At Issue D.C. - When will the District of Columbia Return to the Office?

When Will D.C. Return to the Office?

In February, we called on industry professionals and available data to ask when will D.C. return to the office? As we look back six months later, we find office occupancy rates still well below pre-pandemic levels. Moreover, higher-than-average telework rates and increasing office space contractions point to a “new normal” with significant long-term implications for local government tax revenues, placemaking in our downtown corridors, and the health and viability of ancillary and retail businesses who cater to and serve our weekday crowds.

Return to the office has been slower than projected

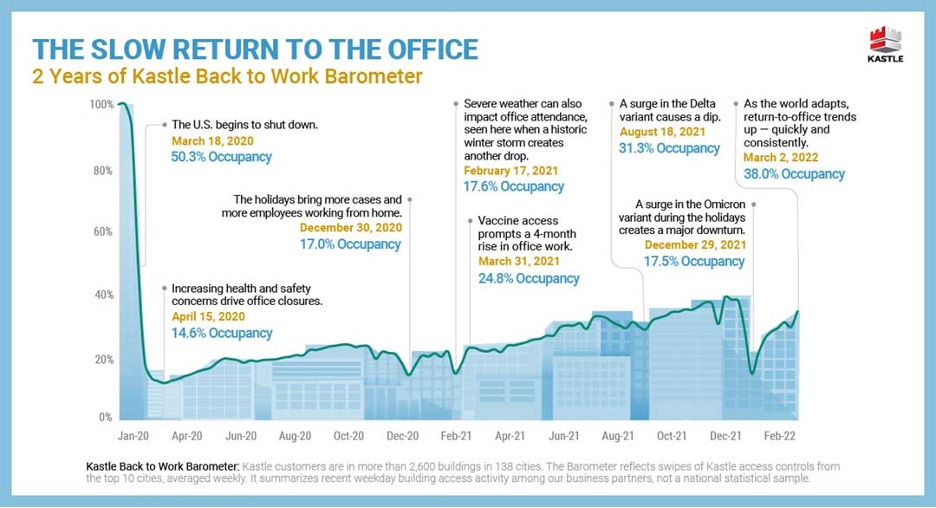

Kastle Systems is a leading security provider in the commercial office sector. Through its “Back to Work Barometer,” Kastle has been tracking keycard, fob and building access data to identify trends in how Americans are returning to the office. In total, Kastle tracks access activity data for 2,600 buildings and 41,000 businesses across 47 states and provides an analysis of anonymized data to identify trends in how Americans are returning to the office.

Nationally, the recovery of the office market has been inconsistent. After plummeting to less than 15% at the outset of the pandemic, the climb back to pre-pandemic occupancy levels has been slow and arduous, with numerous peaks and valleys corresponding to new COVID variants and surges and even holidays and weather events.

Occupancy rates vary significantly by day of the week

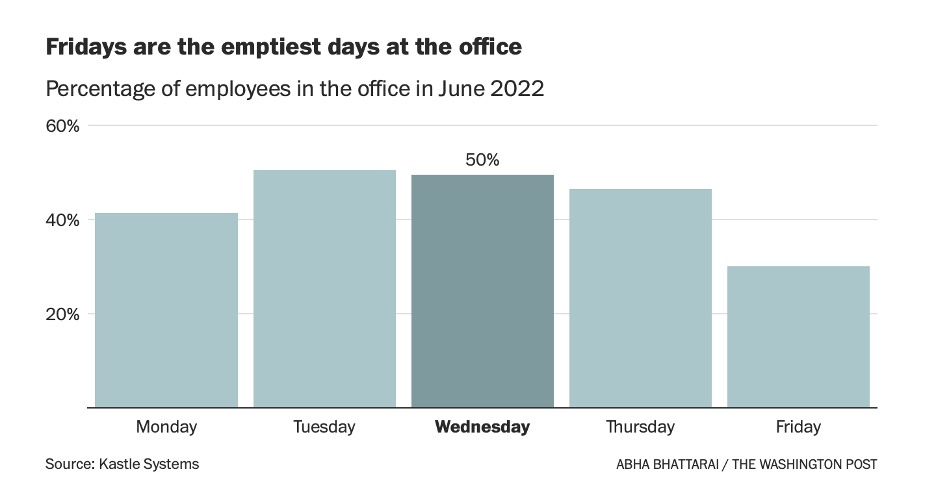

The pandemic has brought about a mass proliferation of telework and hybrid work arrangements, eroding at traditional definitions of a 5-day work week. As highlighted recently in the Washington Post, Kastle data shows a huge drop-off in the number of employees present at the office on Mondays and Fridays.

During the month of June, just 30% of office workers were physically at the office on Fridays. Mondays saw the second lowest level of attendance at 41%. This compares to approximately 50% occupancy on Tuesdays and Wednesdays.

These figures were backed up by Leo Villafana, Mid-Atlantic Vice President for LAZ Parking, which operates more than 3,000 garages nationwide. Villafana was quoted in the Washington Post story that demand on Mondays and Fridays is about 20% lower than midweek. He added that even when workers do come into the office, they are tending to stay for shorter periods.

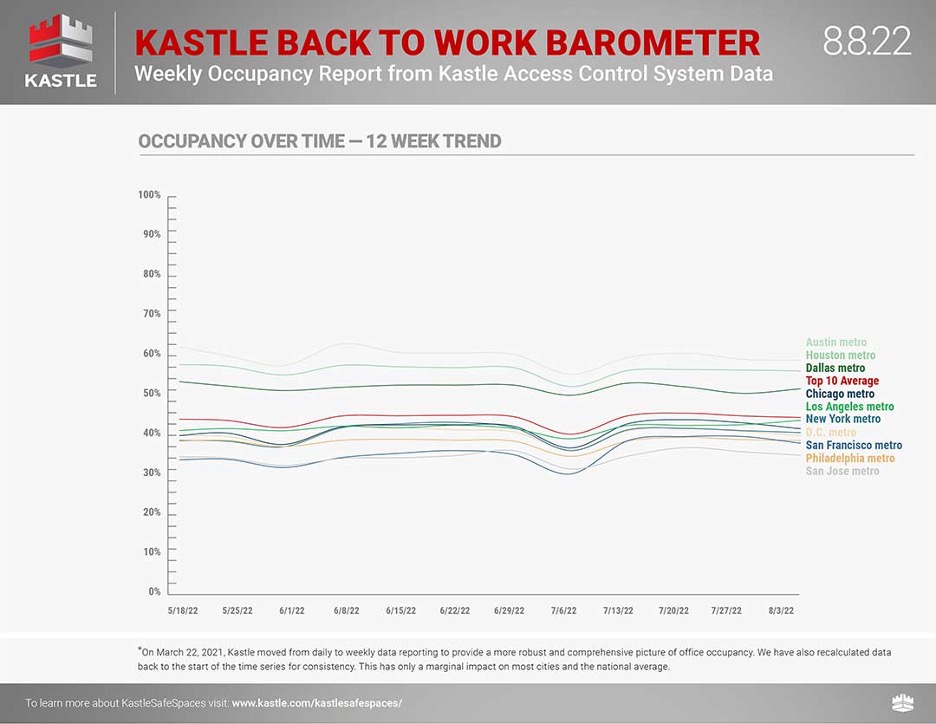

Occupancy rates have leveled off

The Spring of 2022 saw office occupancies increase quickly and consistently as the public health threat receded and businesses and workers began to adapt – a trend that Industry insiders projected to continue into the summer. Instead, occupancy rates have plateaued since April.

The Kastle data shows that Americans’ participation in public activity has rebounded significantly since March 2020. This can be seen in attendance and traffic data from major recreation venues such as TSA travel volume, dining reservations and major sports event attendance. Office attendance, however, is picking up far more slowly and remains well below pre-pandemic levels.

We may be starting to see signs of a “new normal”

It has been nearly two and a half years since the COVID-19 pandemic struck our nation, prompting shutdowns and massive economic disruption. As demonstrated above, the road back to pre-pandemic “normalcy” has been particularly slow as it relates to workers returning to the office place, lagging significantly behind other aspects of society. While occupancy rates are forecasted to continue their slow growth, other forces appear to be working against a full return to pre-pandemic office occupancy levels.

Experts all agree that telework and hybrid work arrangements are here to stay. Interim policies implemented out of necessity at the outset of the pandemic have proven effective and popular among employees, giving way to longer-term adoption. As teleworking has become ingrained as a normal business practice, companies operating in the District are well ahead of the curve and it has already begun to translate into contractions in office space footprints.

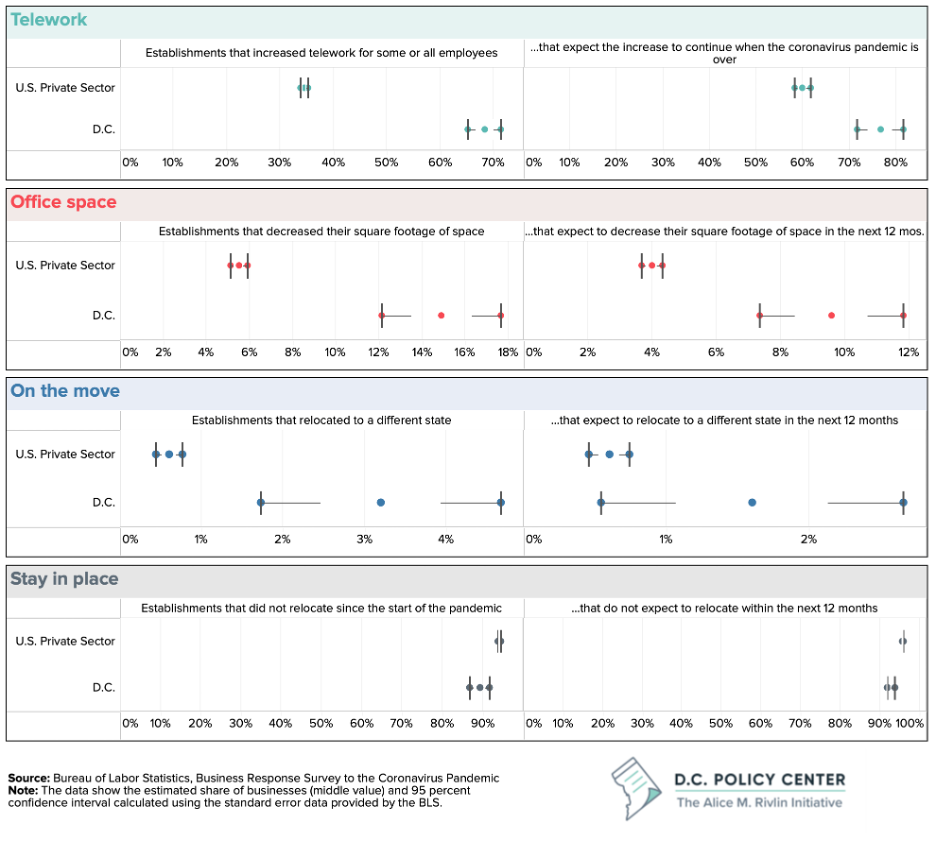

Drawing on data from the federal Bureau of Labor Statistics’ Business Response Survey to the Coronavirus Pandemic, the D.C. Policy Center finds cause for alarm with regard to how these trends will impact our local commercial real estate sector:

- 68% of local businesses increased telework for some or all of their employees (nearly double the share observed across the private sector nationally of 35%)

- These establishments account for nearly 80 percent of all private sector employment in the District

- 77% of these businesses project to continue increasing telework practices, compared to 60% nationally

- 15% of District businesses report reducing their square footage since the beginning of the pandemic (compared to 6% nationally)

- Another 10% expect to do so in the next year (compared to 4% across the country)

- A larger share of business establishments moved out of the District to a different state (3% compared to 1% on average)

- Stated differently, only 89% of local businesses chose to remain in their current location (compared to 94% across the country)

- A smaller share of D.C. establishments plan to remain in place compared to the rest of the nation

What does all of this mean for the future of the District’s office

market?

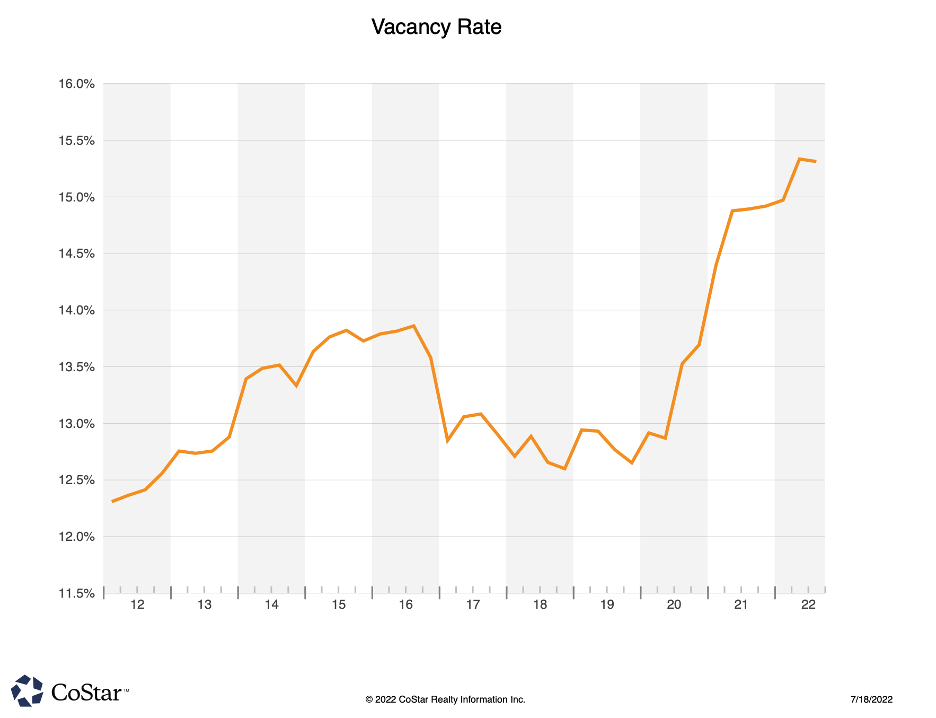

As businesses have begun to reduce their office space footprint, commercial vacancy rates have seen a corresponding jump. The implications are clear for the District, which derives much of its revenue from the commercial real estate sector. This includes not just real estate taxes, but also BID levies, gas and electric subsidies and various other fees and taxes. The D.C. Policy Center recently drew attention to this concern, projecting that commercial property values could further decline because of future increases in vacancy rates.

In addition to funding the local government services our community demands and offsetting residential real estate tax rates, businesses remain the lifeblood of our downtown urban areas. Beyond the tax implications, these trends could dictate a shift in economic development and business attraction strategies. Reducing our office vacancy rates will require creativity as well as a re-thinking of which targeted industries will drive greater occupancy of office space moving forward.

At Issue is compiled by the Apartment and Office Building Association (AOBA) of Metropolitan Washington, and is intended to help inform our elected decision-makers regarding the issues and policies impacting the commercial and multifamily real estate industry.

AOBA is a non-profit trade organization representing the owners and managers of approximately 185 million square feet of office space and over 400,000 apartment units in the Washington metropolitan area. Of that portfolio, approximately 80 million square feet of commercial office space and 94,000 multifamily residential units are located in the District. Also represented by AOBA are over 200 companies who provide products and services to the real estate industry. AOBA is the local federated chapter of the Building Owners and Managers Association (BOMA) International and the National Apartment Association. Along with input provided by AOBA member companies, the following data sources and references were used in compiling the attached report:

- Kastle Systems’ Back to Work Barometer. February 7, 2022.

- Abha Bhattarai. “Nobody Wants to be in the Office on Fridays.” The Washington Post. July 15, 2022.

- Yesim Sayin. “Chart of the Week: Business Response to COVID in D.C. and Across the Country.” D.C. Policy Center. July 15, 2022

- The Building Owners and Managers Association International COVID-19 Commercial Real Estate Impact Study. Second Quarter 2021.

- CoStar Commercial Real Estate Data, Information and Analytics Service.

- Bailey McConnell and Yesim Sayin. “Remote Work and the Future of D.C. (Part 2): What Does Remote Work Mean for the District of Columbia’s Tax Base?” D.C. Policy Center. July 7, 2022.

AOBA strives to be an informational resource to our public sector partners. We welcome your inquiries and feedback. For more information, please contact our Senior Vice President of Government Affairs, Brian Gordon.