At Issue MD - The Costs of Providing Housing Are Going Up

JANUARY 2022 EDITION

The Costs of Providing Housing Are Going Up

A glance at the paper makes it clear, the costs of providing rental housing are skyrocketing across the country. The implications for Suburban Maryland – already starved for housing across the affordability spectrum – are considerable and compounding.

Soaring Operational and Building Costs

Approximately 91% of rent collected goes directly to the cost of maintaining, managing and operating the property and funding the local jurisdiction via real estate taxes. The list is long: mortgage payments and interest, payroll for people who live and work in our towns and cities, utilities, business licenses and other taxes, hazard and liability insurance, in-apartment routine repair and maintenance, contract services like waste collection, janitorial services, maintenance of mechanical systems, boilers, air conditioning systems and elevators, and fire suppression systems. This is not to mention replacement reserves for major repairs to windows, masonry, roofs, elevators, plumbing, electrical and HVAC. All of these line items have been growing at a pace beyond inflation for a decade and have experienced significant increases over the last year, in part due to COVID-19. These costs are projected to continue to rise as our economy struggles to regain its footing amid supply and labor shortages, which only compound the problem.

The folks who provide housing to our communities rely on rent as a singular revenue source. Unlike other types of businesses, housing providers do not have the ability to balance losses with other revenue categories. Unexpected cost increases (and rent losses for that matter) may only be managed through an increase in rent, a reduction in services to residents, or a deferral of planned capital investments.

As just one example of skyrocketing fixed costs, one apartment community in Prince George’s County cites a 47% increase in the cost of water over the last two years. Rising utility rates have combined with increased consumption due to residents spending far more time in their homes during the pandemic. In this case, the rate increased by 17% and consumption grew by 27% on top of that. The result has been an increase of nearly $83,000 per year in utility costs for this one 320-unit community.

Bisnow recently explored the direct relationship between inflation and rent growth in their December 20, 2021 article “The Race is on Between Multifamily Rental Increases and Inflation.” Here are a few selected highlights:

- There is no indication that costs will fall in the future, due primarily to continued supply chain disruptions. Demand for key commodities is forecasted to continue to exceed supply.

- For residential projects, construction input prices rose 23.5% in November compared with a year ago.

- Energy costs were an important driver of this increase, with natural gas prices up 150.6% for the year and crude oil up 115.2%.

- Building material prices also rose, with iron and steel up 105.1%.

- Shortages of some items – such as refrigerators and other appliances – can potentially delay the opening of a property, leading to lost rental income.

- Labor costs are also on the rise

- Hourly wages are up 4.8% in November compared with last year. This is consistent across all private industries.

- The number of residential building projects under development has risen to meet demand, requiring an increase in the number of workers to implement them. The overall increase in the labor force is 6.2% year over year.

- Construction costs affect existing properties as well, with housing providers required to spend substantially more for any significant improvements.

- Premiums have increased substantially across all lines of insurance

- According to NDP analytics in a May 2021 survey for the Institute for Real Estate Management, National Apartment Association, and other sponsors:

- Overall, per unit insurance costs are up nearly 19%.

- 60% of survey respondents reported increases of more than 15% over the previous year for umbrella/excess liability insurance.

- 1 in 10 housing providers saw their premiums double.

- According to NDP analytics in a May 2021 survey for the Institute for Real Estate Management, National Apartment Association, and other sponsors:

In Suburban Maryland, tenants have been somewhat insulated from the impacts of inflation. Montgomery and Prince George’s Counties both instituted limited legislative freezes on rent increases during the COVID-19 pandemic, artificially suppressing rent levels. But the broader trend certainly has reverberating impacts for tenants and housing providers alike.

What is the Continued Viability of Naturally Occurring Affordable Rental

Housing?

Inflation and soaring operating costs are driving increased rents across the region and nationally. Insufficient supply of housing further contributes to rent pressure. (Maryland needs to build approximately 6,000 new apartment homes each year to meet projected demand). The skyrocketing costs of operating rental housing combined with regulatory uncertainty and legislative limitations on revenues exacerbate the challenge of attracting new investment by housing developers. With no immediate relief forecasted on the horizon for most of these factors, housing affordability will continue to challenge the region and the industry over the long-term.

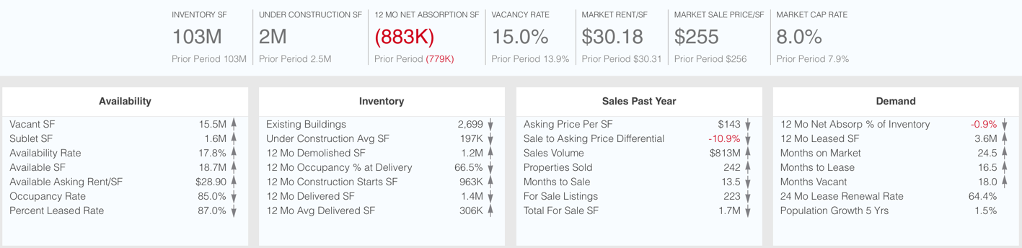

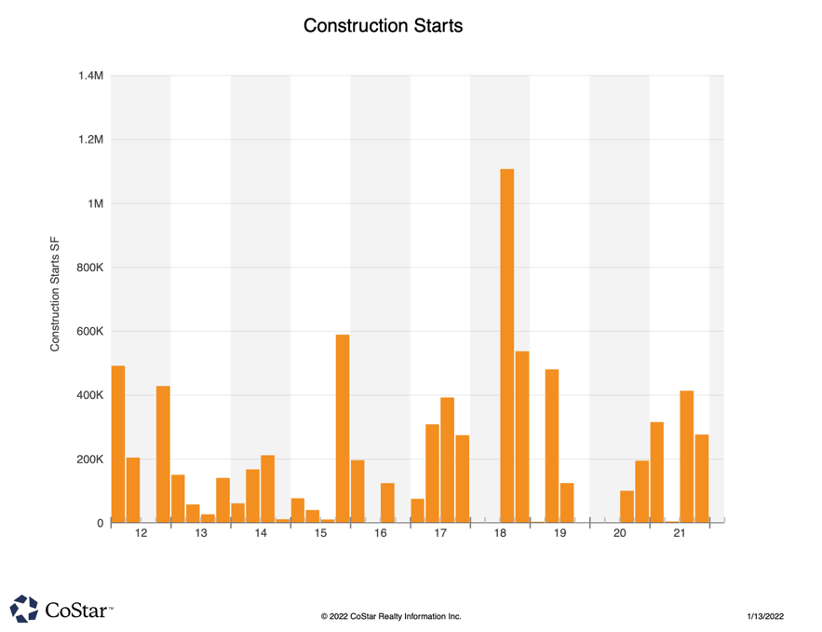

Suburban MD Commercial Office Market Snapshot

Provided below are key performance indicators for the Suburban Maryland commercial office market. Notably, vacancy rates remain high. Hovering at around 15%, this will likely contribute to lower assessed values, suppressing real estate tax collections in the upcoming fiscal year. This shifts the tax burden onto residential taxpayers. Not surprisingly, new construction starts for commercial office properties are also on the decline given the glut of available office space.

|

|

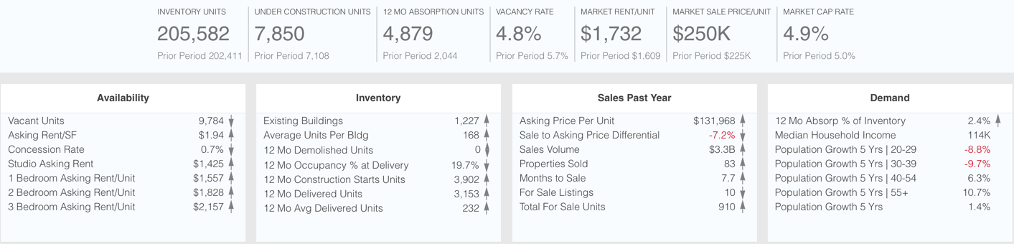

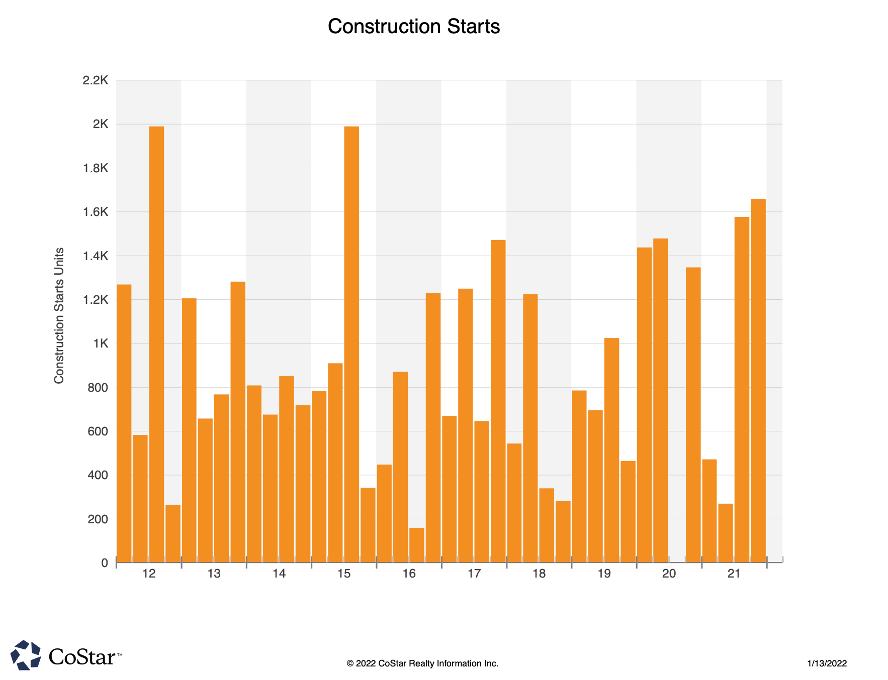

Suburban MD Multifamily Market Snapshot

Provided below are key performance indicators for the Suburban Maryland multifamily residential market. Notably, rents are rising, attributable to the myriad cost factors detailed above. Meanwhile, occupancy rates recovered after taking a significant dip during the early part of the COVID-19 pandemic, but are forecasted to decline over the next few years.

|

|

At Issue is compiled by the Apartment and Office Building Association (AOBA) of Metropolitan Washington, and is intended to help inform our elected decision-makers regarding the issues and policies impacting the commercial and multifamily real estate industry.

AOBA is a non-profit trade organization representing the owners and managers of approximately 172 million square feet of office space and over 400,000 apartment units in the Washington metropolitan area. Of that portfolio, approximately 61 million square feet of commercial office space and 151,000 multifamily residential units are located in Montgomery and Prince George’s County, Maryland. Also represented by AOBA are over 200 companies that provide products and services to the real estate industry. AOBA is the local federated chapter of the Building Owners and Managers Association (BOMA) International and the National Apartment Association.

Along with input provided by AOBA member companies, the following data sources and references were used in compiling the attached report:

- Dees Stribling. “The Race is on Between Multifamily Rental Increases and Inflation.” Bisnow National, December 20, 2021.

- CoStar Commercial Real Estate Data, Information and Analytics Service.

- National Apartment Association, “Explaining the Breakdown of $1 of Rent.” YouTube, April 9, 2020.

- National Apartment Association’s 2021 Survey of Operating Income & Expenses in Rental Apartment Communities.

- National Apartment Association’s COVID-19 Survey Results.

- “Monthly Construction Input Prices Continue to Climb in November.” Associated Building Contractors, December 14, 2021.

- “Nonresidential Construction Employment Rises in November, Says ABC.” Associated Building Contractors, December 3, 2021.

- “Increased Insurance Costs for Housing Providers; Survey Findings on the Magnitude, Rationale, and Impact of Increased Insurance Premiums on Affordable and Conventional Housing Providers.” Institute of Real Estate Management, May, 2021.

AOBA strives to be an informational resource to our public sector partners. We welcome your inquiries and feedback. For more information, please contact our Senior Vice President of Government Affairs, Brian Gordon.