At Issue MD - New Research Shows Regulations Account for 40.6% of Apartment Development Costs

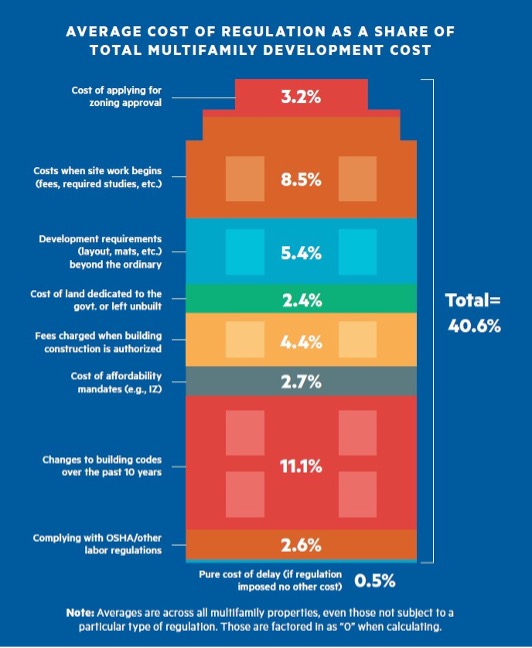

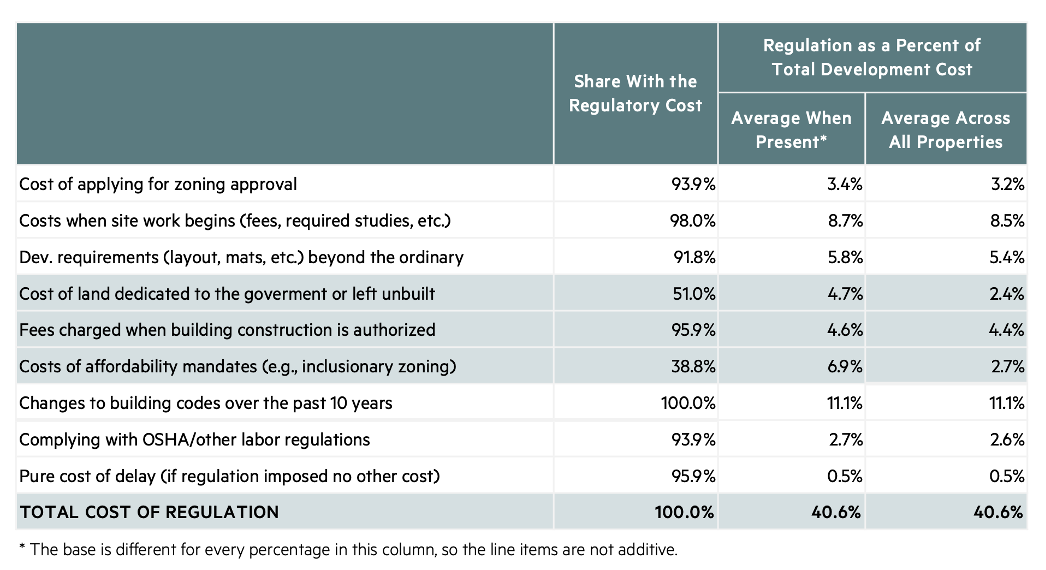

Regulation imposed by all levels of government accounts for an average of 40.6% of multifamily development costs. This staggering figure comes from new research released last week by the National Association of Home Builders (NAHB) and the National Multifamily Housing Council (NMHC).

In a survey of 49 developers across the country, the two organizations examined the impact of zoning requirements, building codes, impact fees, permitting requirements, design standards, public land requirements, federal Occupational Safety and Health Administration (OSHA) regulations and other labor requirements. The two groups then went on to quantify the collective toll and impact that those requirements can have on driving up the costs of housing or whether a project even gets built. The study produced several eye-opening takeaways:

The collective toll of regulations really adds up

Without question, well-reasoned regulations are absolutely necessary to protect the health and safety of residents as well as the integrity of the building or community. But no policy can be considered in a vacuum. For instance, energy efficiency mandates may help to advance a community’s goals towards reducing its carbon footprint but may have an adverse impact on its goal of increasing housing affordability. For this reason, policy decisions must be considered holistically to avoid working at cross purposes.

With this in mind, it is informative to know the financial impact of each type of regulation, particularly in an era of soaring costs of providing housing and worsening affordability problems for renters. Each added cost incurred means the developer must increase rents for the project to remain financially feasible. Multifamily developers cannot secure financing to build their projects unless they can demonstrate to lenders that the rents will be sufficient to cover costs and pay off the loans. Therefore, when multifamily development costs rise, it unavoidably translates to higher rents and reduced rental housing affordability.

As the above chart shows, the highest average regulatory cost to multifamily developers is the result of changes to the building codes over the last 10 years (11.1% of total development costs). The second highest are the costs imposed when site work begins (8.7%). Not far behind that are locally-imposed requirements, such as affordable dwelling unit and land set-asides and the accumulated fees associated with construction approvals.

Developers often avoid investing in jurisdictions with more onerous

regulatory frameworks

This new research offers a cautionary tale at a time when Maryland finds itself needing to produce 6,000 new affordable rental units each year to accommodate demand. With such a drastic housing shortage, we can ill-afford to drive away new investment in housing production. This underscores the critical importance of carefully weighing the impact of new imposed regulatory requirements and the funding and incentives designed to offset those burdens in the context of their overall impact on housing affordability.

Local affordability mandates, for example, are shown to represent a significant cost driver for multifamily developers. These mandates are designed to increase the supply of affordable apartments. A common example is inclusionary zoning, where developers must offer a certain percentage of apartments at below-market rent levels. In many cases, a density bonus is provided to developers, which allows them to include more units in their project than ordinarily permitted by zoning to offset those lowered rents. Unfortunately, these incentives are often inadequate and do not fully cover the lost rental revenue. In those cases, developers are forced to raise rents on the unrestricted apartments to fill the gap or to abandon the project altogether because it is no longer financially feasible.

The survey data speaks to the importance of striking the right balance between affordable unit set asides and density bonuses so as not to discourage investment in new housing supply or drive up rents for unrestricted units. Nationally, covering the costs of lower rents for affordable unit set-asides, on average, resulted in a 7.6% rent increase overall. As a result, 47.9% of developers say they avoid building in a jurisdiction with inclusionary zoning requirements.

The more onerous the policy, the less likely it is that a developer will choose to invest in a particular community. The impacts of rent control policies are well documented. Jurisdictions imposing rent stabilization measures have been documented to see higher rent levels in the uncontrolled market and a deterioration of rental housing stock caused by lack of sufficient resources to reinvest in the property. Worse yet, it drives away the much needed investment in housing stock. Jurisdictions that have implemented rent control have actually seen a reduction in the overall available supply of rental housing. The NAHB/NMHC survey produced results consistent with this finding, showing that 87.5% of developers avoid working in jurisdictions with rent control. This ultimately translates into housing not being built in many areas where it is so desperately needed.

The Region Ranks Among the Most Complex Regulatory Environments

Along with high construction material and labor costs, the Washington Metropolitan region’s counties and cities are found to have regulatory and policy frameworks that stifle higher-density development and make building affordable housing extremely difficult. This is reflected in the region’s ranking of 52 out of 58 major metropolitan markets in the National Apartment Association’s Barriers to Apartment Construction Index.

The index was created out of a ten-category survey containing development, process, and timing questions sourced digitally from real estate professionals in the public and private sector. Reaching our affordable housing targets will be difficult absent regulatory reforms and an increased commitment to government financing of affordable housing projects.

At Issue is compiled by the Apartment and Office Building Association (AOBA) of Metropolitan Washington, and is intended to help inform our elected decision-makers regarding the issues and policies impacting the commercial and multifamily real estate industry.

AOBA is a non-profit trade organization representing the owners and managers of approximately 172 million square feet of office space and over 400,000 apartment units in the Washington metropolitan area. Of that portfolio, approximately 61 million square feet of commercial office space and 151,000 multifamily residential units are located in Montgomery and Prince George’s County, Maryland. Also represented by AOBA are over 200 companies that provide products and services to the real estate industry. AOBA is the local federated chapter of the Building Owners and Managers Association (BOMA) International and the National Apartment Association.

Along with input provided by AOBA member companies, the following data sources and references were used in compiling the attached report:

- Regulation: 40.6 Percent of the Cost of Multifamily Development. Paul Emrath, National Association of Home Builders (NAHB) and Caitlin Sugrue, National Multifamily Housing Council (NMHC). June 9, 2022.

- Dees Stribling. “The Race is on Between Multifamily Rental Increases and Inflation.” Bisnow National, December 20, 2021.

- CoStar Commercial Real Estate Data, Information and Analytics Service.

- National Apartment Association’s 2021 Survey of Operating Income & Expenses in Rental Apartment Communities.

- National Apartment Association’s COVID-19 Survey Results.

- “Monthly Construction Input Prices Continue to Climb in November.” Associated Building Contractors, December 14, 2021.

- “Nonresidential Construction Employment Rises in November, Says ABC.” Associated Building Contractors, December 3, 2021.

- “Increased Insurance Costs for Housing Providers; Survey Findings on the Magnitude, Rationale, and Impact of Increased Insurance Premiums on Affordable and Conventional Housing Providers.” Institute of Real Estate Management, May, 2021.

- U.S. Census Bureau. American Community Survey. 2020 Data.

- National Apartment Association’s We are Apartments Data Set. 2017.

- The Impacts of Rent Control: A Research Review and Synthesis. Dr. Lisa Sturtevant, Ph.D. May, 2018.

- National Apartment Association’s U.S. Barriers to Apartment Construction Index. August 4, 2021 Update.

AOBA strives to be an informational resource to our public sector partners. We welcome your inquiries and feedback. For more information, please contact our Senior Vice President of Government Affairs, Brian Gordon.