At Issue D.C. - Commercial Tenants Reassessing Needs and Reducing Footprints

Commercial Tenants Reassessing Needs and Reducing Footprints

The Building Owners and Managers Association (BOMA) International released a new study last week shedding light on the future of the commercial office space market post-pandemic. Though the study provided reasons for optimism, it also highlighted major concerning developments within the industry. Specifically, and most importantly, the overwhelming majority of commercial tenants surveyed cited they were reassessing their office space needs, with more than half indicating they were likely to reduce their square footage.

Working in conjunction with Brightline Strategies and property management software giant Yardi, BOMA surveyed more than 1,267 office decision-makers and influencers, including company owners, CEOs, C-Suite members, and other high-level professionals with real estate and office operations in their purview. The survey helped to assess the financial and operational implications for commercial real estate owners and operators based on tenants’ sentiments related to COVID-19’s impacts on their businesses, their attitudes toward the physical work environment, and office space decisions going forward. The results reveal a marketplace in transition. Significant value is still assigned to the office, but employers are struggling with methodologies for melding that value with the growing trend toward hybrid work protocols.

Below is a snapshot of the study’s key findings.

Businesses Reassessing Office Space Needs and Reducing Footprints

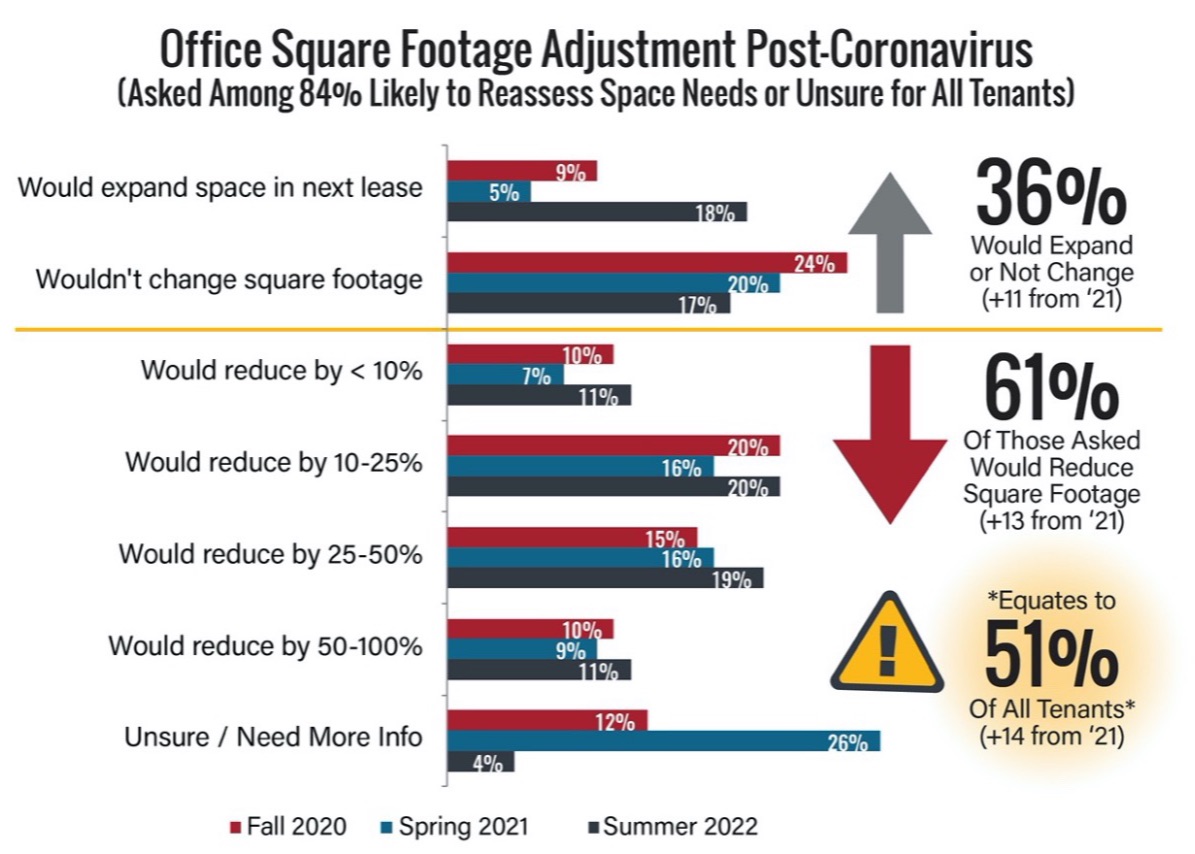

As commercial leases expire, tenants are looking to return space. If this trend continues, it will result in increased office vacancies, declining commercial property values, and reduced real estate tax revenues. BOMA asked survey participants about their current office space and if they plan to adjust the amount of space they will lease upon renewal.

- The majority of survey respondents (70%) indicated that they will reassess their office space needs. The likelihood to reassess space rose dramatically amongst tenants with the largest footprints and those paying the highest rents per square foot.

- More than half (51%) indicated they would reduce square footage. 67% of those planning to reduce their workplace square footage indicated that remote work is a significant factor. 71% indicate that the high cost of office space, along with increased overall costs of doing business were a concern.

- Commercial tenants renewing leases are opting for shorter lease terms, with a new normal of 3-5 years vs. the historic average of 7-10.

Businesses Still Value the In-Person Work Environment

While telework and hybrid arrangements will persist beyond the pandemic, the office isn’t going away. Employers and employees alike place great value on the in-person work environment.

- In spite of stagnant office occupancy, company leaders and employees both expressed comfort with returning to the office after COVID-19 at a rate of 78% and 76% respectively.

- 73% of respondents cited the importance of social connection. 75% indicated that being in the physical workplace is essential to support innovation and new ideas.

- A striking 86% of commercial tenants said they believe office space is now or will be vital to operating a successful business, an increase of 8% over last year’s survey.

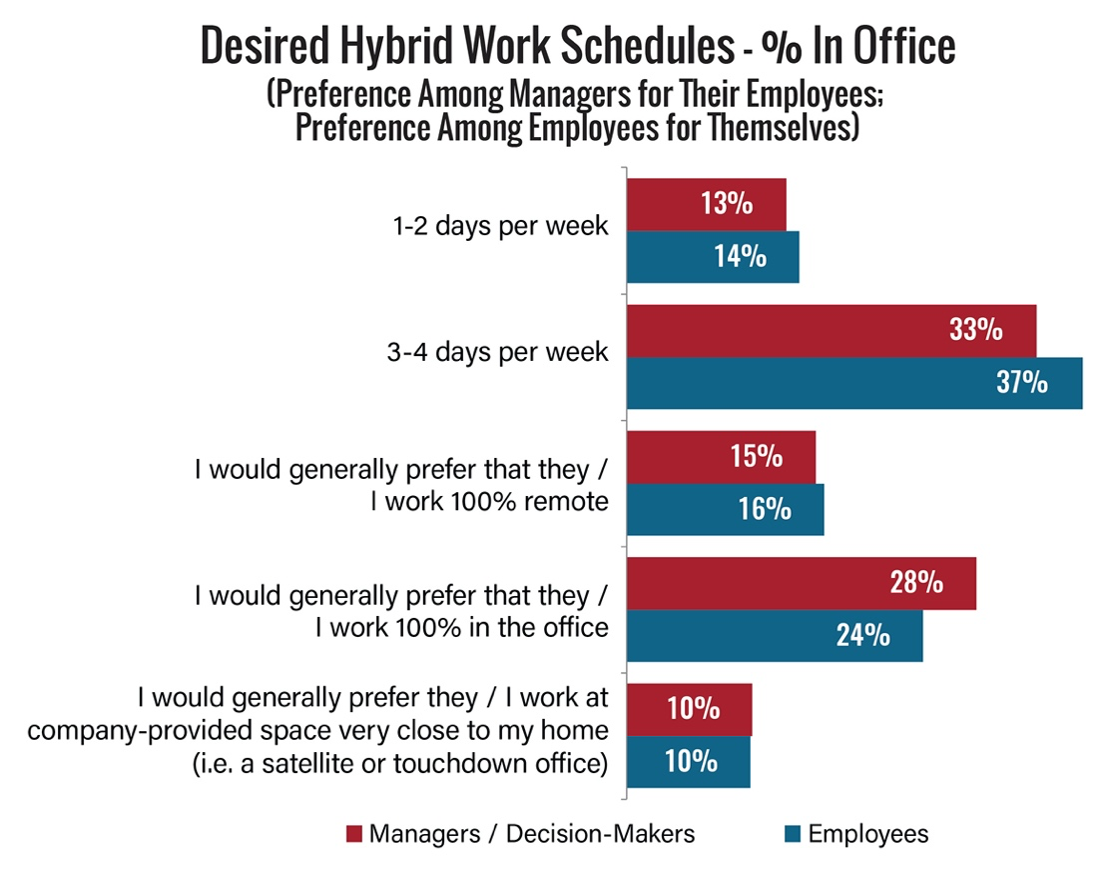

- Businesses and their employees are generally aligned in their sentiment with regard to full-time remote work, with only 15-16% supporting such arrangements. The greatest number of respondents preferred being in the office 3-4 days per week.

- That said, telework and hybrid work arrangements are clearly here to stay with 29% of commercial tenants planning to move toward mostly or full-time telework in the next 12 to 19 months. Smaller tenants tend to be less supportive of telework options than larger businesses. Those paying the higher rents per square foot continue to be the most supportive.

COVID-19 is Reshaping the Office

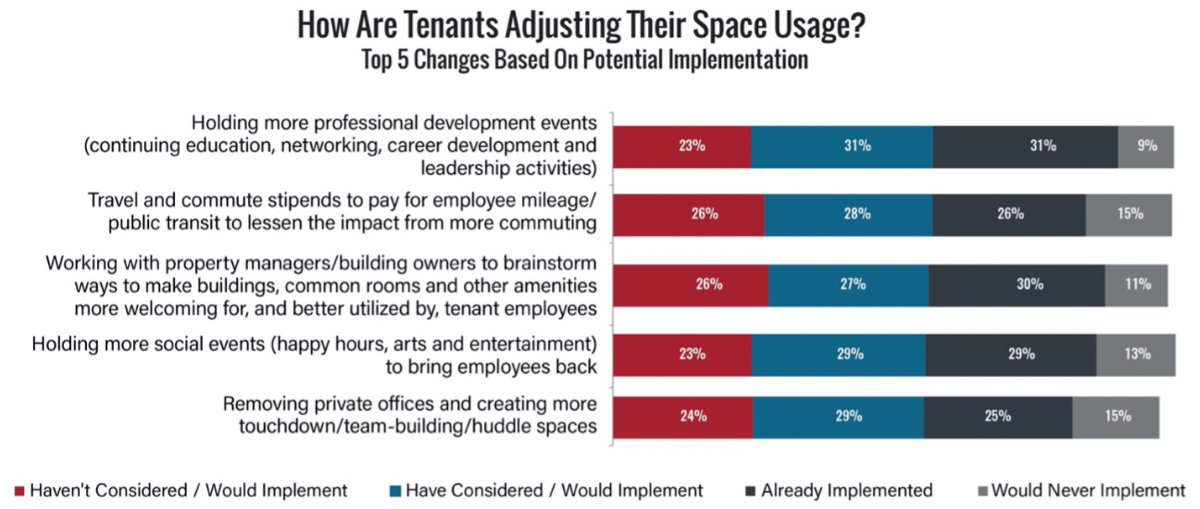

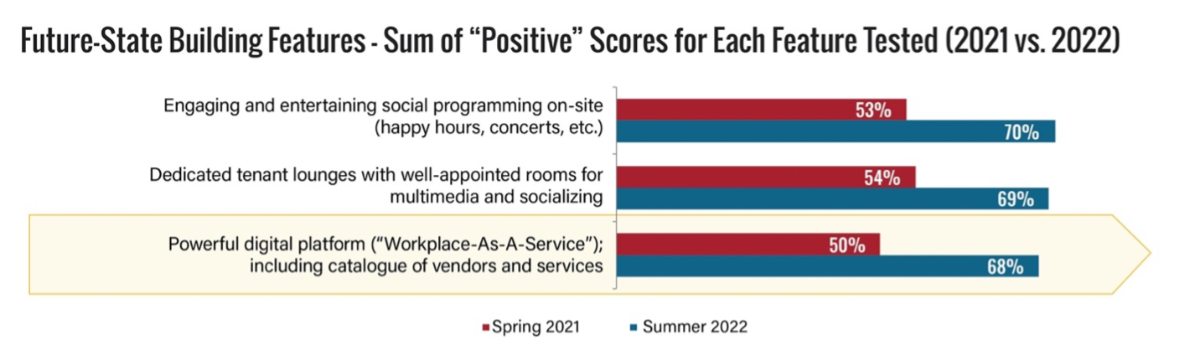

Commercial tenants are seeking new amenities to lure employees back to the office.

- Commercial buildings and tenant businesses are turning to new amenities to encourage employees to return to the office. 78% of tenants indicate a preference for “beyond the status quo of typical amenities.” The most popular planned changes include professional development events, commuting incentives including stipends and parking reimbursements, and more social events.

- 33% of tenants are asking for more investment in tech amenities and programming, including digital platforms with content for professional development, along with online networking and wellness resources.

Office Space Contractions Have Already Begun in D.C.

As teleworking has become ingrained as a normal business practice, companies operating in the District are well ahead of the curve and it has already begun to translate into contractions in office space footprints. Drawing on data from the federal Bureau of Labor Statistics’ Business Response Survey to the Coronavirus Pandemic, the D.C. Policy Center finds cause for alarm with regard to how these trends will impact our local commercial real estate sector:

- 68% of local businesses increased telework for some or all of their employees (nearly double the share observed across the private sector nationally of 35%). These establishments account for nearly 80 percent of all private sector employment in the District. 77% of these businesses project to continue increasing telework practices, compared to 60% nationally.

- 15% of District businesses report reducing their square footage since the beginning of the pandemic (compared to 6% nationally). Another 10% expect to do so in the next year (compared to 4% across the country).

- A larger share of business establishments moved out of the District to a different state (3% compared to 1% on average). Stated differently, only 89% of local businesses chose to remain in their current location (compared to 94% across the country). A smaller share of D.C. establishments plan to remain in place compared to the rest of the nation.

As businesses have begun to reduce their office space footprint, commercial vacancy rates have seen a corresponding jump. The implications are clear for the District, which derives much of its revenue from the commercial real estate sector. The D.C. Policy Center recently drew attention to this concern, projecting that commercial property values could further decline because of future increases in vacancy rates.

Take a Deeper Dive into BOMA’s Study Results

Interested in learning more about the study’s findings and its implications for the commercial real estate market and our community? Click here to register for a FREE webinar with BOMA President & CEO Henry Chamberlain on October 20. Government officials and media are welcome.

At Issue is compiled by the Apartment and Office Building Association (AOBA) of Metropolitan Washington, and is intended to help inform our elected decision-makers regarding the issues and policies impacting the commercial and multifamily real estate industry.

AOBA is a non-profit trade organization representing the owners and managers of approximately 185 million square feet of office space and over 400,000 apartment units in the Washington metropolitan area. Of that portfolio, approximately 80 million square feet of commercial office space and 94,000 multifamily residential units are located in the District. Also represented by AOBA are over 200 companies who provide products and services to the real estate industry. AOBA is the local federated chapter of the Building Owners and Managers Association (BOMA) International and the National Apartment Association. Along with input provided by AOBA member companies, the following data sources and references were used in compiling the attached report:

- The Building Owners and Managers Association International COVID-19 Commercial Real Estate Impact Study. October 6, 2022.

- Kastle Systems’ Back to Work Barometer. October 3, 2022.

- Yesim Sayin. “Chart of the Week: Business Response to COVID in D.C. and Across the Country.” D.C. Policy Center. July 15, 2022

- The Building Owners and Managers Association International COVID-19 Commercial Real Estate Impact Study. Second Quarter 2021.

- CoStar Commercial Real Estate Data, Information and Analytics Service.

- Bailey McConnell and Yesim Sayin. “Remote Work and the Future of D.C. (Part 2): What Does Remote Work Mean for the District of Columbia’s Tax Base?” D.C. Policy Center. July 7, 2022.

AOBA strives to be an informational resource to our public sector partners. We welcome your inquiries and feedback. For more information, please contact our Senior Vice President of Government Affairs, Brian Gordon.