on rent as a sole income stream to fund the operations of the property, including mortgage payments and interest, payroll, utilities, business licenses and other taxes, hazard and liability insurance, in-apartment routine repair and maintenance, contract services like waste collection, janitorial services, maintenance of mechanical systems, boilers, air conditioning systems and elevators, and fire suppression systems. Some may additionally be set aside for very costly replacement reserves for major system replacement and repairs to windows, masonry, roofs, elevators, plumbing, electrical and HVAC. Costs are even higher for older buildings, which require constant reinvestment to maintain safe and healthy living conditions. For these buildings, CPI represents a bare minimum for reinvestment to stave off deterioration and adequately plan for upgrades to building systems.

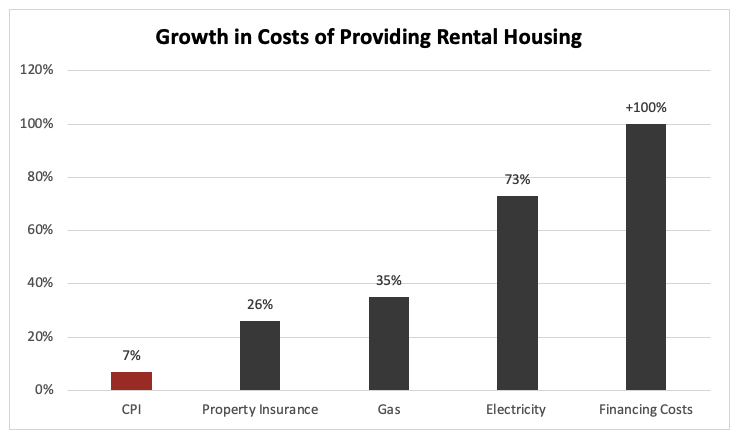

Highlighted below are just some of the major cost drivers for rental housing that have increased well beyond the CPI.

Many of the rental housing industry’s primary cost drivers have grown at a rate far in excess of CPI (listed for 2023 at 6.9%).

- Dominion Virginia Power customers’ fuel rates soared by 73% in July.

- Another 22% increase in slated for July of 2024.

- According to HUB International, multifamily property insurance rates increased by roughly 26% this year and are projected to increase up to 50% in 2024.

- Each of the prior two years (2021 and 2022) saw increases of more than 20%.

- Gas utility costs increased substantially in November. Group metered apartments are now paying approximately 35% more for distribution costs.

- Interest rates have increased by over 100% in the last 14 months; a measure which can result in millions in additional expenses over the life of a multifamily loan.

As reflected above, CPI fails to come even close to capturing the actual costs of operating and maintaining rental housing. Moreover, it can’t account for expenses specific to each individual building, particularly at a time when the costs of financing repairs for building systems – either planned or unexpected – are through the roof.

Restricting rents by any measure inherently constrains the ability of property owners and managers to reinvest in the property and can even imperil the refinancing of a community. In addition to the myriad well-documented negative consequences of such policy approaches, rent regulation ultimately risks a degradation in the quality of, and even an outright loss of critically needed housing stock.

Along with input provided by AOBA member companies, the following data sources and references were used in compiling the attached report:

- Morgan Baskin. “Affordable Housing Preservation in D.C. Hits Road Blocks As Building Costs Rise.” DCist. June 7, 2023.

- U.S. Bureau of Labor Statistics. Consumer Price Index. May 2023.

- CoStar Commercial Real Estate Data, Information and Analytics Service.

- Dominion Virginia Power. State Corporation Commission Case No. PUR-2023-00067 fuel rate request.

- Commercial Real Estate Direct. “Higher Insurance Premiums Predicted for Multifamily Properties This Year.” March 23, 2023.

- Mark Gilman. “Rising Insurance Rates Yet Another Storm for Multifamily Investors to Weather.” Yahoo! Finance. March 27, 2023.

- John Salustri. “Extreme Weather’s Influence on Multifamily Insurance Costs.” Multi-Housing News. February 1, 2023.

- Washington Gas & Light Company. Apportionment of Distribution Revenue Increase. Case No. PUR-2022-00054.

- Natalie Sherman. “US Interest Rates Raised to Highest Level in 16 Years.” BBC News. May 4, 2023.

- Apartment and Office Building Association (AOBA) of Metropolitan Washington. How Multifamily Rental Properties Are Financed. May 2023.

AOBA strives to be an informational resource to our public sector partners. We welcome your inquiries and feedback. For more information, please contact our Senior Vice President of Government Affairs Brian Gordon at bgordon@aoba-metro.org.