At Issue MD - What's Driving Rent Increases?

What's Driving Rent Increases?

Rising rents are grabbing headlines across the region and feeding concerns about affordability and stability in the housing market. Provided below is a peek behind the curtain of what’s really going on with rental housing and what’s driving rent increases.

Actual rent increase numbers are more modest than you think

Many of the rent increase figures being bandied about in public conversations simply don’t jive with reality. Some accounts rely on anecdotal information or focus on extreme outliers, painting a picture that fails to accurately reflect overall market conditions. But even well-sourced data often has its limitations. Among the most notable shortcomings of most commonly cited data sources is that rent increase figures generally include new lease rates only. This fails to capture renewal leases, which comprise the majority of leasing activity and can trail new lease rates by as much as 7-8%. This is because the cost of turning over a unit exceeds that of renewing an existing tenant. Accordingly, housing providers typically offer more favorable renewal rates as an incentive to keep tenants in place.

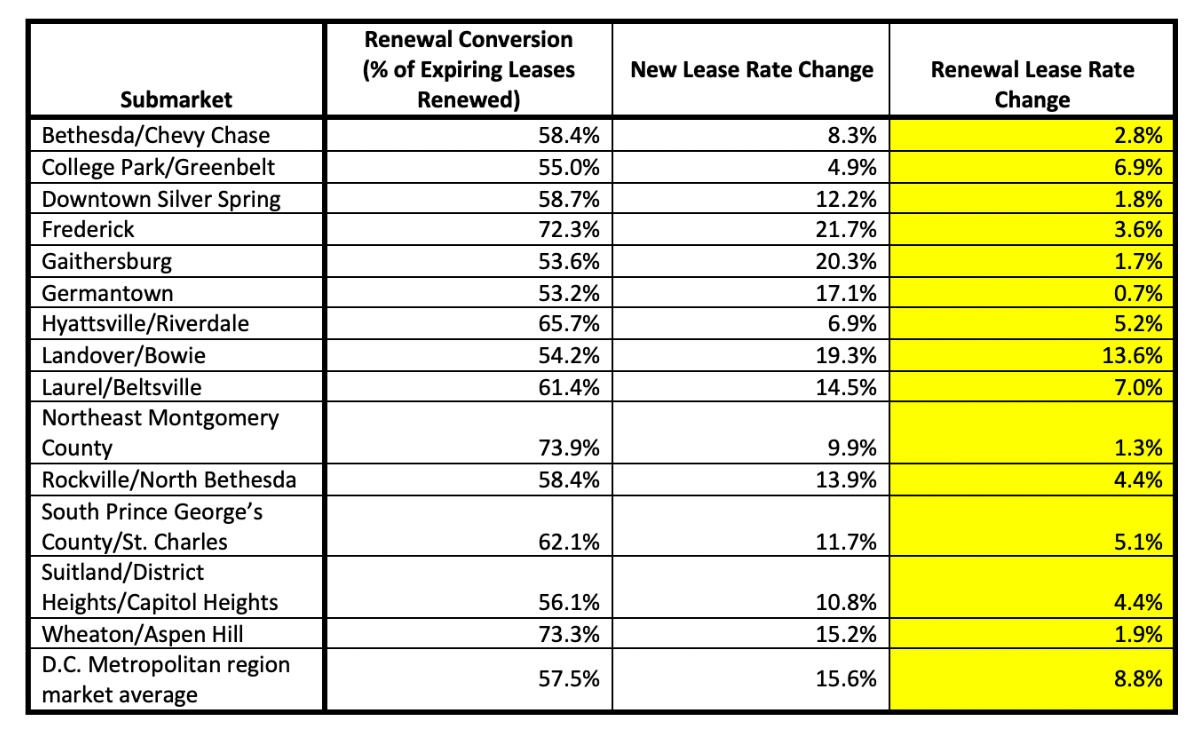

As depicted in the chart below, renewal lease rates are lower than those reported for new leases across the board, and in some submarkets by almost 10%.

Other data sources exclude significant chunks of the market. For instance, some figures include only Class A apartments.

Operating costs are soaring

The property management industry has not been immune to the inflation and supply chain challenges that have plagued every other business sector. But, because housing providers rely on rent as their sole revenue stream, when costs skyrocket as they have over the last two years and delinquency jumps as it did during the pandemic, it inevitably places upward pressure on rents.

The single greatest driver of the rent increases currently being seen in the Suburban Maryland market is the skyrocketing costs of providing housing. Housing providers have seen huge increases in fixed costs, impacting all levels of operation from payroll to raw materials. Very few businesses have been able to absorb the costs of inflation without raising prices. But this is particularly true of the rental housing industry, for which rent constitutes a singular revenue stream. Unlike other types of businesses, housing providers do not have the ability to balance losses with other revenue categories. This is compounded in rent-controlled jurisdictions where rents do not keep pace with expenses. Unexpected cost increases (and rent losses for that matter) may only be managed through an increase in rent, a reduction in services to residents, or a deferral of planned capital investments.

There is a prevailing misconception that housing providers are reaping tremendous profits as rents go up. This inaccurate assumption comes from a fundamental misunderstanding of the industry and looking only at one side of the ledger.

Even in the best of times, the vast majority of rent collected goes directly to the cost of maintaining, managing and operating the property. Assuming 100% occupancy and rent collection, a full 91% of rent goes towards mortgage payments and interest, payroll, utilities, business licenses and other taxes, hazard and liability insurance, in-apartment routine repair and maintenance, contract services like waste collection, janitorial services, maintenance of mechanical systems, boilers, air conditioning systems and elevators and fire suppression systems. This is not to mention replacement reserves for major repairs to windows, masonry, roofs, elevators, plumbing, electrical and HVAC. All of these items have been growing at a pace beyond inflation for a decade and have experienced significant increases over the last year. The rent increases being observed across the market right now aren’t attributable to housing providers propping up “profits” or exploiting heightened demand. Rather, a lot of housing providers are simply trying to keep up with the skyrocketing costs of providing housing. Indeed, many AOBA members have reported cutting staff and delaying planned capital improvements in an effort to simply keep up with routine maintenance and operations.

Vacancy rates are extremely low (around 2.5%)

Maryland’s rental housing market is further afflicted by one of the most basic of economic laws: low supply combined with high demand yields higher prices.

Montgomery and Prince George’s Counties suffer from a lack of housing supply. Maryland needs to produce 6,000 new apartment units each year to meet projected demand. As a region, the D.C. metropolitan area needs to add 320,000 units by 2030. That’s 75,000 beyond what is currently forecasted.

Indecision and rising costs in the single-family housing market have also contributed to more people staying in rental housing that would have otherwise vacated the rental market for homeownership. That is to say that many potential home buyers are waiting for the dust to settle on the currently chaotic home purchase market. This exacerbates the already strained rental housing inventory.

Rents have been artificially suppressed over the last two years

Rental properties in Suburban Maryland have been subject to rent increase caps during and coming out of the pandemic. Absent such regulation, renters may have seen more modest/gradual increases over time. Instead, we are now seeing higher increases as the market attempts to catch up to its equilibrium point and housing providers are attempting to recover costs incurred.

Most significant rent increases are falling on higher-income renters

In spite of market conditions, a closer examination of rent growth data shows that the renters paying the largest renewal rent increases tend to be higher-income and live in newer Class A housing stock, located in the most expensive communities. Renters at lowers levels of area median income (AMI) are generally seeing less drastic rent increases. Operators of Class C buildings (professionally managed, older communities with some basic amenities and more affordable rents) are offering renewal increases that are significantly more affordable and below headline inflation (8.5%).

At Issue is compiled by the Apartment and Office Building Association (AOBA) of Metropolitan Washington, and is intended to help inform our elected decision-makers regarding the issues and policies impacting the commercial and multifamily real estate industry.

AOBA is a non-profit trade organization representing the owners and managers of approximately 172 million square feet of office space and over 400,000 apartment units in the Washington metropolitan area. Of that portfolio, approximately 61 million square feet of commercial office space and 151,000 multifamily residential units are located in Montgomery and Prince George’s County, Maryland. Also represented by AOBA are over 200 companies that provide products and services to the real estate industry. AOBA is the local federated chapter of the Building Owners and Managers Association (BOMA) International and the National Apartment Association.

Along with input provided by AOBA member companies, the following data sources and references were used in compiling the attached report:

- RealPage Real Estate and Property Management Software and Analytics Service.

- CoStar Commercial Real Estate Data, Information and Analytics Service.

- Dees Stribling. “The Race is on Between Multifamily Rental Increases and Inflation.” Bisnow National, December 20, 2021.

- National Apartment Association, “Explaining the Breakdown of $1 of Rent.” YouTube, April 9, 2020.

- National Apartment Association’s 2021 Survey of Operating Income & Expenses in Rental Apartment Communities.

- National Apartment Association’s COVID-19 Survey Results.

- “Monthly Construction Input Prices Continue to Climb in November.” Associated Building Contractors, December 14, 2021.

- “Nonresidential Construction Employment Rises in November, Says ABC.” Associated Building Contractors, December 3, 2021.

- “Increased Insurance Costs for Housing Providers; Survey Findings on the Magnitude, Rationale, and Impact of Increased Insurance Premiums on Affordable and Conventional Housing Providers.” Institute of Real Estate Management, May, 2021

AOBA strives to be an informational resource to our public sector partners. We welcome your inquiries and feedback. For more information, please contact our Senior Vice President of Government Affairs, Brian Gordon.